What is the theory of Minsky moment?

What is the Minsky moment?

Minsky moment refers to a period of time when the market deflates or falls into recession after a long price rising period with high market speculation, and unsustainable growth. This theory is based on the idea that if a bull lasts long enough, it will eventually lead to a recession. In addition, the longer the speculation period lasts, the worse the scene will get. The theory was named after Hyman Minsky (1919 – 1996), an American economist and professor, who is famous for his debate about the inherent instability of the market, especially the bull market. He argued that the lasting bull market would only end in a big crash. Minsky followed the Keynesianism and established his theory on the idea of “stability is unstable.”

According to the Minsky moment theory, a recession occurs after a period of prolonged speculation, which is also related to the giant debt of both retail investors and organizations. Paul McCulley was the person who first mentioned this theory in 1998 referring to the Asian debt recession in 1997, in which speculators were increasingly placing pressure on dollar-pegged Asian currencies until they eventually collapse.

The global financial recession in 2008 can also be cited as a leading example of the Minsky Moment. During this recession, plenty of markets hit rock bottom, causing margin calls and assets sell-off to cover debt or higher insolvency rates.

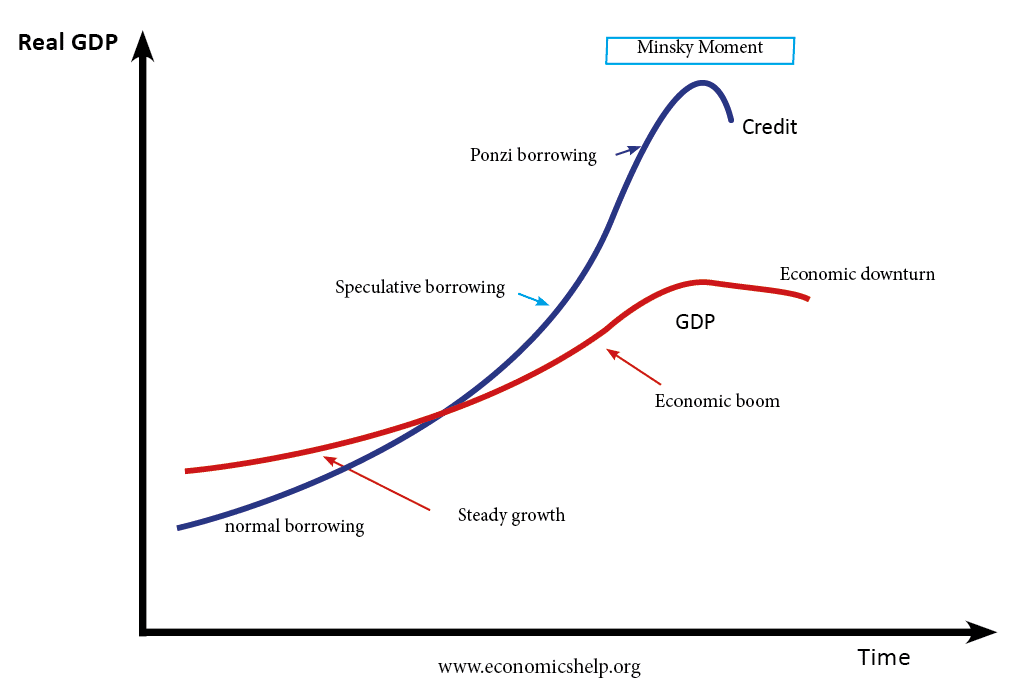

To reach the Minsky moment, the economy must progress through three major stages:

Phase 1: The economy recovers from the recession and starts developing steadily, thus excited investors will start buying into the one area forecasted to bring tremendous profit in the future.

Phase 2: Excessive investment in this field will bring in many more investors, enough for the price to climax and create a price bubble that will soon burst.

Phrase 3: Price bubble burst, leading to financial recession.

Hyman Minsky disagrees with the neoclassical school about the source of instability in our financial system. According to neoclassicism, such instability is caused by the complexity of the market, and that complexity comes from creativity in financial engineering. For Minsky, meanwhile, that instability lies in the very nature of capitalism, that it has always been inherently structural and flawed. The freedom of the capitalism economy causes it to always stay dynamic, mostly because there are plenty of opportunities for wealth.

