[Deribit] Vol Commentary: All Eyes On The CPI

.fusion-body .fusion-builder-column-0{width:100% !important;margin-top : 0px;margin-bottom : 0px;}.fusion-builder-column-0 > .fusion-column-wrapper {padding-top : 0px !important;padding-right : 0px !important;margin-right : 1.92%;padding-bottom : 0px !important;padding-left : 0px !important;margin-left : 1.92%;}@media only screen and (max-width:1024px) {.fusion-body .fusion-builder-column-0{width:100% !important;}.fusion-builder-column-0 > .fusion-column-wrapper {margin-right : 1.92%;margin-left : 1.92%;}}@media only screen and (max-width:640px) {.fusion-body .fusion-builder-column-0{width:100% !important;}.fusion-builder-column-0 > .fusion-column-wrapper {margin-right : 1.92%;margin-left : 1.92%;}}

.fusion-body .fusion-flex-container.fusion-builder-row-1{ padding-top : 0px;margin-top : 0px;padding-right : 0px;padding-bottom : 0px;margin-bottom : 0px;padding-left : 0px;}

Cumberland is commenting on the recent volatility and potential opportunities to take advantage of it.

For further information about Cumberland, please visit Cumberland website here.

December 12

What we are seeing in the markets

This week brings a round of data releases which have market moving potential. Whilst the main numbers to look for are US CPI and the FOMC rate decision, we also have EU and UK central bank meetings that add extra uncertainty.

1) Data from the beginning of November showed signs of inflation beginning to slow, with CPI and PPI both undershooting expectations and causing a risk on rally as the markets began to price in a FED pivot (from being solely focused on fighting inflation to taking some consideration for the lag effect of their restrictive policy and not wanting to unnecessarily hurt the economy).

