What is FETCH.AI (FET)? Find out in detail and in depth about FETCH.AI

FETCH.AI provides a new internet economy with ML (Machine Learning), AI (Artificial Intelligence), multi-agent system and decentralized ledger technology.

Overview of the project

Main features and highlights

- Digital infrastructure to deploy the Multi-Agent system.

- Unique scalable ledger to support high transaction rates.

- Synergetic computing: Brilliant smart contracts for autonomous systems.

- An economic framework for dynamic market management.

What is FET?

Fetch.AI (FET) brings together Machine Learning, Artificial Intelligence, Multi-agent systems, and decentralized ledger technology to create a new Internet economy – an environment, where digital representations of moving parts of the economy (such as data, hardware, services, people and infrastructure) can get things done through introductions and effective predictions.

Target

Fetch’s goal is to automate massive markets that currently require enormous human labor intervention. Automated economic transactions (autonomous) will help the market almost no transaction fees and operate at digital speed.

It is aiming at a world in which people own multiple economic agents on the Fetch.AI platform, working in series or parallel to build solutions to complex problems of today and the future.

Value proposition

- Near-autonomous for many components of a complex system.

- Easy integration and use of ML/AI results in decision making without having to understand ML / AI techniques.

- Collective intelligence (a combination of machine intelligence and human intelligence) to create a non-siloed AI model, improve decision making.

Token sale and Economy

What is the FET token?

FET is the native token in the Fetch ecosystem. FET is issued as ERC-20.

There will be a fixed number of tokens used on the Fetch.AI network to serve as the digital currency for all transactions, as well as for network activities such as secure information exchange. Tokens can also form an access deposit for both nodes and agents wanting to perform certain activities (such as a security mechanism to prevent bad action).

FET token use cases

- Used for staking

- Used to pay the reward of mining nodes and transaction fees/gas

- Agents use FET tokens to access the Fetch.AI ecosystem

- Allow two agents to exchange values, no matter where they are

- Use tokens to access, view and interact with the Fetch.AI search engine

- Use to access the multi-dimensional digital world of Fetch.AI

- Used to access and develop AI/ML-based algorithms

Seed Investments & SAFT boosts

Issuing organization: Fetch.AI Foundation Pte Ltd

Seed:

- 2017 to April 2018

- The raised amount is $ 2,058,587

- Accounting for 5.24% of the total supply

SAFT 1:

- Round 5 million USD at the time of completion (April 3 – April 30, 2018)

- Raised $ 724,975 and 7,426.5 ETH

- 2.68% of the total supply

SAFT 2:

- Round 10 million USD at the time of completion (May 1 – June 5, 2018)

- Raised $ 250,000 & 14,448.99 ETH

- Accounting for 3.17% of the total supply

SAFT 3:

- June 6 – July 10, 2018

- Raised 2,721 ETH

- Accounting for 0.53% of the total supply

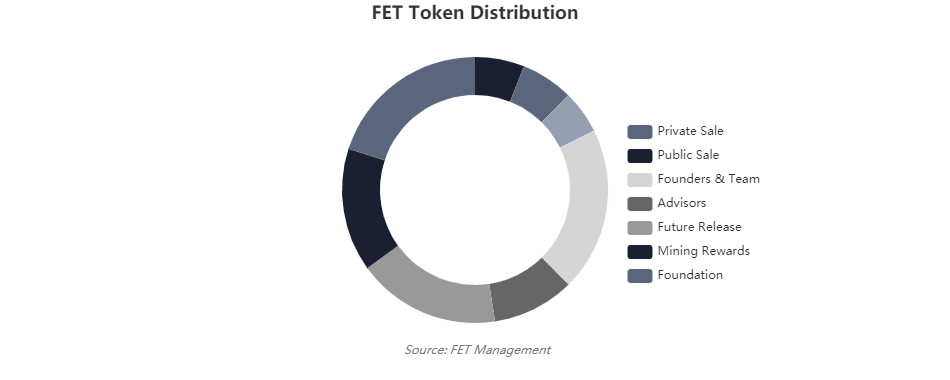

Source: FET Management

To administer the token and how to use the fund

As of December 1, 2018, Fetch.AI has used approximately 85% of the SAFT amount in the following allocation:

- Cooperation: 10%

- Marketing: 10%

- Group: 25%

- Development: 45%

- Professional service: 5%

- Other: 5%

All the money raised in SAFT rounds has been deposited into a multi-signature account: two keys are held by TokenMarket (the independent manager of the private sale round) and two keys are held by Fetch.AI. To request a transaction, it requires at least 3 keys.

Of the ETH raised through three SAFT rounds (24,596.5 ETH), the majority (21,125 ETH or 86%) were converted into fiat currencies in Q4 2018 and Q1 2019. Because of the cost of Fetch.AI is mainly derived from the United Kingdom (in staff and office expenses), this ETH has been converted to Pound Sterling.

Wallet hosting

You can hold FET in wallets that support ERC-20 tokens. Besides, you can keep them in cold wallets such as Ledger Nano, Trezor, etc. In addition, there is a more convenient way to keep them directly on the exchanges with this token listing, such as Binance.

