[Kyber Netwok] Kyber 3.0: Architecture Revamp, Dynamic MM, and KNC Migration Proposal

Over the last year, DeFi has been evolving at a rapid pace, and we had previously addressed the key architectural constraints and challenges we had in responding to these changes in a post last October.

In this post, we will explain how we intend to remove past limitations to growth (e.g. high gas consumption, partially-permissioned model) to allow Kyber to quickly adapt to DeFi trends and foster future innovation, while providing a host of new benefits to liquidity providers, takers, developers, and KNC holders.

Firstly, we are embarking on the Kyber 3.0 upgrade, which will transition Kyber from a single protocol into a hub of purpose-driven liquidity protocols, each catered to different DeFi use cases. This will be the biggest change to Kyber’s architecture and token model since its inception and will be implemented over 2 phases — Katana and Kaizen.

Secondly, as the first major addition to our new network, we will launch a brand new liquidity protocol called the Kyber DMM — DeFi’s first automated Dynamic Market Maker. Kyber DMM will provide important benefits to liquidity providers, allowing fully permissionless liquidity contribution from anyone and access to this liquidity by any taker (e.g. Dapp, aggregators, end users).

Thirdly, to support the new architecture and increase the overall value of the network, a proposal to upgrade the KyberDAO and KNC to a new token contract will be made and voted on, with the aim to greatly enhance KNC token’s governance power, create multiple streams of utility, as well as support new liquidity innovation.

Kyber Network has been a leader in innovation since the beginnings of DeFi, establishing the first liquidity aggregation protocol, on-chain endpoint, and in KyberDAO, one of the most successful DAOs and communities in the space. In addition, we launched KyberPRO, the only framework for on-chain professional market making and the gateway into DeFi for market makers. Kyber 3.0 represents an exciting new phase for us, and we hope that you will join us in this journey.

New Network Architecture To Remove Constraints And Enable Innovation

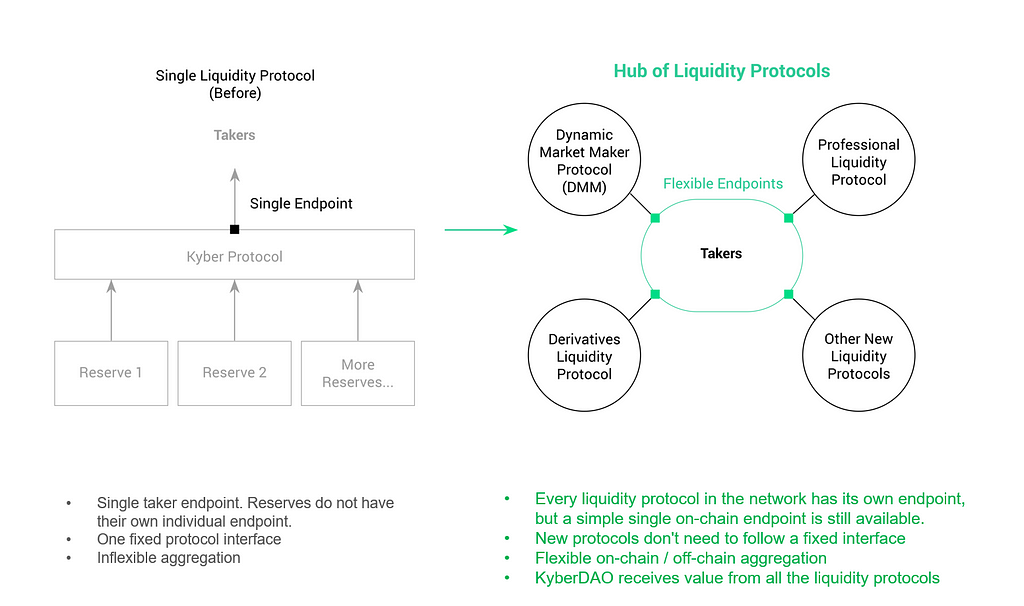

Our existing architecture allowed for efficient on-chain scanning of available liquidity providers on Kyber called ‘reserves’. These reserves followed a single fixed interface, which meant that they all followed certain rules like using ETH as a quote currency, and a single permission model to prevent DDOS attacks.

While this model worked extremely well at the early stages of DeFi, allowing us to offer the best rates by leveraging on-chain aggregation and a unique network of liquidity providers — it proved to be too restrictive over time and prevented us from quickly capturing key DeFi trends, including the recent rise of aggregators, permissionless contribution of liquidity, and stablecoin trading.

To remove these constraints, improve adaptability, and enable Kyber to capture all future DeFi trends, we are upgrading Kyber from a single liquidity protocol to a hub of diverse, purpose-driven liquidity protocols catered to different DeFi use cases.

Kyber’s previous reserve system will be overhauled and important reserves, like the Fed Price Reserves (FPR) and Bridge Reserves will be upgraded to full-scale liquidity protocols, with other new protocols created by the Kyber team as well as ecosystem developers over time.

What Does This Change Mean For Liquidity Providers and Takers?

By transitioning from a single liquidity protocol with reserves to a hub of liquidity protocols, we will remove a number of previous constraints and expand our capacity to serve liquidity providers, takers, and developers in DeFi.

DeFi has many use cases and possibilities. We believe that no one liquidity protocol can fit the needs of all liquidity providers, takers, and other market participants. This architecture change will allow us to rapidly innovate and integrate new protocols into our overall network to cater to different needs.

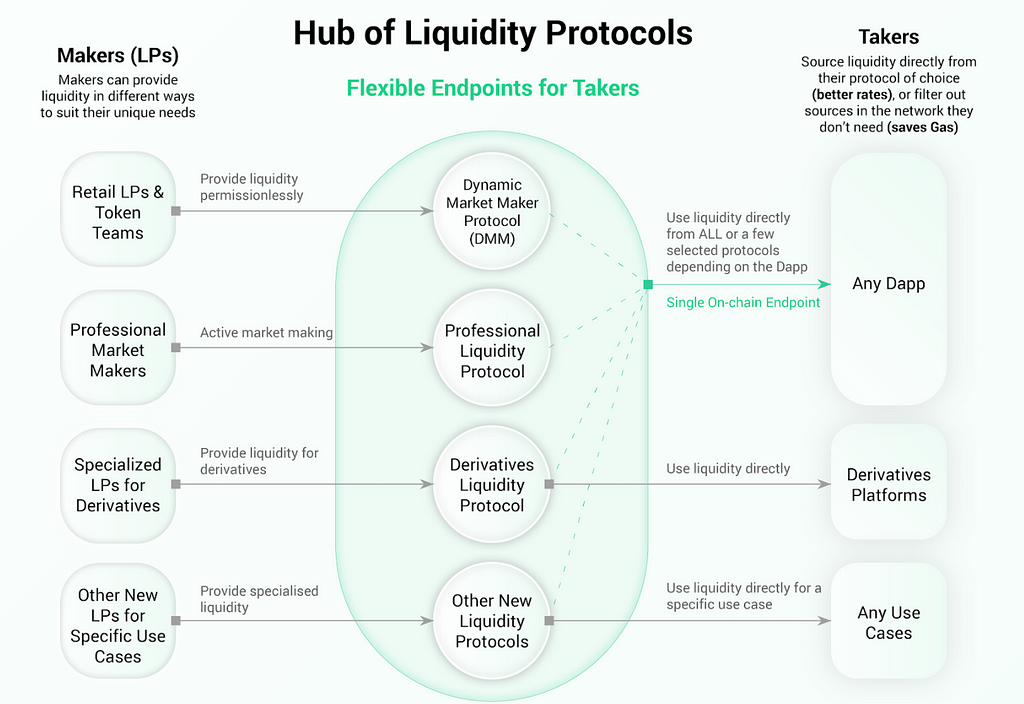

1. A Wide Range Of Options For Liquidity Provision

As we move away from one fixed interface / permissioned model into building various purpose-driven protocols, we will be able to cater to different types of liquidity providers, who have very different needs and objectives for how they want to provide liquidity.

For example:

- For professional market makers, they will be able to market make on-chain effectively by leveraging Kyber’s professional liquidity protocol, without the need to deploy and maintain their own reserve contracts

- For external on-chain liquidity sources that would like to be accessible to our large network of 100+ takers, they can work with the team to be incorporated into our on-chain Bridge Protocol

- For all LPs, they will be able to contribute to our new automated, permissionless Dynamic MM in a unique way that fits their own preferences

Moving forward, we will potentially develop a Derivatives protocol for aggregating and trading derivatives, an advanced trading protocol that supports stop-loss features, or a protocol to facilitate token sales — all these protocols will have unique and different sets of liquidity providers.

All these new protocols will enable different liquidity providers with their own unique needs to offer liquidity for Kyber.

2. Flexible And Gas Efficient Taker Options

In this network upgrade, we address some of the important limitations of our current architecture, which is centered around having only one single network-level endpoint as well as a single fixed reserve interface across all the reserve types. These created several major constraints, with the former causing high gas fees and difficulties for aggregators to select the liquidity sources they needed, and the latter limiting options, with the most significant one being ETH having to be the single quote currency.

Kyber 3.0’s new architecture is designed to reduce overall gas costs. Takers (e.g. Dapps and other integrations) now have the flexibility to take liquidity directly from their protocol of choice or filter out sources in the network they do not need. This results in much lower gas used and flexible on-chain (or even off-chain) aggregation options.

In addition, takers have increased flexibility as ETH will no longer be the only quote currency, with all the protocols expected to allow multi-quote pairs and direct token-token and stablecoin-stablecoin trades e.g. DAI-USDC to offer better liquidity.

We expect these changes to greatly increase the ease and flexibility for takers, especially for aggregators to effectively leverage the available liquidity across Kyber. We will also continue to provide a simple network level on-chain endpoint that sources liquidity from all the protocols in the network to find the best available rates.

3. Driving Innovation With New Liquidity Protocols

Through this new architecture, the KyberDAO, Kyber team, and DeFi ecosystem can work together to create and maintain innovative liquidity protocols that can be seamlessly used by makers and takers. We believe that Kyber is able to add substantial value to new protocols while allowing developers to exercise their creativity. We are also committed to making it easier and more useful for developers to build and integrate with Kyber.

Every new protocol will increase liquidity availability, taker attractiveness, technical innovation, and the value of the overall network.

DeFi’s 1st Dynamic Market Maker (DMM)

Kyber will be launching DeFi’s first automated Dynamic Market Maker (DMM), which is also the first new liquidity protocol added to the network and is accessible to anyone, including retail LPs and token teams. The new Kyber DMM addresses two of the most critical problems in AMMs today — capital inefficiency and impermanent loss.

Unlike the static nature of typical AMMs and other liquidity platforms in the space, the Kyber DMM protocol is designed to react to token pairs and market conditions to optimise fees for liquidity providers and rates for takers. This is achieved via two simple yet novel mechanisms: Programmable Pricing Curve based on the nature of the token pairs and Dynamic Fees based on market conditions.

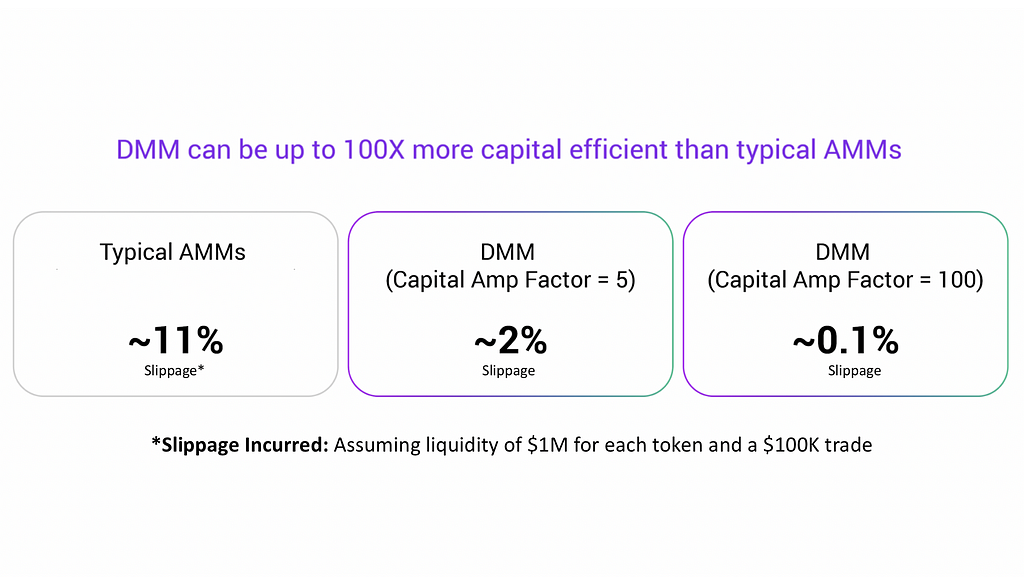

1. Programmable Pricing Curve To Improve Capital Efficiency

The current generation of AMMs adopts a ‘one size fits all’ approach to the pricing curve, with the most common curve used in Uniswap’s model, which aims to cater to all possible price variations.

While this type of pricing curve ensures that the pool can always be traded on both sides, it comes at a serious downside to LPs, who need to contribute a huge amount of liquidity to make low price slippage possible. In addition, takers will suffer high slippages for pools without a very high amount of liquidity.

For example, a stablecoin pair (eg: USDC/USDT) works poorly on regular AMMs (e.g. Uniswap), since the price curve for Uniswap is built to cater towards all types of pairs, which means that the amount of slippage is the same for stablecoin pairs and a new Token/ETH pair. This results in an extremely inefficient capital allocation for LPs, since they will need to provide a huge amount of capital (and hence capture much less fees in proportion to funds provided).

Kyber DMM’s Programmable Pricing Curves allows liquidity pool creators to customize the pricing curve and set the capital amplification factor of the pool in advance:

Stable pairs with low variability in price range (like USDC/USDT, ETH/SETH) will be able to support pools with a very high amplification factor, which means given the same liquidity pool and trade size, slippage can be up to 100X better. For other pairs, (like WBTC/ETH), capital efficiency can be up to 5–10X better as well. This means that LPs can have the opportunity to earn much more fees relative to their contribution size.

Liquidity providers can then determine which pool to put capital in and we believe that ultimately the market will determine the best parameters for different pairs to achieve higher capital efficiency.

2. Dynamic Fees To Mitigate IL and Increase LP Profit

The risk of impermanent loss (IL) is a very well known issue in current AMMs, with the main losses happening when the price of one token moves dramatically relative to the other token in the pair. During these volatile periods of high price movement between the pair, we can expect a high level of volume.

Kyber DMM hence watches the volume happening on-chain and adjusts fees accordingly. In a normal market, the DMM will behave like other AMMs. In a market where volume is higher than usual, the DMM will increase the fees, and in periods of low volume, the DMM will reduce the fees. This is similar to the strategy undertaken by professional market makers to maximise returns.

By increasing the fees for trades during these periods, the DMM recoups what would usually be ‘impermanent losses’ for LPs during periods of sharp token movements and absorbs more fees for LPs, thereby helping to reduce the impact of IL. Conversely, the DMM dynamically optimizes for lower fees to encourage trading and higher volume during periods of low volatility.