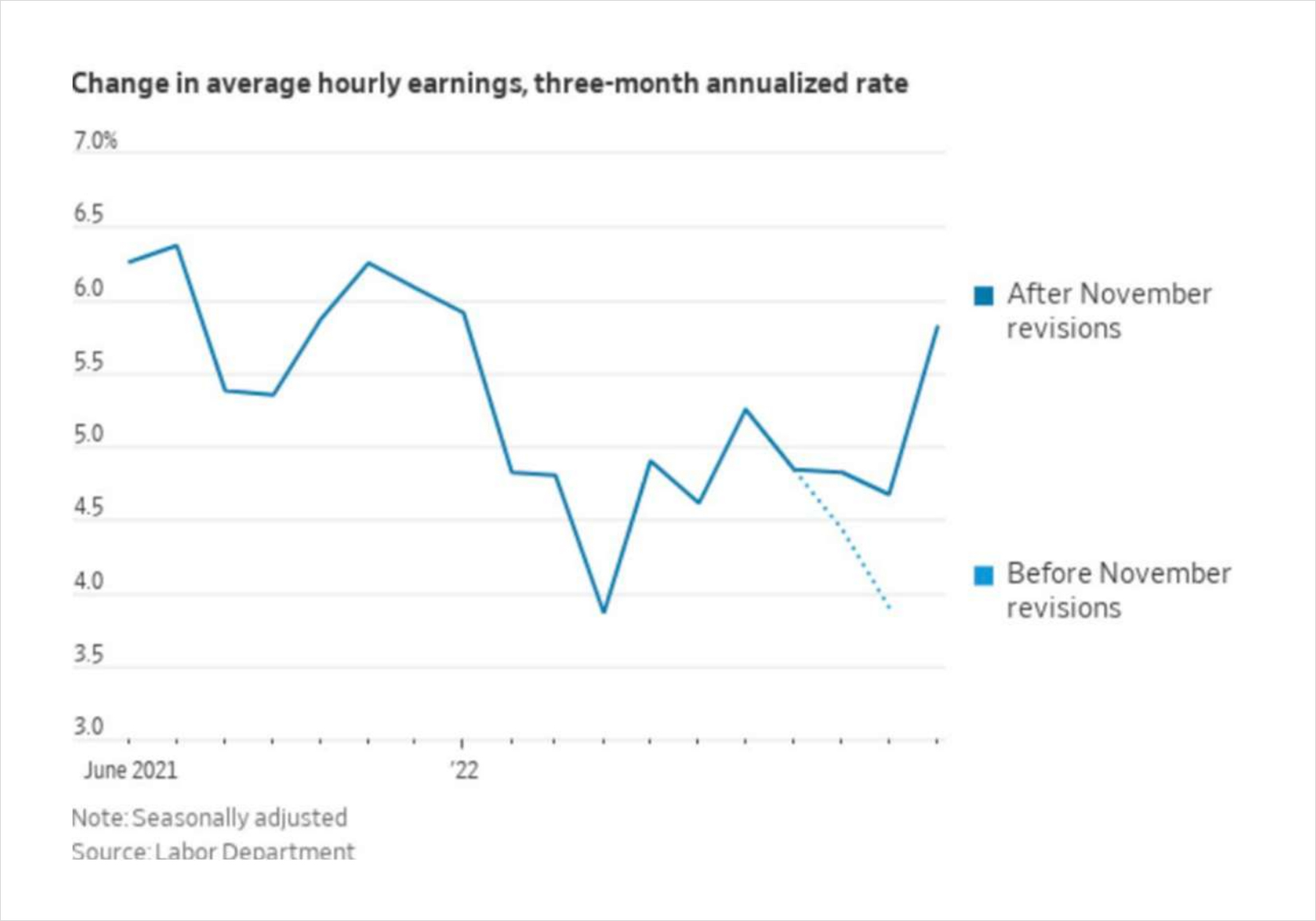

2) More recently however, we have seen data that suggests the pivot idea might not be so clear cut. December numbers showed average hourly earnings strongly overshooting expectations. What is perhaps slightly less appreciated is that revisions of previous earnings data (see graph) provide even more evidence to suggest that the labor market is tighter than initially believed. Note PPI also overshot expectations last Friday (YOY at 7.4% vs an expected 7.2%).

3) The most recent messaging by Powell has been that whilst a slowdown in large rate hikes is to be expected, inflation risks are nowhere near over. The FED may indeed raise the terminal rate to levels higher than initial projections/market pricing and keep them there for a longer period of time.

4) Despite all this, risk assets have showed little sign of reversing the recent rally. The S&P 500 is 10% higher than its local lows in October, US 10Y yields have come down from highs of 4.2% to nearer 3.5%, and ETH is 16% higher than its post FTX implosion lows.

5) The FOMC meeting this week comes with an updated Summary of Economic Projections. This provides clarity on the FED’s current thinking, giving the market an opportunity to reprice its view, but then bringing a greater sense of medium term certainty in the outlook ahead.

Potential trades

A) Sell BTC June Calls and hedge with December options.

Based on (2), (3) and (4), there is reason to believe that a high CPI print on Tuesday could be a tipping point, giving risk assets a strong reason to move back towards the downside and thus generating delta P&L through call selling. A low CPI should reassert the market’s confidence in inflation coming down, causing a rally in risk assets but bringing vols down again (generating vega P&L through call selling) as this narrative is already somewhat priced in.

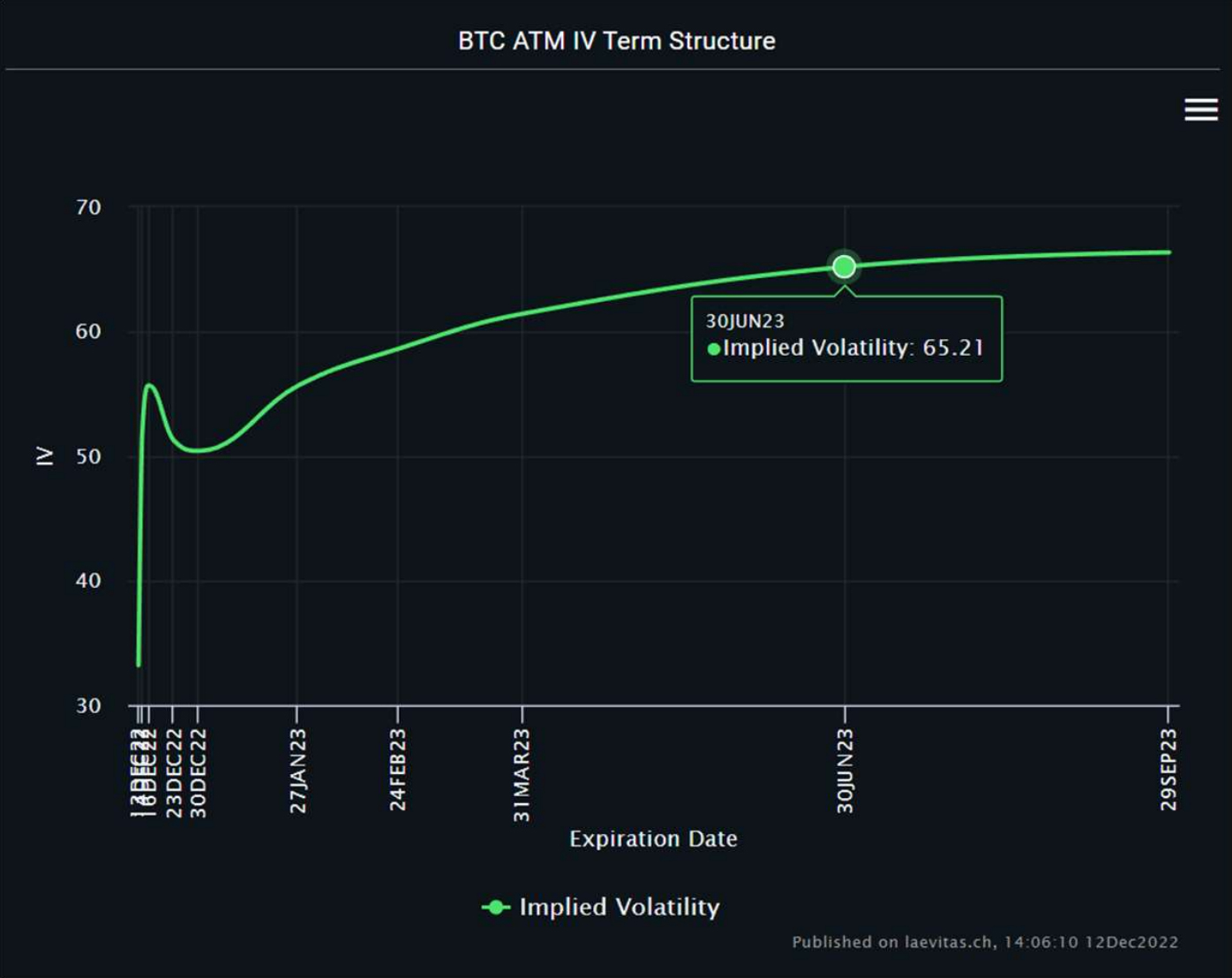

From a volatility surface perspective, BTC June is 4 vols higher than BTC March. This makes it one of the most attractive points to sell, even when ignoring the macro factors in playBackend crypto vol levels have remained high recently, despite shorter dated vols dropping on low realized vol levels. We are entering the festive period with expectation of low realized as people take holidays, thus if spot continues to remain range bound, the backend of the term structure may finally give way. The medium term macro clarity provided by (5) adds even more weight to this argument, as well as the fact that vols typically come back down after CPI/FOMC events.

One can hedge this trade by buying some gamma (short dated options expiring in December). The low levels of realized vol have made the weekly straddle prices reasonably cheap compared to historical levels during ‘data week’. This Friday’s BTC and ETH straddles are priced at 0.0453 and 0.0642 respectively, implying approximate moves of 4.5% and 6.4%.

Disclaimer

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements.

Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

.fusion-body .fusion-builder-column-1{width:100% !important;margin-top : 0px;margin-bottom : 0px;}.fusion-builder-column-1 > .fusion-column-wrapper {padding-top : 0px !important;padding-right : 0px !important;margin-right : 1.92%;padding-bottom : 0px !important;padding-left : 0px !important;margin-left : 1.92%;}@media only screen and (max-width:1024px) {.fusion-body .fusion-builder-column-1{width:100% !important;}.fusion-builder-column-1 > .fusion-column-wrapper {margin-right : 1.92%;margin-left : 1.92%;}}@media only screen and (max-width:640px) {.fusion-body .fusion-builder-column-1{width:100% !important;}.fusion-builder-column-1 > .fusion-column-wrapper {margin-right : 1.92%;margin-left : 1.92%;}}