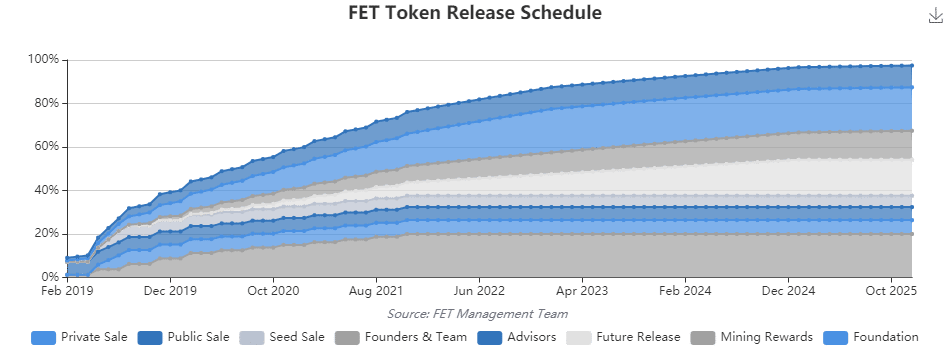

FET token release schedule

The following chart shows the number of FET tokens intended to be issued in monthly circulation.

Quarter 3/2018

Released Ledger code

Quarter 4/2018

Virtual Machine (Virtual Machine)

Quarter 1/2019

Invited to join Testnet

Quarter 2/2019

Released Testnet

Testnet smart market

Quarter 3/2019

Alpha launch phase (July)

Provided OEF original mainnet and ledger function in the original form

Released the beta version (late September)

Q4 2019

Mainnet release (December 19)

Source: FET Management Team

Trade partnerships and business development

European Blockchain: Founded by four leading blockchain companies: Ripple, NEM, Fetch.AI, and EMURGO/Cardano. The goal is to promote an understanding of the true potential of distributed ledger (DLT) and blockchain technology

Clustermarket: To access advanced technologies, GE Health and Clustermarket have implemented Fetch.AI’s Autonomous Economic Agents on Clustermarket platform.

AI Innovation Network (“AIIN”)/Warwick Business School: Provides collaboration between stakeholders to test the changing impact of AI

ULedger: ULedger’s stateless blockchain protocol makes it possible for Fetch.AI to consume real-world data centralized from IoT devices and other data sources in a provable way. It brings safety, integrity, and identification of electronic communications.

Overview of the Fetch development team

Humayun Sheikh (CEO): One of the first investors of DeepMind Google

Toby Simpson (CTO): Producer of the a-life Creatures series, the first developer at DeepMind

Thomas Hain (CSO): Professor at Sheffield University, who founded the ML/AI’s science team

In addition, the development team gathered a range of experts with in-depth experience in this area.

Fetch technical overview

Public Github repositories

Ledger: public fork of the main ledger archive

OEF Python SDK: public fork of the main SDK to create agents in Python 3

OEF C ++ SDK: public fork of the main SDK to create agents in C ++

OEF Core: public fork of the main repository for the OEF node

OEF Core Protocol: public fork of the main repository for network protocol between agents and OEF nodes.

Private Github repositories

Fetch.AI Ledger: Private development warehouse

Wallet-desktop: Desktop wallet

Wallet-mobile: Mobile wallet (Android and iOS)

Fetch-ledger-API: Python SDK to interact with the Ledger

Fetch-ledger-API-js: Node SDK to interact with the Ledger

OEF-core: OEF node’s own development repository

OEF-SDK-python: Python 3 SDK for creating OEF agents and instructions

OEF-core-protocol: Network protocol between agents and OEF nodes

OEF-SDK-CPP: C ++ SDK to create OEF agents

OEF Maze: The Maze demo uses OEF agents

Fetch Products & Figures

Efficiency

The ledger is expandable by design, so the exact performance will vary depending on resources. In tests, Fetch.AI achieved speeds of over 30,000 transactions per second.

It is expected that when started, the time taken to perform a block will be in minutes. This estimate will decrease over time thanks to improvements to the consensus protocol.

Open Economic Framework

This is a second class protocol that provides services to agents. Agents connect with OEF to search, negotiate and transact with other agents on the network.

In early implementations, OEF nodes had two classes: “trusted” and “trustless”. The “trustless” button can be operated anonymously, just like pure ledger buttons. The “trusted” button can be given access to additional agent information to provide intelligent search and discoverability. Drivers of these buttons must have a public, legal identity, and be accredited by the Fetch.AI Foundation.

How to profit from FET

- Trade on exchanges that support FET tokens (like BTC or ETH)

- Participate in Staking on Binance to receive a profit of 8-12%

- Occasionally, Binance supports making money in the “lending” way. So, please follow the Lending section of Binance

Should we invest in FET?

Any investment decision is always risky, so we recommend that you consider, consider and make your own decision. Hopefully, the information we provided above can help you make the most accurate decision.

Read more: