[Kyber Netwok] KyberDMM DEX Brings Capital Efficiency and the Best Token Rates to Fantom

DeFi’s first Dynamic Market Maker will enable better prices for traders and higher capital efficiency and returns for LPs on Fantom

Kyber Network’s KyberDMM DEX, DeFi’s first multi-chain dynamic market maker, has launched on the Fantom network, bringing the best token prices and enhanced liquidity to Fantom users!

After our beta launch on Ethereum a few months ago, we have also successfully expanded to the Polygon, BSC and Avalanche networks.

- Total Trade Volume: Over $2B

- Over $4M in fees collected for close to 10,000 liquidity providers

- All-time-high TVL of ~$500M and $50B in Amplified Liquidity

- Integrated by Dapps such as Coin98 Wallet, Kattana Trade, Rome Terminal, The Graph, as well as other top Aggregators such as 1inch, Paraswap, 0x API, Matcha and Slingshot.

We now look forward to providing better token prices and enhanced liquidity for the increasingly popular Fantom network!

What is Fantom?

Fantom is a fast, secure, and highly scalable asynchronous distributed ledger that allows people to develop smart contract applications with low transaction fees. The Fantom ecosystem is growing rapidly with $5.5 billion in TVL and hundreds of Dapps deployed. Ethereum assets can be easily migrated via the Fantom Bridge and the KNC (Kyber Network Crystal) token will soon be supported.

Bringing Better Token Prices and Liquidity to Fantom

KyberDMM is an extremely capital efficient and flexible liquidity protocol that enables traders and liquidity providers to maximize the use of their token assets.

Traders and Dapps can swap any token at the best token prices through dynamic trade routing across different Fantom DEXs. In addition, at a fraction of the TVL compared to typical AMMs, KyberDMM is able to provide better liquidity and very low slippage for popular token pairs, so liquidity providers enjoy higher capital efficiency and returns.

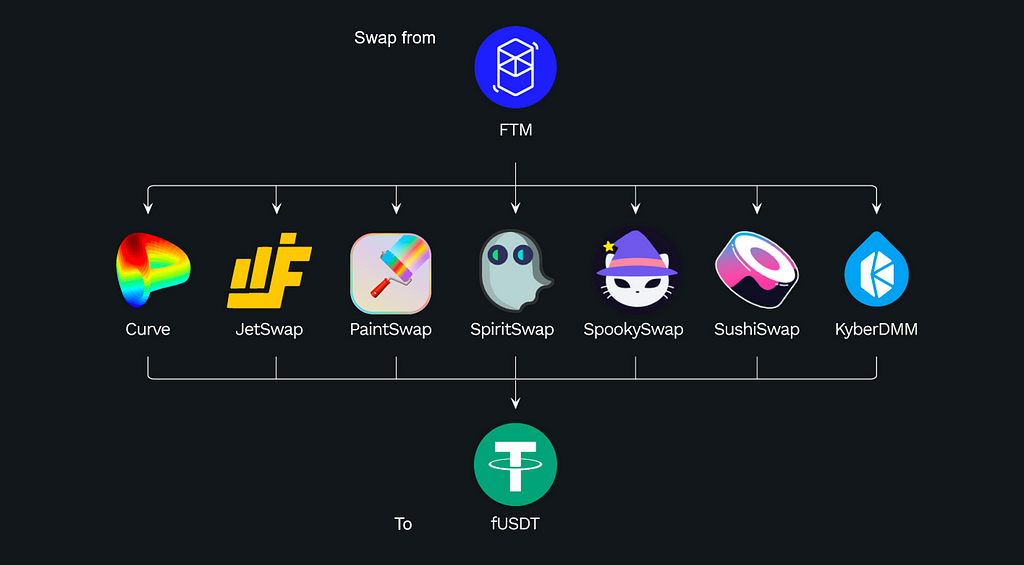

At launch, 7 DEXs and 5,000 liquidity pools have been integrated on Fantom — SpookySwap, SpiritSwap, PaintSwap, JetSwap, Sushi, Curve and also KyberDMM.

This improves the overall trading and liquidity provision experience for Fantom ecosystem users, Dapps and NFT games!

A portion of KyberDMM trading fees on Fantom will go to KyberDAO and subsequently to KNC voters, complementing the existing KyberDMM deployments on Ethereum, Polygon, BSC and Avalanche.

Accessing Fantom and Bridging Assets to the Network

- Switching from Ethereum/Other networks to Fantom: On KyberDMM, click the Ethereum button at the top right corner to switch your network to Fantom or change your network to ‘Fantom’ on your Metamask Wallet extension directly. Instructions on how to set up Fantom on Metamask can be found here: https://docs.fantom.foundation/tutorials/set-up-metamask

- Fantom Scan network explorer: https://ftmscan.com/

- Fantom Bridge: https://multichain.xyz/

Note: KNC tokens are NOT available on the Fantom network at this time. We are working closely with the Fantom Foundation and Anyswap team to add KNC to the bridge.

How to Trade at the Best Prices on Fantom

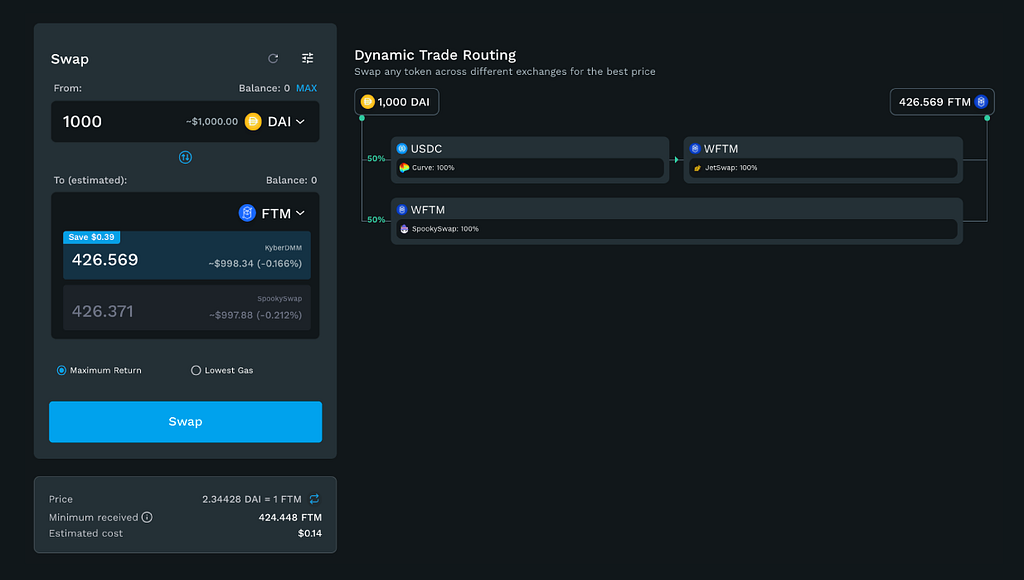

On the ‘Swap’ page of dmm.exchange, simply select the two tokens you wish to swap.

KyberDMM’s Dynamic Trade Routing algorithm would aggregate liquidity, automatically searching multiple DEXs to identify and select the optimal trade routes and best prices for you! You can see exactly which DEXs were involved in the trade and the % split between them. You can also see how much you save!

Start trading now! More DEXs, pools and tokens will be added soon.

Add Liquidity to Earn Fees with your Crypto Assets

On the ‘Pools’ page, connect your wallet e.g. Metamask on the Fantom network.

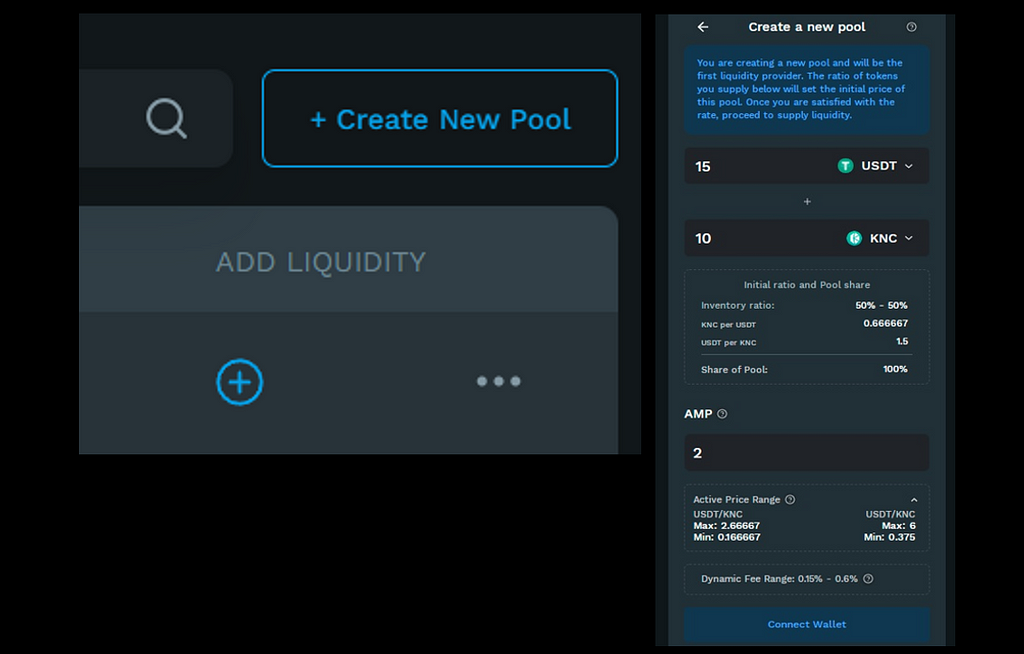

Creating a new liquidity pool: Create a new liquidity pool for a token pair by clicking +Create a New Pool. Type in the ratio of tokens you wish to add (this sets the price of the pool) and the AMP factor*.

*AMP = Amplification factor. Amplified pools have much higher capital efficiency. Higher AMP, higher capital efficiency within a tighter price range.

Add liquidity to existing pools: Select a token pair and click the + icon. Add liquidity by depositing the required tokens into one (or more) pools. You will receive DMM LP pool tokens in your wallet representing your pool share and start earning fees for that pool. Note that KyberDMM just launched on Fantom so there are only a few pools at the start.

View liquidity positions: On the ‘My Pools’ page, you can view all your liquidity positions and remove or add liquidity there. If you cannot see your liquidity position, click ‘Don’t see a pool you joined? Import it’ to add it manually.

We welcome all Fantom projects to reach out and propose joint liquidity mining campaigns with Kyber! Learn more here.

Why use KyberDMM DEX?

Traders and liquidity providers on KyberDMM enjoy powerful benefits that are not available on typical AMMs.

Dynamic Trade Routing: Traders can swap tokens at the best prices. Liquidity is aggregated from different decentralized exchanges to achieve better prices for any token swap on supported networks. Much better prices compared to trading on individual DEXs.

Amplified Liquidity Pools: Liquidity providers use amplified pools that enjoy excellent capital efficiency with reduced trade slippage. With the same pool and trade size, stable token pairs with low variability in price (e.g. USDT/USDC) can enjoy up to 400 times better slippage compared to other platforms. Liquidity providers can provide better prices and earn more fees with less capital.

Dynamic Fees: Fees are adjusted dynamically based on market conditions to maximise returns and reduce the impact of impermanent loss for liquidity providers, with fees automatically accruing from transactions in the pool.

Fully permissionless: Anyone can create a pool or add liquidity to existing pools; while any Dapp, DEX aggregator, or end user can access this liquidity. KyberDMM is already integrated with 1inch, 0x, Matcha, and Slingshot, with more aggregators and Dapps on the way.

Reliable and Secure: KyberDMM’s codebase has been audited by external auditors such as Chain Security and is open source on Github for community review. KyberDMM doesn’t use 3rd-party oracles so it is not vulnerable to external oracle risks. Kyber DMM is also covered up to $20 Million by decentralized insurance provider Unslashed Finance.

Invitation to DeFi Builders on Fantom

Kyber’s vision is to be the liquidity infrastructure for DeFi, which includes popular networks such as Fantom. This is Kyber’s first major step in building a sustainable and scalable liquidity infrastructure for the Fantom ecosystem.

We invite Fantom ecosystem players to use KyberDMM DEX to trade at the best prices and add liquidity to enjoy higher capital efficiency and returns! Any Dapp or DEX Aggregator also can utilize the KyberDMM API to get excellent rates in their own DeFi Dapps, whether for decentralized trading, liquidity provision, or yield farming.

DeFi projects can also propose joint liquidity mining campaigns with Kyber and get KNC from our ecosystem fund.

For developers looking to build with KyberDMM, please check out our developer documentation.

Follow us on Twitter and Discord to stay updated and start trading now!

Onward, Kyber Network!

About Kyber Network

Kyber Network aims to deliver a sustainable liquidity infrastructure for DeFi. As a liquidity hub, Kyber connects liquidity from various protocols and sources such as KyberDMM to provide the best rates to Dapps, DEX aggregators, DeFi platforms, and retail traders.

Anyone can contribute liquidity to Kyber Network and Dapps can integrate different protocols depending on their liquidity needs. Using Kyber, developers can build innovative applications, including instant token swap services, decentralized payment flows, and financial Dapps — helping to build a world where any token is usable anywhere.

Kyber is powering more than 100 integrated projects and has facilitated over US$7 billion worth of transactions since its inception.

Discord | Website | Twitter | Forum | Blog | Reddit | Facebook | Developer Portal | Kyber Tracker | Github | KyberDMM | KyberDMM Docs

KyberDMM DEX Brings Capital Efficiency and the Best Token Rates to Fantom was originally published in Kyber Network on Medium, where people are continuing the conversation by highlighting and responding to this story.