[Kyber Netwok] Recap: KyberDAO Community Call #3

In this call we touched on what to expect with the announcement of the Kyber 3.0 upgrade and Kyber’s permissionless Dynamic Market Maker (DMM). You can listen to a complete recap of the call here:

https://medium.com/media/debd52932435b738bfbfb3ba0dddece8/href

KyberDAO — Key Highlights

We’ve had 16 Epochs so far, with 16 BRR campaigns. Our first 2 Kyber Listing Proposals (KLPs) were also passed.

Stats:

- 55+m KNC tokens staked in KyberDAO ($100M+)

- $8m+ distributed as rewards to voters in the DAO

- $2m+ in rebates to professional liquidity providers

Prior to the launch of the permissionless Kyber DMM, a KLP will still have to be submitted for every new ERC-20 token or reserve to be added to Kyber Network. The KLP process will provide a clear agenda for stakeholders to approve new tokens and reserves through the KyberDAO, allowing a constant polling of the community and dynamic governance of the token and reserve listing process.

Read more about our latest KLPs

- KLP-1: GRID, OM, RFOX, STRONG, NTB

- KLP-2: 1INCH, NRG, EVEREST, MITX

Reminder on Available Staking Pools

Note: These are all third-party pools that are not managed by Kyber. Please do your own research. Follow https://twitter.com/KyberDAO and https://t.me/KyberDAO for updates

Non-custodial, trustless options (you have control over your funds):

- Unagii by StakeWithUs https://app.unagii.com/stake/kyber

- StakeDAO by Stake Capital https://www.stake.capital

- Kyber Community Pool by defidude https://kybercommunitypool.io

- xKNC by xToken https://xtoken.market

Custodial options

- Binance Staking

- Smart Valor

For xKNC holders using xToken:

xToken is migrating xKNCa and xKNCb to a new proxy structure soon in anticipation of Kyber 3.0. With their new proxy, they will be able to offer a seamless transition when Kyber 3.0 comes. Details here.

View your estimated APY/ROI by using these calculators from the community:

- Staking pool Unagii https://app.unagii.com/stake/kyber (you can stake with Unagii as well)

- By Mirko: https://www.stakingrewards.com/asset/kyber-network/

- By Lincoln: http://kyberstake.xyz/

Check for gas prices at: https://gasnow.org— for small amounts of KNC, you can try to use the 3rd-party staking pools mentioned above.

Recap: What to expect with the Kyber 3.0 upgrade

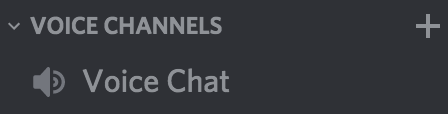

1. Kyber 3.0: Hub of Purpose-driven Liquidity Protocols

Kyber 3.0 transitions Kyber from a single protocol into a hub of liquidity protocols catered to different use cases. Kyber 3.0 is a process made up of 2 phases, Katana and Kaizen.

- Phase 1: Katana (Q1–2) will launch the permissionless DMM, a next-gen AMM that offers high capital efficiency and other benefits for LP and users. The KNC Migration (if the proposal passes) will also happen in this phase.

- Phase 2: Kaizen (Q3) will introduce more improvements and the full network upgrade will be completed.

2. Removing previous barriers to growth

Kyber is aware of all the main issues from last year and major steps have been taken to address them in 2021:

- Permissioned single liquidity contribution model

- High gas issues

- Inflexible ETH-only quoting for trades

- Fixed, inflexible reserve interface for developers

Removing these barriers will create the flexibility to create completely new liquidity protocols with unique strengths, use cases, and target audiences. Providing a method for any user to add liquidity via a permissionless manner while achieving high capital efficiency and dynamic fees is especially important and a novel DeFi use case.

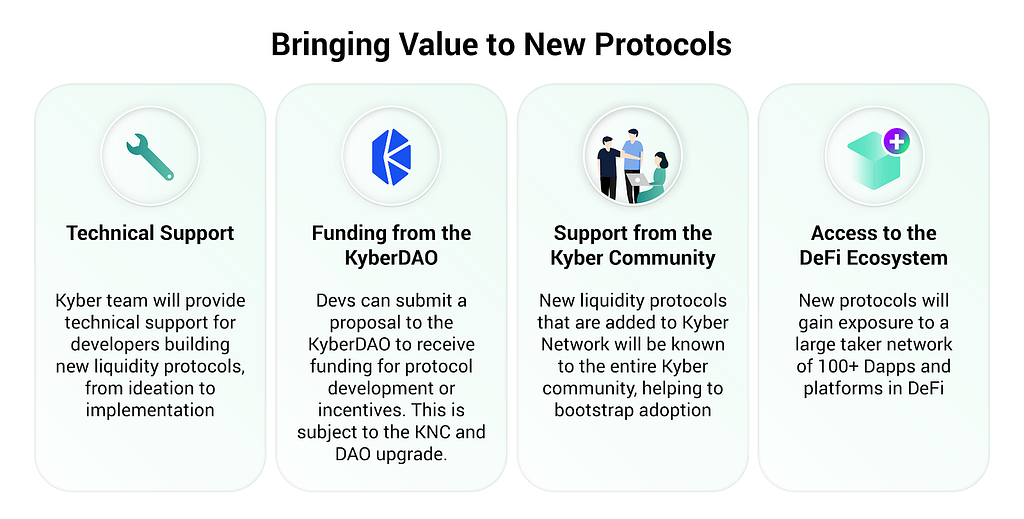

3. Supporting New Liquidity Innovation (New protocols)

Kyber 3.0 makes it easier for developers to work with Kyber to create innovative liquidity protocols that can be seamlessly used by makers and takers. If you have ideas on what new protocols to build with Kyber and/or require funding for your project, suggest them on our new governance forum here.

