[Kyber Netwok] KyberDMM Launches Dynamic Trade Routing: Aggregating Liquidity for Better Token Rates!

Users can now source liquidity across different decentralized exchanges to help achieve the best prices for any token swap, on any supported network

We’re excited to share that KyberDMM’s swap function is now greatly enhanced with Dynamic Trade Routing! This powerful new feature enables users to source liquidity across different decentralized exchanges to help achieve the best price for any token swap, on any supported network, in an entirely trustless manner!

Kyber Network is a liquidity hub that connects liquidity from a wide range of sources to power instant and secure crypto swaps for any user or application. Our vision is to be a sustainable liquidity infrastructure for DeFi and we’re constantly developing solutions to add value to the ecosystem.

This led to the creation of DeFi’s first multi-chain dynamic market maker protocol, KyberDMM DEX. With its high capital efficiency and dynamic fees, KyberDMM was designed to maximize the use of capital and optimize returns for liquidity providers and traders alike.

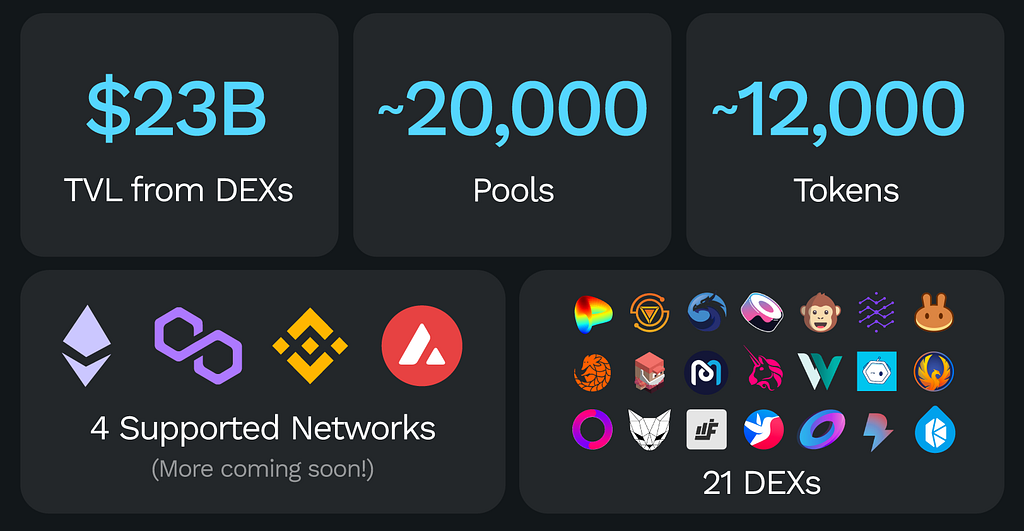

KyberDMM has hit several milestones since its beta launch just a few months ago!

- Multi-chain: Ethereum, Polygon, BSC, Avalanche and more networks on the way

- Over $30M in incentives being given out as part of our Rainmaker Liquidity Mining campaigns

- Total Trade Volume: $2B

- Over $4M in fees collected for close to 10,000 liquidity providers

- All-time-high TVL of ~$500M and $50B in Amplified Liquidity

- Integrated by Dapps such as Coin98 Wallet, Kattana Trade and Rome Terminal, as well as other top Aggregators such as 1inch, Paraswap, 0x API, Matcha and Slingshot.

- Collaborations with xToken, xDollar, O3 Swap, PolyDoge, Jarvis Network, Pegaxy, DeFi Warrior, Creator, StepHero, APEIN, DYP Protocol, Avalaunch, with others coming up such as Unbound Finance and Evrynet!

KyberDMM has also been covered in the media by Coindesk, Cointelegraph, The Block, DeFiant, Bankless, Decrypt, DeFi Pulse, DeFiprime, AltcoinBuzz, CryptoBriefing, Delphi Digital, and more.

Having showcased the major advantages and returns for liquidity providers, we now turn our attention to the other important segment in the DeFi space — Traders. Previously, KyberDMM DEX only allowed trading of tokens that were in its own liquidity pools. Although these tokens could enjoy low slippage due to KyberDMM’s extremely high capital efficiency, some popular DeFi token pairs were unavailable.

Given that we aim to provide maximum value for both liquidity providers and traders, there was a pressing need to ensure a large variety of tokens for users to trade (and at the best prices!). We’re a community-driven project and many token teams, partners and community members have also requested for more of their favorite tokens to swap.

