[Kyber Netwok] Kyber Ecosystem Report Jun-Jul 2021

Hello fellow Kyberians,

We’re especially excited to come to you with this month’s ecosystem blog as we have a number of important developments. First of all, Kyber is now on Polygon! Yes, you can now swap tokens on one of the largest scaling solutions available to Ethereum today for almost no cost or wait time (more on that below). Second, there’s a liquidity mining program! Voted for by the KyberDAO, the Rainmaker program provides $25M in rewards to liquidity providers (LPs) on both the Ethereum and Polygon Kyber DMM contracts. The uptake and interest from LPs has already been phenomenal and total value locked in the DMM has shot 15x to $330M and amplified TVL now sits at $34Bn. Apart from that, we also have a slew of partnerships and integrations to take advantage of all this highly efficient liquidity, so let’s jump right in..

Kyber DMM on Polygon

As you may be aware, the Kyber team has been exploring various scaling solutions for a while now (you may remember our Rollup Research). The need for a solution became especially evident in the first half of 2021 as gas prices shot through the roof, making transactions on Kyber and across DeFi cost upwards of hundreds of dollars per transaction.

The first important milestone in our scaling journey starts with Polygon, currently the largest scaling solution out there with over $6.5Bn in assets across 400+ dapps and projects. Polygon’s rapid growth has meant there’s already a nascent DeFi ecosystem that includes Aave, Curve, Sushiswap, and many other well known DeFi dapps, and it is therefore a good fit for Kyber to deploy and continue serving the liquidity needs of this DeFi ecosystem on Polygon. This ecosystem is seeing rapid growth as DeFi users migrate from the expensive and slow Ethereum base layer to the much faster and cheaper sidechain.

Just how much faster and cheaper is Kyber on Polygon than Ethereum for an average transaction you might ask;

Swapping on the Kyber DMM on Polygon costs less than $0.0007 and requires two seconds or less confirmation time.

This is an orders of magnitude improvement, and with centralized exchanges gradually allowing users to withdraw directly to these scaling solutions, we except more and more volume to shift from Ethereum to L2s and sidechains. We expect Kyber to be a beneficiary of this growth and we’ve already started seeing dapps like 1inch and 0x integrate with the Kyber DMM on Polygon.

We highly recommend reading our full Kyber & Polygon partnership blog here and trying out the DMM on Polygon here.

Note that using Polygon requires transferring of assets from Ethereum to Polygon and you can find the bridge with instructions here

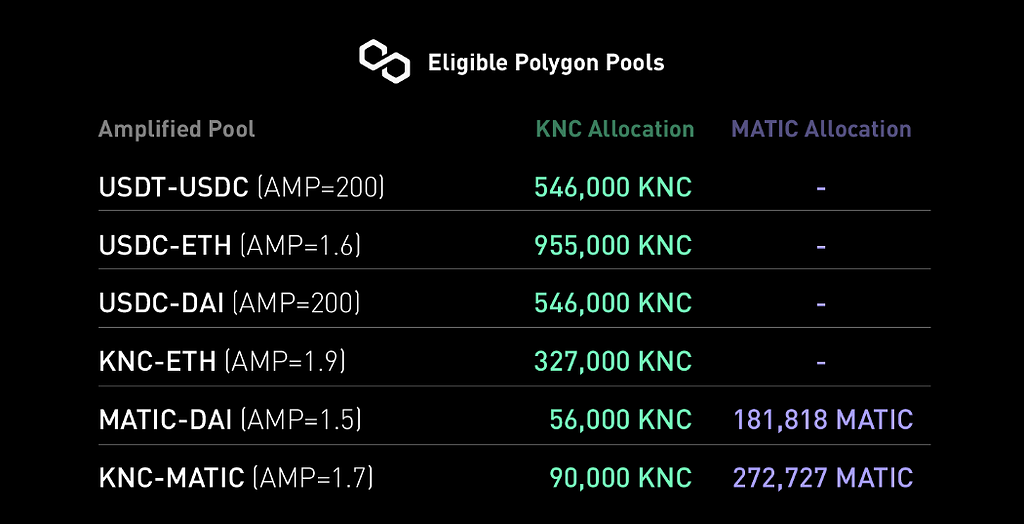

Rainmaker Liquidity Program

With the DMM in full swing on both Ethereum and Polygon, the KyberDAO decided to deploy part of the KNC in the Ecosystem Growth Fund towards a new liquidity mining program called Rainmaker, to supercharge usage and increase awareness of the DMM.