Scaling (L2) and Cross-chain: Kyber 3.0’s new architecture also makes it easier for Kyber to support potential scaling and cross-chain solutions (e.g. L2) in the future, given the increasing need for faster and cheaper transactions in Ethereum and DeFi. If you have ideas on these topics, share them here.

4. Kyber DMM Launch

Kyber DMM (new liquidity protocol), DeFi’s first automated dynamic market maker, will allow liquidity contributions from anyone, including regular/retail liquidity providers as well as token teams, while providing high capital efficiency and dynamic fees.

Kyber DMM has two key features:

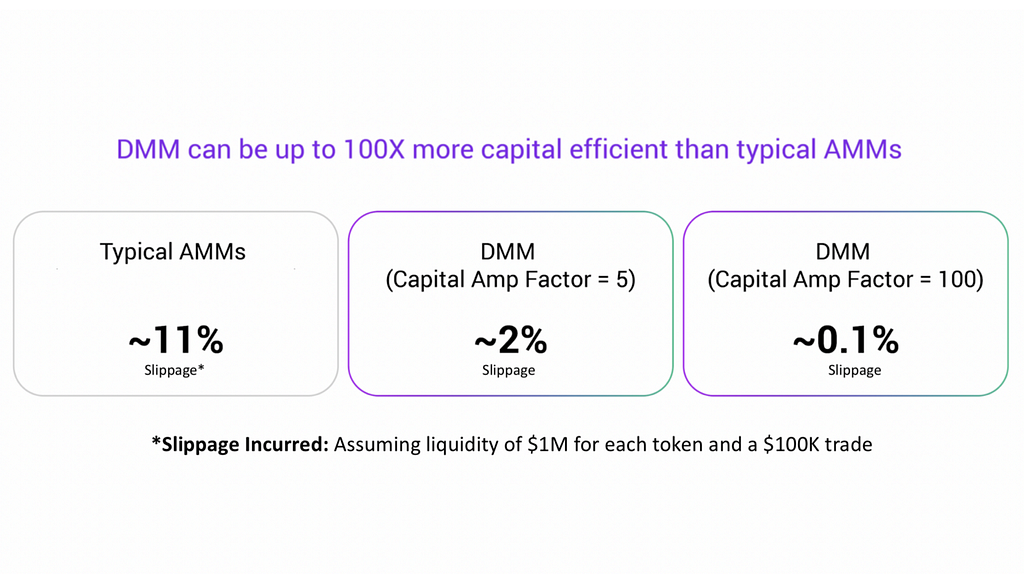

Programmable Pricing Curves: allows liquidity pool creators to customize the pricing curve and set the capital amplification factor of the pool in advance: Stable pairs with low variability in price range (like USDC/USDT, ETH/SETH) will be able to support pools with a very high amplification factor, which means given the same liquidity pool and trade size, slippage can be up to 100X better. For other pairs, (like WBTC/ETH), capital efficiency can be up to 5–10X better as well.

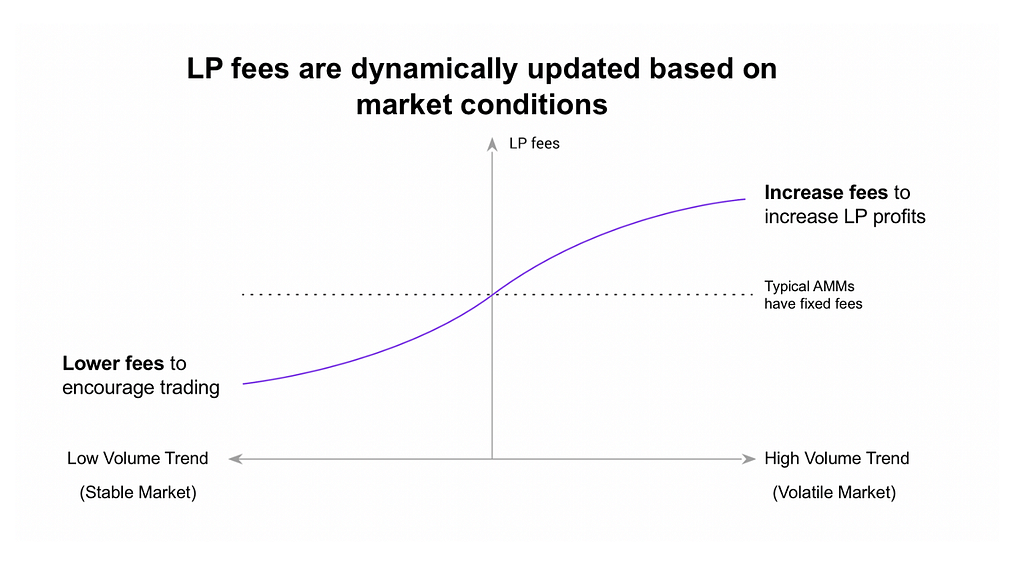

Dynamic Fees: Kyber DMM watches the volume happening on-chain and adjusts fees accordingly. In a normal market, the DMM will behave like other AMMs. In a market where volume is higher than usual, the DMM will increase the fees, and in periods of low volume, the DMM will reduce the fees. This is similar to the strategy undertaken by professional market makers to maximize returns.

By increasing the fees for trades during these periods, the DMM recoups what would usually be ‘impermanent losses’ for LPs during periods of sharp token movements and absorbs more fees for LPs, thereby helping to reduce the impact of IL. Conversely, the DMM dynamically optimizes for lower fees to encourage trading and higher volume during periods of low volatility.

Kyber DMM: Progress Update

At launch, the DMM will likely start with a few competitive token pairs which will offer the best/one of the best rates. We expect more tokens to be available as we further optimize the protocol and more liquidity pools are created. It will be very easy for anyone to add liquidity on the DMM, for users to swap, and for developers to source the liquidity. The Kyber team will work closely with Dapps and aggregators, as they will naturally pull liquidity from Kyber if the best rates are offered.

Progress-wise, the litepaper is almost complete and the team is fine-tuning the UI design, in parallel with the final phase of development. They are confident that the DMM will provide a very seamless and intuitive experience for all users and liquidity providers.

For the latest overview of Kyber 3.0 and the DMM, please read our announcement post.

KNC Migration & Upgrade Discussion on our new governance forum

To support the new architecture, there will soon be a Kyber Improvement Proposal (KIP) for KNC to be migrated to a new flexible token contract that has the ability to manage and collect fees from multiple protocols, and allow the token to capture the value created by all the innovation in the network. Kyber intends to work with the AAVE team on this migration since we will utilize elements of their governance framework. If this migration is approved, holding KNC would mean having a clear stake in all the important new liquidity protocols created for DeFi.

We have started a discussion around this upcoming KIP and its impact on Kyber and KNC. Join the conversation here. One of Kyber’s earliest investors, HyperChain Capital (they hold 5M KNC), also shared their thoughts on the potential KNC migration and upgrade.

To be clear, this KIP is focused on making the KNC token more dynamic, flexible, and easily upgradeable, as well as providing any necessary safeguards. This KIP does not include minting of new KNC or liquidity mining right away, which are separate topics to be discussed by the KyberDAO at a later date. For example, in a separate KIP in the future, members of the KyberDAO may propose and vote to reward liquidity providers/users with incentives to bootstrap adoption of new protocols such as the Kyber DMM.

How can you (the community) help?

Share the Kyber 3.0 announcement post, infographic, and tweet with your friends and other DeFi community members! Participate in our new Kyber governance forum https://gov.kyber.org/

body[data-twttr-rendered=”true”] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height);resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === “#amp=1” && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: “amp”, type: “embed-size”, height: height}, “*”);}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind(‘rendered’, function (event) {notifyResize();}); twttr.events.bind(‘resize’, function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute(“width”)); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Kyber will be increasing our education efforts e.g. For major updates, Kyber will launch a ‘Learn & Win’ series to educate community members and allow them to apply what they learnt through quizzes or surveys (and win attractive prizes). The first quiz will be on Kyber 3.0 and it will be announced soon.

Thanks to those of you who participated in our community poll about which Kyber 3.0 image should be used on our Kyber Twitter profile banner!

Join the conversation

If you haven’t done so, join us on Discord! You can use the following channels to keep discussions focused on specific topics:

- #kyberdao: for general discussion and feedback around the KyberDAO

- #burn_reward_rebate: for discussions about the network fee allocation and BRR (Burn/Reward/Rebate) proposals

- #kip: for discussions about the latest KIP proposals

- #kyberdao-updates: for important governance-related updates

- Voice Chat: for listening and speaking during our community calls

As always, all updates and calls will be announced on Twitter, Discord, and our new Kyber Governance Forum. These discussions are part of Kyber’s commitment to transparency and community engagement on the path of progressive decentralization.

To help stay up to date with important KyberDAO events and deadlines, an unofficial KyberDAO Google Calendar was set up by community ambassador DeFi Dude, which provides reminders/alerts on Epochs, BRRs, KIPs, and more. To add the KyberDAO Reminders Calendar to your list, click here.

See you at the next KyberDAO Community Call!

Onward, Kyber Network!

Discord | Website | Forum | Blog | Twitter | Reddit | Facebook | Developer Portal | KyberPRO | Kyber Tracker | KyberWidget Generator | Github

Recap: KyberDAO Community Call #3 was originally published in Kyber Network on Medium, where people are continuing the conversation by highlighting and responding to this story.