3. Simple, User-Driven, Permissionless

Unlike complex mechanisms which either rely on external oracles or fixed systems, the Kyber DMM applies astute market observations into elegant mechanics for the benefit of LPs and takers.

Through an intuitive, user-friendly UI, anyone can decide on certain key parameters and easily contribute liquidity for any token pair, while any taker (e.g. Dapp or end user) can access this liquidity for their needs.

We will work closely with the KyberDAO, token teams, and the rest of the DeFi ecosystem to figure out the best incentive mechanisms to drive adoption and liquidity for this new DMM protocol. Higher adoption of Kyber DMM would potentially increase the fees collected by the KyberDAO (and rewards for KNC voters) in the long run.

We expect Kyber’s next generation AMM to add highly-differentiated value to space — helping to reduce the impact of impermanent loss, achieve better capital efficiency, and provide a more dynamic and robust solution to trading and liquidity provision.

KyberDAO and KNC Migration Proposal

To facilitate this network architecture change, development of new protocols, and overall growth of Kyber, the Kyber team will be proposing a major upgrade to the KyberDAO and the KNC token.

KyberDAO has matured into one of the most successful DAOs in DeFi, measured by % of tokens staked and a number of DAO participants. There is also a comprehensive ecosystem of platforms offering staking and voting services, and a diverse network of delegates who represent the interests of different Kyber stakeholders (Dapps, liquidity providers, KNC holders etc.) and provide important feedback around proposals.

There are 3 main motivations behind this proposal:

- Amplifying KyberDAO’s governance power

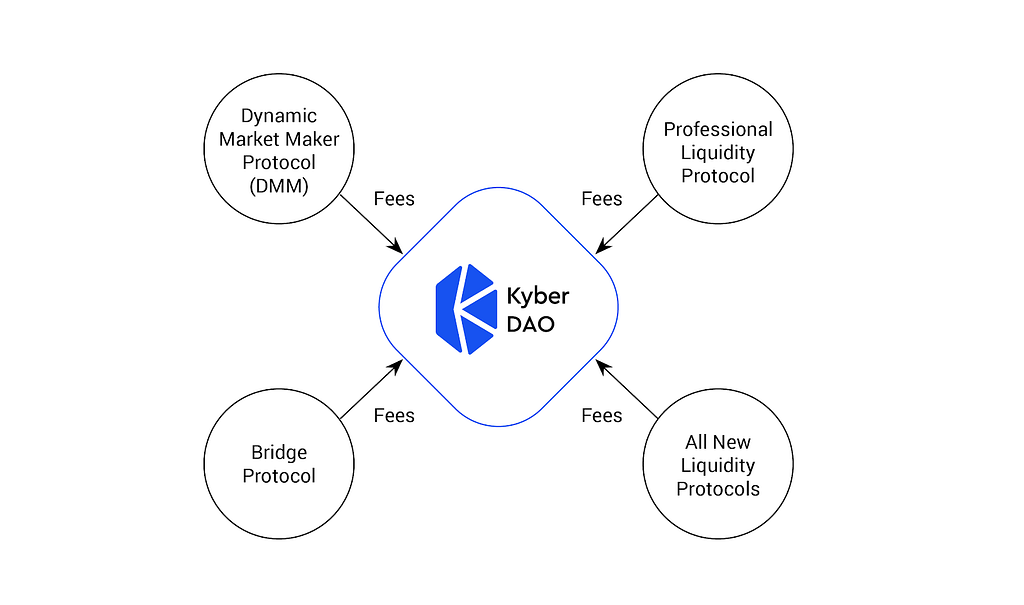

- Creating Multiple Sources Of Utility and Value Accrual For KNC

- Enabling KyberDAO To Drive Liquidity Innovation

1) Amplifying KyberDAO’s Governance Power

KyberDAO’s governance importance will be greatly enhanced, given that it will now be responsible for governing a range of liquidity protocols with different needs, with some of these new protocols providing additional use cases for KNC. Token holders can determine which new protocols to fund, the fees for the protocols, and which growth opportunities to pursue and fund via liquidity mining initiatives.