There will be a total of 15.12M KNC and ~454k MATIC rewards available to LPs who provide liquidity across 11 pools on Ethereum and Polygon:

The Ethereum reward program will run for 3 months while the Polygon program runs for 2 months, and there will be no lock-up period for the duration of the program although there is a 30-day vesting period for rewards.

The initial uptake of the program has already been incredibly positive as figures we mentioned in our intro show, and if you’re still on the fence on whether to participate or not, we’ve published a full blog post and step-by-step guides here, happy mining!

The Polygon deployment and Rainmaker program are both part of a larger KIP-9 proposal so we’d like to take this opportunity to once again familiarize you with what this important improvement proposal contains:

KIP-9 TL/DR:

- Add the KyberDMM protocol to Kyber’s liquidity hub (this proposal was in KIP8 but was subsequently rolled up into KIP9)

- Launch the Kyber Ecosystem Growth Fund and mint 42M KNC for growth initiatives (also in KIP8 rolled up into KIP9)

- Allocate 20% of the above towards a DMM Liquidity Incentives Program

- Deploy the KyberDMM on Polygon

- Allocate another 6% of minted KNC for Liquidity Incentives on Polygon

- Make the necessary technical changes to the KyberDAO smart contracts to enable all the above proposals.

In parallel, the migration of KNCL to KNC continues and as of now, Binance, Kraken, Huobi, Bitfinex, FTX, OkEX and almost all the other large and small exchanges have migrated, with Coinbase expected to migrate in the near future. If you haven’t already migrated your KNC, please visit kyber.org/migrate.

Integrations

We are really energized by Kyber’s launch on Polygon as well as the recent deployment of Katana and the DMM, and with this energy, we’re in full swing exploring new potential integrations with various DeFi protocols. We’ve already started seeing a good flow of projects connect to Kyber;

B.Protocol

B.Protocol’s new V2 uses Kyber to aggregate orders when ETH is put up for sale using the B.AMM formula combined with the Chainlink oracle.

body[data-twttr-rendered=”true”] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height);resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === “#amp=1” && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: “amp”, type: “embed-size”, height: height}, “*”);}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind(‘rendered’, function (event) {notifyResize();}); twttr.events.bind(‘resize’, function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute(“width”)); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Firebird Finance

Firebird, the multi-chain yield farming and dex aggregator, will use its own Vaults to provide liquidity to the Rainmaker program while it also taps into Kyber’s liquidity as part of its aggregation service.

The Graph

The Graph has been integrated into the KyberDMM UI to provide the data used in the info.dmm.exchange analytics page. Important information including volume, TVL, amplified liquidity and transactions are all provided through subgraphs which are open APIs fed by The Graph’s indexing and querying layer.

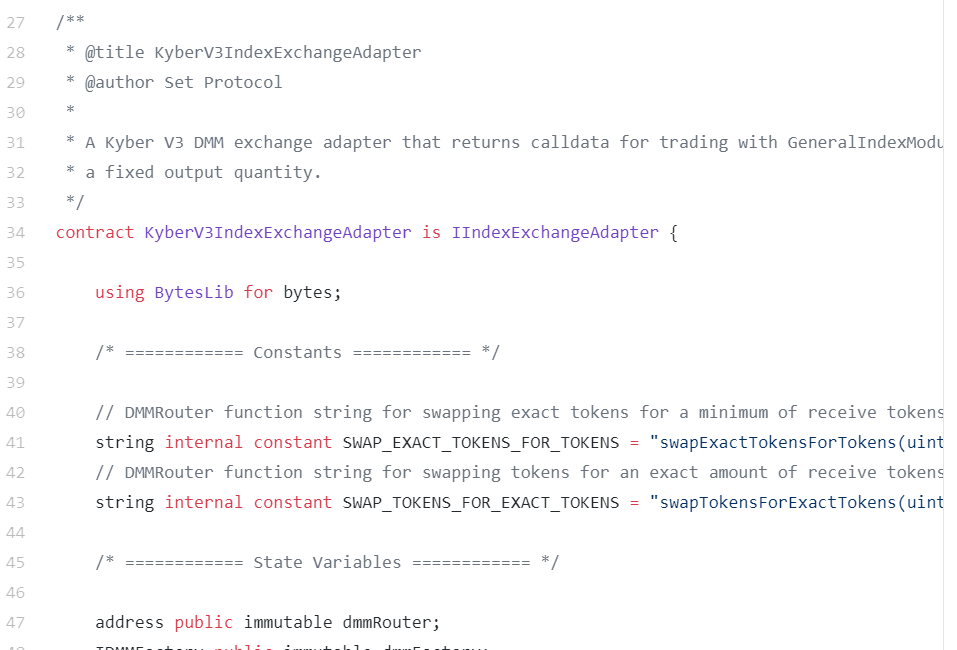

Set Protocol

Set Protocol, the popular asset management protocol, has integrated the KyberDMM by building a DMM exchange adapter so any index can use Kyber’s liquidity for rebalancing.

ETHGlobal HackMoney Event

We would also like to thank the eight teams that used Kyber in various unique ways in their HackMoney project submissions. We had projects that used the KyberDMM to explore different yield-maximizing strategies, projects that allowed fractionalized synths, created zero-slippage stablecoin swaps, and built cross-chain liquidity aggregation.

If you’re a developer interested in integrating Kyber (and particularly the DMM) you’ll find Anton’s KyberDMM workshop video below really useful. We’ve also got a team on hand to support and guide you through your integration on our official discord server.

https://medium.com/media/59fc6c4216700f6084d16e2e90e3dca2/href

Kyber Network Stats

With the Kyber team working in overdrive mode to deliver on so many different fronts, we haven’t had time to update and consolidate our backend data dashboard to reflect statistics across KyberDMM, Polygon DMM, and Kyber Network itself. Rest assured, one of your favourite ecosystem blog sections will be back very soon!

KyberWorld

AMA’s and appearances by the team:

- July 1: Kyber’s Shane Hong and Bo-yeon Beon participated in OKEx’s AMA to discuss Kyber 3.0, KyberDMM and the ‘Rainmaker’ Liquidity Mining program

- July 7th: DeFiPulse hosted an AMA with Shane

- June 22: Loi’s “Avalanche — What’s Next for Automated Market Makers?” Panel video has been published and is now available at bit.ly/3qi6hsH

Thank you all for tuning into our AMAs and panels. Additionally, we’d also like to thank the 4,200 participants who took part in our KyberDMM Learn and Win contest. Participants learnt about the DMM, what its key benefits are, what the Rainmaker is about, and entered a contest to win prizes.

Media

With the launch of the DMM on Ethereum and Polygon, Kyber was featured across most popular crypto media channels. We’ve provided a select few below.

Coindesk, Cointelegraph, CryptoBriefing, ChainBulleting, Capital.com, DeFiRate, CryptoNinjas, TheBlockCrypto, CryptoNews, AltcoinBuzz, Yahoo Finance, Nasdaq, Explica.co, Investing.com, Quebec News Tribune,

Conclusion

And that’s a wrap from another busy month in the world of Kyber and DeFi. We hope you are enjoying using the DMM and participating in Rainmaker. For us at the team, although it’s been extremely hard work, it’s also been a pleasure being at the forefront of on-chain market making innovation, exploring scalability solutions, and being one of the best protocols to take liquidity from for the last three years. Together with you, our community, we look forward to building on these foundations and growing our user numbers, growing Kyber’s reach, and bringing decentralization to the masses. Onwards and upwards!

Kyber Ecosystem Report Jun-Jul 2021 was originally published in Kyber Network on Medium, where people are continuing the conversation by highlighting and responding to this story.