Therefore, Minsky places debt structure in the financial system and the “investment/speculation” attitude of investors to be the focus of this model. With three stages before approaching Minsky moment, investors have three different attitudes at each relevant stage. In the early stages when an economy begins to recover after a recession, investors often choose to invest safely, borrowing to invest in reliable plans. The cash flow from the investment will be sufficient to repay the debt, both principal and interest. By the second stage, when economic growth is strong and profits arise, businesses expect that profits will continue to increase, therefore will choose to invest with a higher risk to maximize profits by taking loans.

But this time, the money from the investment was just enough to cover the interest. This only lasts as long as there is still liquidity within the market. At the final stage, also known as the Ponzi phase, investors are either in difficult situations without any liquidity, or in the desperate state where they start greedily defrauding, all of which will lead to the “Ponzi phenomenon,” which means taking loans to pay debts. This process takes place in a corrupted credit environment, where lenders seek ways to avoid legal constraints so they can lend as much as possible. Thus, the only way to repay the debt is continuously increasing the price of investment assets. Since capitalism is intrinsically “unstable”, each successful recession aid is the dawn to arising risks for investors.

Minsky is an independent researcher with unique thoughts. His work is evaluated as the most prototypical work on the issue of financial instability. However, it was not until after the death of Minsky that his theory became famous. Many authors recently relied on his theory to reanalyze financial crises, knowing that many crises go through three phases, along with investor or early investor traits, are in accordance to each period of Minsky model: Asian 1997, Brazil 1999, Turkey 2000-2001, Argentina 2001, the global economic recession in 2008.

Minsky’s approach clarifies the problem of the economic cycle, which Keynes mentioned, but has been misinterpreted by many economists. His explanations are called “financial instability hypothesis”. His theory is one that explains the effect of debt on systematic behaviors. This theory declares that the cause of the economic recession is not due to external shocks but endogenous problems. It was during the prosperous period of the economy that comprises the instability factors, which cause a recession. He explained that during periods of strong economic growth, risk-preferred (or over-optimism) mentality increased debt leverage. The reason for which businesses increase debt leverage is that they see profitability from many projects.

However, the key point of Keynes and Minsky’s views is that people are very awful at forecasting the future. The future is a “black swan” and many forecasts of businesses about profits of projects are inaccurate. The increase in debt leverage is also remarkably high that it creates enormous risks. Minsky said that in the expansion process, the loans of businesses changed from “hedge”, which is able to pay both capital and interest in due time, to “speculative” financing.

This means that they can only pay interest and need more time to cover the loan. Finally, switching to “Ponzi” financing means that businesses are no longer able to pay interest. In fact, businesses borrow money from one place to dodge another. Of course, Ponzi-style financing has always led to defalcation. Thus, Minsky suggested that the financial structure of capitalism will grow more and more fragile after each prosperous period.

Minsky’s cycle is divided into three phases. The first is a long period of rapid debt accumulation. Next is what economists call: the Minsky phrase (Minsky moment), where lenders become cautious or restrict lending, and highly leveraged businesses will face difficulties financially (which happened in the US unqualified loans crisis of 2007). The next stage is the Minsky collapse (Minsky meltdown) when businesses are forced to sell off assets to pay debts (which was 2008).

Another study by Richard Koo (2008) shows that the reduction of debt by the private sector to improve the balance of assets has led to an economic downturn. Koo’s research on deflation in Japan shows that it is caused by businesses and people pursuing the goal of debt reduction rather than profit optimization. During the real estate bubble in the 1990s, people often used real estate as collateral for loans and continued to invest in other projects. When the real estate bubble burst, prices plummeted and a large loss was made on the balance sheet. Therefore, this is called a “Balance sheet crisis recession”. Koo thinks that both the Great Depression and current deflation in Japan share this situation. When losses appear on the balance sheet, cash flow generated each year is used to pay off debt instead of reinvesting. When the whole economy does not reinvest, it will reduce total demand and lead to a stagnant economy.

Read more: