[Vechain] The VeChain Foundation Financial Report — 2021 Overview

The VeChain Foundation Financial Report — 2021 Overview

A Brand New Launch for VeChain Foundation Finance Reports

At the commencement of the 2022 fiscal year, the VeChain Foundation would like to share the final outcome of developments towards a fundamental shift in how the Foundation will operate starting in 2022.

As part of our journey into 2022 and beyond, we want to start by presenting a reconstructed financial report detailing fiscal year 2021 (year ending December 31, 2021), which also includes details of the restructuring of the foundation, its finances and our focus as we head into our growth phase.

An Evolving Foundation To Meet Evolving Needs

Over the past 3 years, the VeChain Foundation has worked extensively with leading enterprises, global regulators and leaders in compliance to best position VeChain to serve the real economy. The outcome was a suite of solutions and tools that adequately and effectively addressed the diverse needs of global legal jurisdictions, allowing us to operate globally and seamlessly, even in territories where crypto assets have been less favourably viewed.

Today, the VeChain Foundation proudly finds itself housed in San Marino — a jurisdiction in which we were fundamental to the development of legal frameworks based on our experiences of working closely with traditional jurisdictions and political systems.

Moving forwards, our reports will now feature in-depth reporting of VeChain Foundation expenditures and breakdowns, stated in USD values to more closely align with real world expectations and norms. This was done to satisfy the needs of traditional regulators and set the standards of blockchain company finance reporting moving forward. It also serves to allow our stakeholders to more intuitively understand our financial position and understand where Foundation money is being spent.

Thanks to our pioneering of national level regulations in San Marino, VeChain has helped create a highly favourable environment for blockchain technology to flourish. The rules and regulations created in San Marino will be exported to other European countries where we are present, with more to likely follow after that.

As the global regulatory environment shifts and the world transitions to wide scale adoption of blockchain, VeChain is proud to know it played a crucial role in delivering the rules and standards on which this new world will be built.

Embracing The Era Of Regulation

The VeChain Foundation currently operates in Singapore and San Marino and has global operational coverage from Luxembourg, France, Italy, Cyprus, the United States and across SEA. We intend to greatly enhance our operations in these jurisdictions, thus, the VeChain Foundation will significantly deepen cooperation on a range of compliance practises across all aspects of operations, including financial disclosure as we openly embrace a better-regulated future.

In keeping with the principle of accuracy, completeness and prudence, the Foundation hereby presents a new form of financial report, which discloses fiat equivalent values that are more widely applicable to the latest authority requirements. The new form of financial report will be disclosed quarterly in the 2022 fiscal year.

We have also included a newly added section ‘SDGs’ (short for Sustainable Development Goals) which shows the long-term commitment of the VeChain Foundation in our mission to tackle global sustainability initiatives.

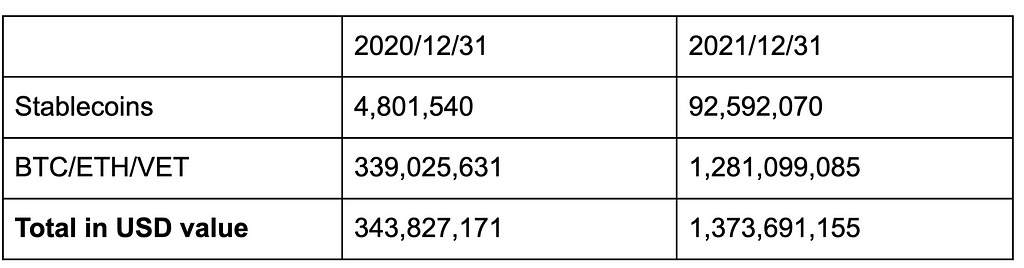

Balance Sheet of 2021

The Balance Sheet is composed of crypto assets including basic crypto assets BTC/ETH as well as stablecoins acquired during our ICO in 2017, as well as asset management operations. VeChainThor’s native crypto asset reserves, VET, are controlled by the VeChain Foundation and noted in their fiat equivalent value, calculated by the price shown on CoinMarketCap.com.

The balance at the start of 2021 was $ 343,827,171. The balance at the end of 2021 is $1,373,691,155. Due to the value of VET having increased around five times during the period of 2021, the total value on the balance sheet has increased approximately four times compared to the previous year.

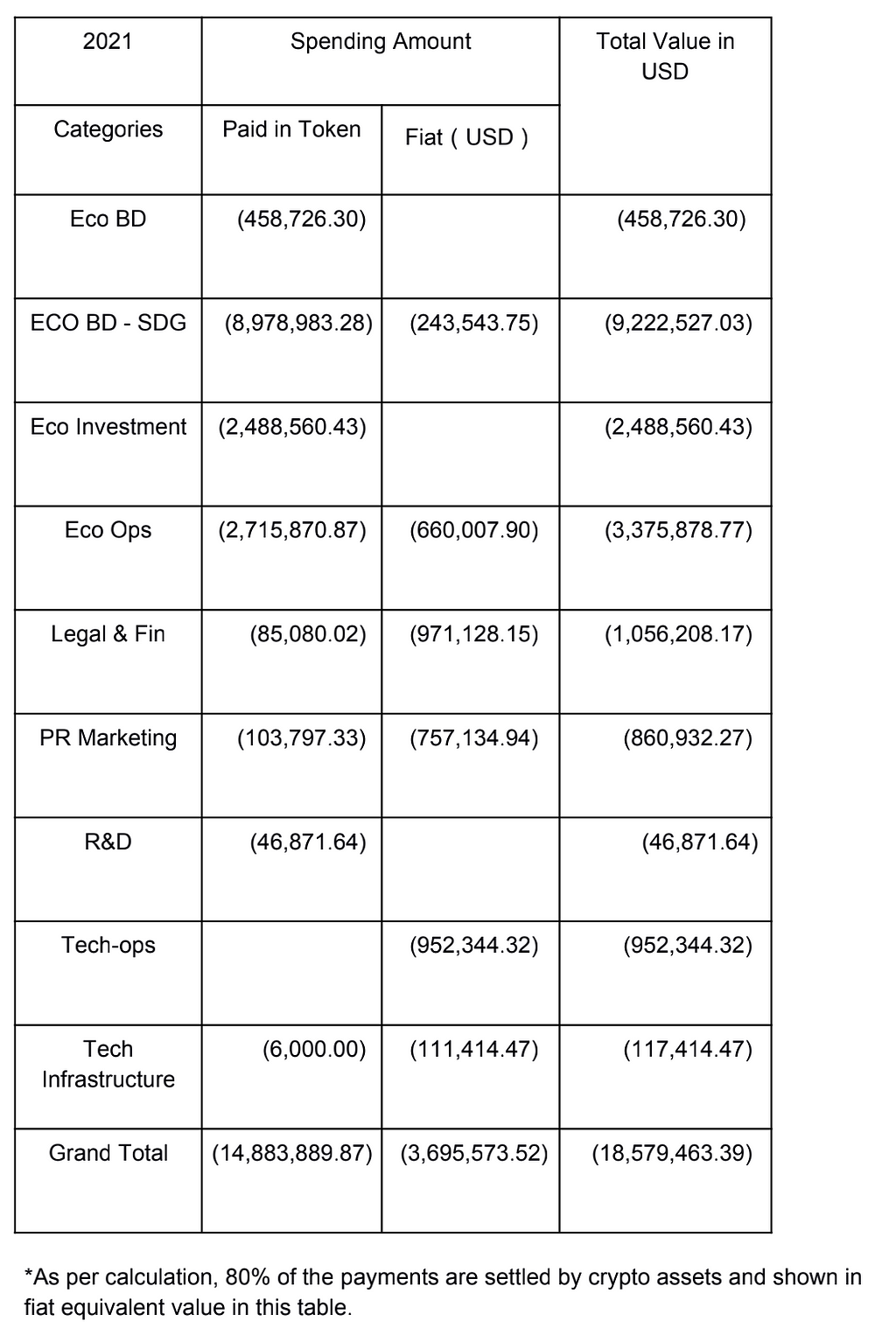

P/L Sheet(Including all spendings)

We have also adjusted the spending categories to ensure the income statement (P/L), which is a financial statement that summarizes the revenues, cost and expenses incurred, could be more accurate, precise and complete. Categories now include:

- Ecosystem development: Including ecosystem partners cooperation like exchanges, custodians, wallet providers, brokers etc., community events, ecosystem projects cooperation and business case development

- Ecosystem operation: Including the operation cost such as team cost, office rents, utilities, consulting fees, external services;

- Ecosystem investment: Including the grants, incubations, accelerations, and investments for VeChain ecosystem projects;

- Technical operation: Including technical team human cost, incentives, travel spending and the cost of attending events, external technical services like smart contract auditings, security auditings, penetration testings etc.;

- Technical infrastructure: Including cloud service fees and other infrastructure implementation fees.

- Legal & Finance: Including entity setup, compliance consulting, legal and finance service fees;

- PR & Marketing: Including marketing events, sponsorship and commercials, communication and media services;

- R&D: Including technical research & development, Scholar program sponsorship, IP related costs;

Key Disclosure

Trust and shared values are tenets of any collective effort, especially when it comes to the development of a public blockchain ecosystem. The data above shows where the Foundation has invested its resources. In the following sections, we will brief stakeholders on our major achievements and progress during the 2021 fiscal year as well as the resulting outcome, in accordance with ultimate accountability laying with stakeholders’ interests.

Technical Achievements

During 2021, there were 4 major upgrades on the VeChainThor Mainnet, from v1.4.0 to v1.6.0. The latest oversaw the activation of hardfork VIP214, part of the PoA 2.0 consensus mechanism upgrade.

In February 2020, Dr. Peter Zhou, Chief Scientist at VeChain and Dr. Zhijie Ren, Senior Blockchain Researcher at VeChain introduced the concept of a next-generation Proof-of-Authority (PoA 2.0-SURFACE). It is characterized as a Secure, Use-case adaptive, and Relatively Fork-free Approach of Chain Extension. The PoA 2.0 consensus mechanism is a major step for us in delivering the tools, architecture and most importantly the level of data security needed to ensure VeChainThor leads mass adoption.

After almost a year of efforts, on November 16, 2021, the PoA 2.0 phase 1 upgrade was officially implemented on the VeChainThor mainnet. It added a per-epoch VRF-based source of randomness that improves the security of the current leader selection mechanism, making it immune to corruption attacks or grinding attacks, preventing manipulation of the block producer selection process and drastically increasing the security of the network. Following this success, we turned our focus to the final phases of PoA 2.0 consisting of two more steps, including a finality mechanism that ensures no risk of data loss, even in a highly disrupted environment or major attack.

A Focus On Sustainability

The VeChainThor public blockchain provides a secure and efficient layer 1 public blockchain platform and combines it with high performance and an almost neutral environmental impact.

Based on the research of Centre Testing International Group Co. Ltd. completed in September 2021, the total annual electricity consumption of VeChainThor is estimated to be 7581.31 kWh. For users looking to embrace sustainable targets, VeChainThor is the perfect public blockchain for longer-term and green collaboration.

Commanding such green technologies furthers our ability to expand our technological development both globally, and to rural areas that require eco-conscious implementation, allowing us to shorten the path towards poverty alleviation. For example, the Inner Mongolian government in China recently issued policies to create an interoperable system that met the country’s call to erase poverty in rural areas. VeChain was commissioned to build this large traceability platform and has already brought benefits to a million-dollar’s worth of local farming products as of December 2021.

In October, 2021, Mr Antonio Senatore officially joined the VeChain Foundation as Head of Technology for SDGs, with the immediate goal of building VeChain’s technical force focused on delivering SDGs and related Ecosystems, helping take our green efforts even further.

Expanding Business Cases

In August 2021, VeChain launched the first Digital Carbon Footprint Software as a Service (SaaS) module built on the VeChainThor public blockchain. It is a powerful, rapidly deployable tool, enabling enterprises of all sizes to re-engineer their carbon footprint data management practice.

In September 2021, VeChain launched a new offering — the Sustainable Fashion Carbon Footprint SaaS module that allows a permanent and accessible record of carbon footprint across every step of the supply chain.

As the world’s only technology provider to combine the merits of decentralized ledger technology and an SaaS business model, VeChain has been accumulating use cases with these off-the-shelf tools under its belt. For example, in the case of Canadian fashion brand Frank and Oak, a certified B Corporation, it uses Yak wool tracked on VeChain to ensure durability, functionality and style without compromising the planet.

Blockchain-enabled data transparency allows upstream and downstream counterparts to better communicate their sustainability efforts directly to their consumers. This trend will become a major focus in the consumer goods industry and subsequently open many doors for VeChain. As regulations start to fall into place, VeChain’s growth in this sector will rapidly accelerate.

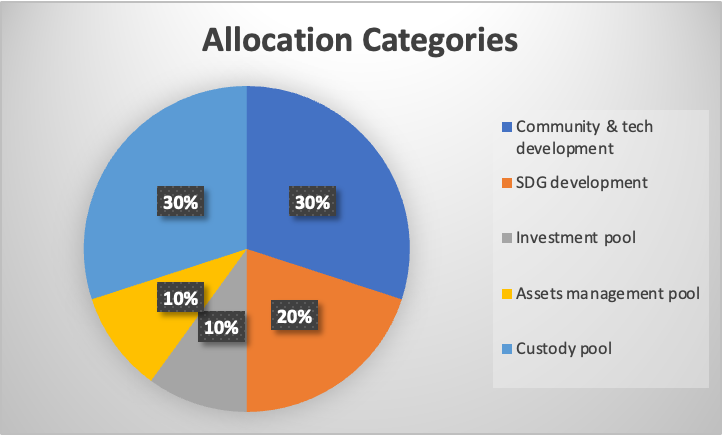

Reallocation of Assets

In recent years, our assets pool was defined in accordance with VeChain Whitepaper 2.0:

- Enterprise Investor Pool

- Co-founder, Development Team

- Ongoing Operation and Technological Development

- Business Development

Guided by this initial design, the Foundation has successfully made progress towards the development of the VeChainThor mainnet, most notably marked by recent achievements in PoA 2.0, and now advancing to achieve a much wider vision.

Standing at the starting point of 2022 and with new focuses in our minds, we set new objectives and so hereinafter re-allocate assets held by the Foundation into new categories.

Community & Tech Development: 30%

Technology and community development is always one of the priorities of the VeChain Foundation. To pull off even more efficient and creative iterations, we will pool more resources to expand this diverse and robust team. Also, the additional resources represent a call from the Foundation to build more tools and more protocols in the ecosystem, including DeFi, Web3, cross-chain and more.

SDG Development: 20%

VeChain is one of the greenest layer 1 smart contract public blockchain platforms and has been investing in related projects and use cases since 2019. With governments and organisations now applying considerable resources in attempting to achieve the 17 Sustainable Development Goals (SDGs) set out by the UN, the Foundation intends to remove as many barriers as we can by becoming the technology provider of this new era. This pool helps us, our enterprise users and community developers alike achieve these goals for the benefit of all of humankind.

Investment pool: 10%

The VeChain Foundation believes that Blockchain is going to build a better world by transforming technological value into business value. VeChain will continue expanding the VeChain Ecosystem with the three major focuses starting in 2022 as per below:

1) Sustainability Use Cases

2) Web3 Tools & Services

3) DAO Tools & Services

The proper use of available instruments is what will carry VeChain forward most significantly. We intend to connect with more projects and partnerships to co-develop the VeChain Ecosystem during the above stages.

Assets management pool: 10%

To maintain a healthy asset structure, we allocate 10% to asset management, including basic cryptos like BTC/ETH, Stablecoins like VeUSD/USDT/USDC and VET which aims to guarantee the robustness of VeChain operations and help us achieve our milestones in the years ahead.

Custody pool: 30%

30% of assets go to the custody pool that includes the lockup pool for X-node rewards in VTHOs generated by the 5B VET the Foundation has locked up for the benefit of the Economic X-nodes. The remainder of this pool ensures that the VeChain Foundation will stay self-sufficient, agile, and stable.

We have made consistent statements during the last 15 volumes of the Financial Report so as to foster transparent communication with our stakeholders about our accomplishments and the creation of tangible economic value through blockchain technology.

This still is, and always will be, the commitment of the VeChain Foundation, only now with even greater enhancement of discretion and compliance. We intend to facilitate and enable more participation from enterprises, developers, think tanks, academics, and many other parties than ever before and build a trustless ecosystem fitting at the start of our growth phase.