Dynamic Trade Routing: Best Prices for Any Token

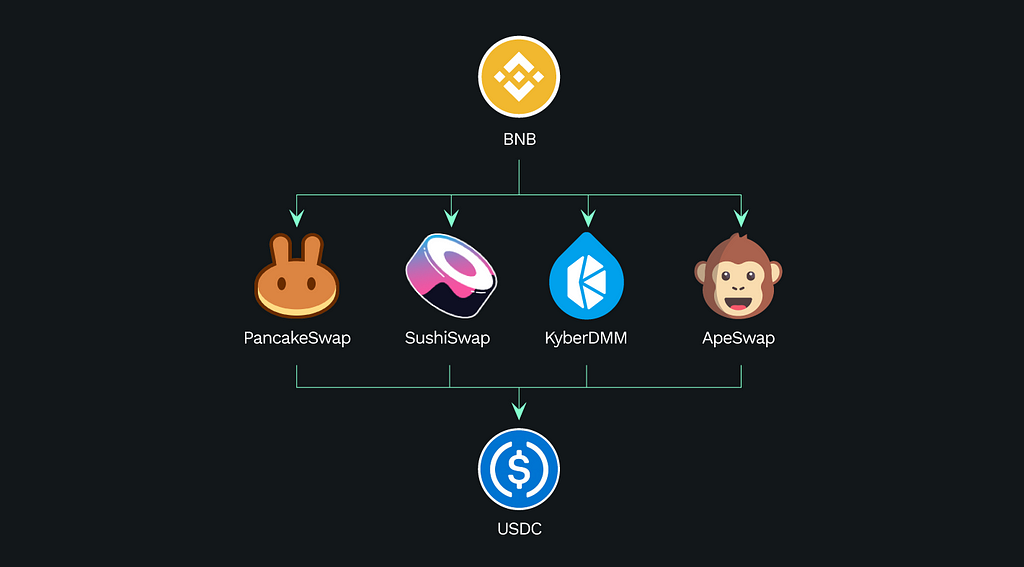

As such, we’re happy to launch Dynamic Trade Routing for KyberDMM swaps! Our team developed a novel trading algorithm that enables KyberDMM to find the optimal route and split trades through multiple DEXs in order to achieve the best prices for any token swap on supported networks! This also means that for the first time, users are able to trade tokens that are not within KyberDMM pools but are available on other DEXs.

At launch, Dynamic Trade Routing will source tokens from 21 popular DEXs across Ethereum, Polygon, BSC and Avalanche; such as Uniswap, Sushiswap, Curve, QuickSwap, PancakeSwap, Pangolin and Trader Joe.

This is just the beginning as we build the liquidity infrastructure for DeFi. We are continuously optimizing our algorithm and will add more liquidity sources over time to get better rates as we expand into different chains.

How it works

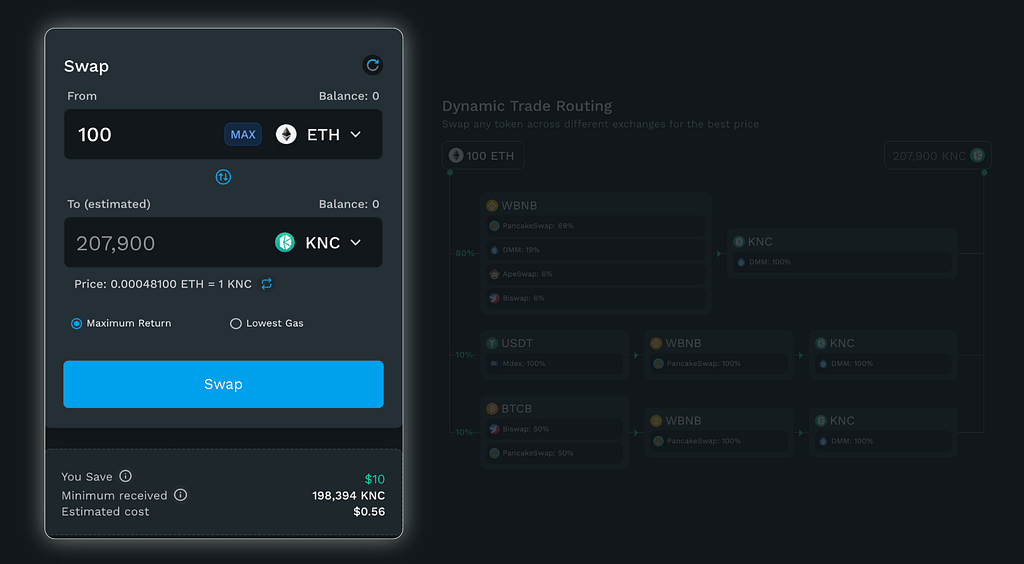

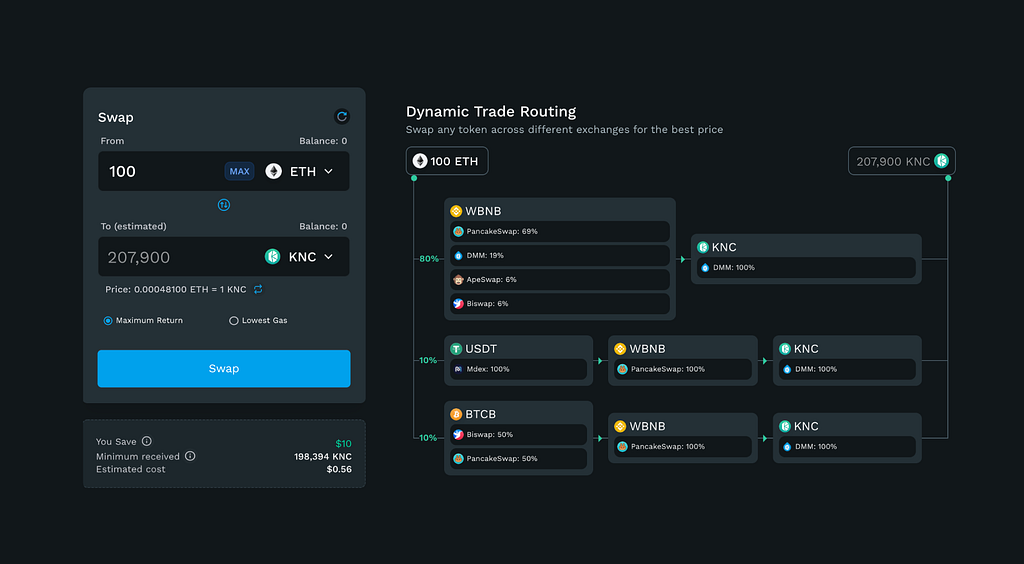

On the ‘Swap’ page of dmm.exchange, simply select the two tokens you wish to swap.

Our Dynamic Trade Routing algorithm would automatically search across multiple DEXs to identify and select the optimal trade routes and prices for you! You can also see exactly which DEXs were involved in the trade and the % split between them. Many more DEXs, pools and tokens will be added soon!

You save: You can view how much you are saving from each trade with dynamic trade routing.

Minimum received: During the token swap process, you will be guaranteed to receive at least a certain amount of tokens (shown as the minimum received amount). The transaction will revert if there is a large, unfavorable price movement before it is confirmed.

Any Dapp or DEX Aggregator Can Utilize the KyberDMM API to Get Excellent Rates

For any developers that wish to integrate KyberDMM DEX and enjoy excellent rates and yield in their own DeFi Dapps, whether for decentralized trading, liquidity provision or yield farming, check out our KyberDMM documentation and API here and reach out to us! We’re thankful for all the DEX aggregators in the space and will continue working closely with them to better utilize our liquidity pools and grow the entire DeFi space together.

KyberDMM DEX trading and yield farming stats are already supported on data analytics platforms such as CoinGecko, DeFi Pulse, DeBank, DeFi Llama and vfat.tools.

Uniting Traders and Liquidity Providers via a Seamless Trading Experience

Apart from Dynamic Trade Routing for traders, KyberDMM also offers liquidity providers important benefits to maximize the use of their capital; benefits not available on typical AMMs.

- Amplified Liquidity Pools: Liquidity providers enjoy excellent capital efficiency with reduced trade slippage, achieving better prices and earning more fees with much less capital. Check out our ?Rainmaker yield farms!

- Dynamic Fees: Protocol fees are adjusted dynamically based on market conditions to maximise returns and reduce the impact of impermanent loss for liquidity providers; LPs earn more!

- Fully permissionless: Anyone can create a pool or add liquidity to existing pools; while any Dapp, DEX aggregator, or end user can access this liquidity. KyberDMM is already integrated with 1inch, Paraswap, 0x, Matcha, and Slingshot, with more Dapps on the way.

- Reliable and Secure: KyberDMM’s codebase has been audited by external auditors such as Chain Security and is open source on Github for community review. KyberDMM doesn’t use 3rd-party oracles so it is not vulnerable to external oracle risks. The protocol is also covered up to $20 Million by decentralized insurance provider Unslashed Finance.

By uniting powerful trading and liquidity provisioning functionalities into a single platform, KyberDMM is able to connect traders and liquidity providers (takers and makers) and provide them with a seamless decentralized trading experience. We expect to see a lot more traders become LPs and vice versa.

The improvements won’t stop here, as we have many unique features in the pipeline that will over time make KyberDMM the DEX protocol of choice for DeFi traders, liquidity providers, NFT gamers and Dapps on multiple chains.

Start trading on Ethereum, Polygon, BSC and Avalanche using KyberDMM DEX today!

About Kyber Network

Kyber Network aims to deliver a sustainable liquidity infrastructure for DeFi. As a liquidity hub, Kyber connects liquidity from various protocols and sources (e.g. KyberDMM DEX) to provide the best token rates to takers such as Dapps, aggregators, DeFi platforms, and traders.

Through Kyber, anyone can contribute or access liquidity, and developers can build innovative applications, including token swap services, decentralized payments, and financial Dapps — helping to build a world where any token is usable anywhere.

Kyber is powering more than 100 integrated projects and has facilitated over US$7 billion worth of transactions for thousands of users since its inception.

Discord | Website | Twitter | Forum | Blog | Reddit | Facebook | Developer Portal | Kyber Tracker | KyberWidget Generator | Github | KyberDMM | KyberDMM Docs

KyberDMM Launches Dynamic Trade Routing: Aggregating Liquidity for Better Token Rates! was originally published in Kyber Network on Medium, where people are continuing the conversation by highlighting and responding to this story.