.fusion-fullwidth.fusion-builder-row-2 a:not(.awb-custom-text-color):not(.fusion-button):not(.fusion-builder-module-control):not(.fusion-social-network-icon):not(.fb-icon-element):not(.fusion-countdown-link):not(.fusion-rollover-link):not(.fusion-rollover-gallery):not(.fusion-button-bar):not(.add_to_cart_button):not(.show_details_button):not(.product_type_external):not(.fusion-view-cart):not(.fusion-quick-view):not(.fusion-rollover-title-link):not(.fusion-breadcrumb-link) , .fusion-fullwidth.fusion-builder-row-2 a:not(.awb-custom-text-color):not(.fusion-button):not(.fusion-builder-module-control):not(.fusion-social-network-icon):not(.fb-icon-element):not(.fusion-countdown-link):not(.fusion-rollover-link):not(.fusion-rollover-gallery):not(.fusion-button-bar):not(.add_to_cart_button):not(.show_details_button):not(.product_type_external):not(.fusion-view-cart):not(.fusion-quick-view):not(.fusion-rollover-title-link):not(.fusion-breadcrumb-link):before, .fusion-fullwidth.fusion-builder-row-2 a:not(.awb-custom-text-color):not(.fusion-button):not(.fusion-builder-module-control):not(.fusion-social-network-icon):not(.fb-icon-element):not(.fusion-countdown-link):not(.fusion-rollover-link):not(.fusion-rollover-gallery):not(.fusion-button-bar):not(.add_to_cart_button):not(.show_details_button):not(.product_type_external):not(.fusion-view-cart):not(.fusion-quick-view):not(.fusion-rollover-title-link):not(.fusion-breadcrumb-link):after {color: #00cfbe;}.fusion-body .fusion-flex-container.fusion-builder-row-2{ padding-top : 0px;margin-top : 30px;padding-right : 0px;padding-bottom : 0px;margin-bottom : 0px;padding-left : 0px;}

AUTHOR(S)

.fusion-body .fusion-builder-column-2{width:100% !important;margin-top : 0px;margin-bottom : 0px;}.fusion-builder-column-2 > .fusion-column-wrapper {padding-top : 0px !important;padding-right : 0px !important;margin-right : 1.92%;padding-bottom : 0px !important;padding-left : 0px !important;margin-left : 1.92%;}@media only screen and (max-width:1024px) {.fusion-body .fusion-builder-column-2{width:100% !important;}.fusion-builder-column-2 > .fusion-column-wrapper {margin-right : 1.92%;margin-left : 1.92%;}}@media only screen and (max-width:640px) {.fusion-body .fusion-builder-column-2{width:100% !important;}.fusion-builder-column-2 > .fusion-column-wrapper {margin-right : 1.92%;margin-left : 1.92%;}}

.fusion-body .fusion-flex-container.fusion-builder-row-3{ padding-top : 0px;margin-top : 30px;padding-right : 0px;padding-bottom : 0px;margin-bottom : 0px;padding-left : 0px;}

RECENT ARTICLES

.fusion-body .fusion-builder-column-3{width:100% !important;margin-top : 0px;margin-bottom : 0px;}.fusion-builder-column-3 > .fusion-column-wrapper {padding-top : 0px !important;padding-right : 0px !important;margin-right : 1.92%;padding-bottom : 0px !important;padding-left : 0px !important;margin-left : 1.92%;}@media only screen and (max-width:1024px) {.fusion-body .fusion-builder-column-3{width:100% !important;}.fusion-builder-column-3 > .fusion-column-wrapper {margin-right : 1.92%;margin-left : 1.92%;}}@media only screen and (max-width:640px) {.fusion-body .fusion-builder-column-3{width:100% !important;}.fusion-builder-column-3 > .fusion-column-wrapper {margin-right : 1.92%;margin-left : 1.92%;}}

.fusion-body .fusion-flex-container.fusion-builder-row-4{ padding-top : 0px;margin-top : 30px;padding-right : 0px;padding-bottom : 0px;margin-bottom : 30px;padding-left : 0px;}

The post Vol Commentary: All Eyes On The CPI appeared first on Deribit Insights.