Community is of the utmost importance when it comes to Kyber’s long-term success. With Kyber transitioning into a multi-purpose liquidity network, we expect KyberDAO’s governance power and responsibility to be greatly expanded, with the community taking on the mantle of deciding new growth and value-capture opportunities and incentive mechanisms.

2) Creating Multiple Streams of Utility and Value For KNC

With these changes, KyberDAO (and hence KNC holders) will receive fees from all major protocols launched on Kyber, starting with the new DMM protocol as well as existing protocols. KyberDAO may also vote to reward liquidity providers and users with incentives to bootstrap adoption of new protocols. It is also imperative that KNC gets upgraded to a new token that has the ability to manage and collect fees from multiple protocols, and allows KNC to capture the value created by all the innovation in the network.

Investing in KNC would mean having a clear stake in all the important new liquidity protocols created for DeFi.

3) KyberDAO To Drive Innovation And Funding For New Protocols

In this new model, KyberDAO will decide on how to support and fund DeFi innovation (e.g. liquidity incentives and rewards) and deliver a sustainable liquidity infrastructure. The entire innovation process, from ideation to funding to adoption and growth will be driven by the KyberDAO.

We believe this proposal will be the key to creating competitive advantage, new growth vectors, and long term sustainability for Kyber Network.

Phase 1: Katana

Katana represents swiftness, decisiveness, and a sharp focus on achieving Kyber’s full potential. In the Katana phase (Q1–2), the Kyber DMM will be launched and a proposal will be submitted for a KyberDAO and KNC upgrade. The subsequent Phase 2 (Kaizen) and the entire Kyber 3.0 upgrade is expected to be completed by late Q3.

a) KNC Migration Discussion And Proposal

Community engagement is crucial for Kyber’s long-term success. In order to spark discussions and gather feedback around important Kyber topics, we will soon create a new discourse-based governance forum to complement our official Discord server. The upcoming KNC migration and upgrade proposal will be the first major topic to be discussed in the forum together with the community and the proposal will eventually be voted on by the KyberDAO.

b) Kyber DMM Litepaper, Testnet, Security Audits

The Kyber DMM Litepaper will be released in February with more comprehensive details on how it operates and its distinct advantages over existing liquidity protocols. Prior to the mainnet launch around end March, it will undergo testnet operations as well as smart contract audits to ensure the security of the new architecture.

c) KyberDAO and KNC Upgrade (pending proposal passing)

If the proposal passes by the KyberDAO, then the team will proceed to execute on the KyberDAO and KNC upgrade, which in turn sets the stage for the major architecture revamp and the upgrade to our existing reserves into full-fledged protocols. We will soon be speaking to our various stakeholders to help prepare them and ensure a smooth transition.

Delivering a Sustainable Liquidity Infrastructure for DeFi

Kyber 3.0 is the biggest change to Kyber’s architecture since its inception and will form the basis for the continuous growth of user bases, liquidity, and volume, and establish Kyber as the cradle for liquidity innovation.

By having a new architecture for innovation and growth, we aim to transform Kyber into a network of purpose-driven liquidity protocols for DeFi, while greatly expanding the governance scope and rewards potential for KNC under a sustainable and scalable framework.

This architecture also makes it easier for Kyber to support potential scaling and cross-chain solutions (e.g. L2) in the future, given the increasing need for faster and cheaper transactions in Ethereum and DeFi.

We hope this article presents a good overview of Kyber 3.0 and we will also be ramping up efforts to educate the community and DeFi ecosystem about the many upcoming changes. We would like to warmly invite all our partners and KNC stakeholders to join us in taking this important step towards the next evolution of Kyber Network!

Kyber 3.0: Architecture Revamp, Dynamic MM, and KNC Migration Proposal was originally published in Kyber Network on Medium, where people are continuing the conversation by highlighting and responding to this story.