[Deribit] OTC Commentary – Week 46, 2022

It is particularly challenging to synthesize the last couple of weeks into a few paragraphs this week but let’s give it a go. The market had been talking itself into a Fed pivot all the way into the Fed’s November 1/2 FOMC meeting. The Fed hiked rates by 75 bps as expected, and while some saw the messaging as mixed, markets sold off in the immediate aftermath. Crypto, by contrast, fared reasonably well taking into account its higher beta, though this was short lived.

US nonfarm payrolls released on November 4th were unremarkable, while the subsequent weekend brought increasing noise surrounding the leaked balance sheet of Alameda Research, a crypto prop trading firm started by Sam Bankman-Fried. By Tuesday, both Alameda and FTX, the crypto derivatives exchange also founded by Sam Bankman-Fried, started to spiral as their solvency was questioned, and the crypto market similarly fell into full blown meltdown with large drawdowns across the board on both Tuesday and Wednesday. A soft US CPI offered a bit of a reprieve and led to a relief rally, though we are still a good 20% off the level at the beginning of the week. In the meantime, the broader macro market rallied on the CPI number and we saw large risk on moves across the board, with equites up, yields down and the US dollar weaker.

While the general macro outlook is becoming a bit more constructive with the lower-than-expected CPI, the ISM edging down, and a less hawkish Fed tone, we believe we are potentially still some distance from a full-on Fed pivot. For crypto specifically, there is an ongoing hunt for who has been impacted by the FTX fiasco, and an unsettled feeling from potential coming regulation. It is likely to be a difficult next few weeks, even if nobody else implodes.

Rates, Funding and Basis

The scale of capital that has been eroded in the FTX / Alameda saga has had far reaching implications on the OTC lending market. FTX was one of the more prominent spot and derivative exchanges in the market, and most sophisticated market participants had capital sitting on the exchange. Liquidity in the lending markets tightened very quickly early last week, as lenders recalled loans or sought additional collateral. Needless to say, new lending activity has nearly come to a halt entirely right now.

A sizable amount of capital loaned to institutional borrowers in this space ultimately originates from platforms and protocols offering yield to retail clients, either in a permissioned or permissionless manner. In addition, most lenders will likely wait until they see borrower quarter-end financials to get a clearer sense of damage to balance sheets before starting to extend credit again. This is the second time lenders have been burnt this year, after the credit crisis we saw during the summer and it’s likely to take many weeks, if not months, for the lending markets to get back to the liquidity they had in the past.

Perpetual funding rates across the major exchanges have been volatile, not only from prior derivatives positions on FTX trying to find a new home at other exchanges, but also from market participants de-risking and conserving capital ahead of the unknown risks that lie ahead. It will unfortunately likely be a while before the dust settles.

Derivatives

Bitcoin

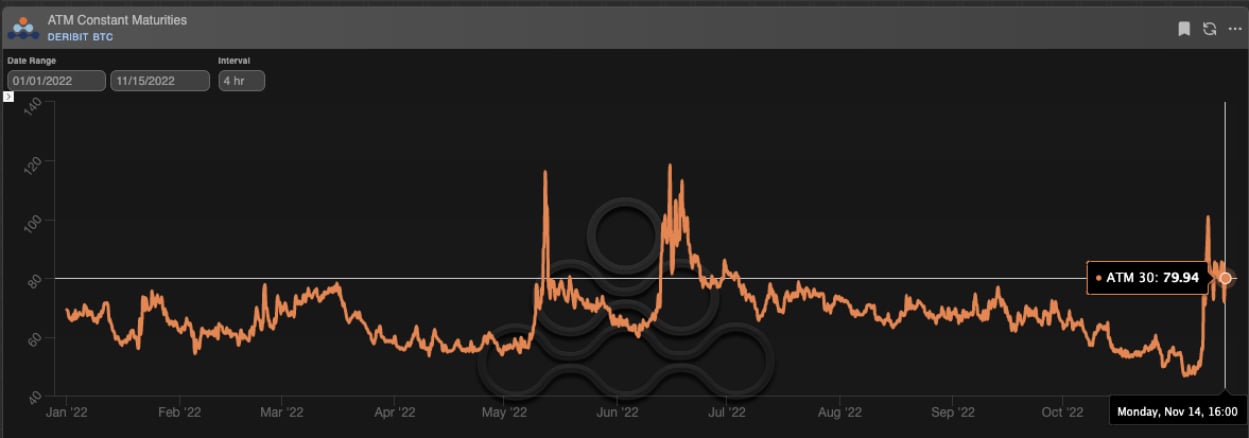

With the price of bitcoin closing the week down 22% on year lows, 30 day implied volatility bounced from 52% to a high of 101% on Wednesday, and is currently sitting at an elevated 80%. Over the last 24 hours, one-hour realized volatility has been 105%.

BTC ATM Implied Volatility

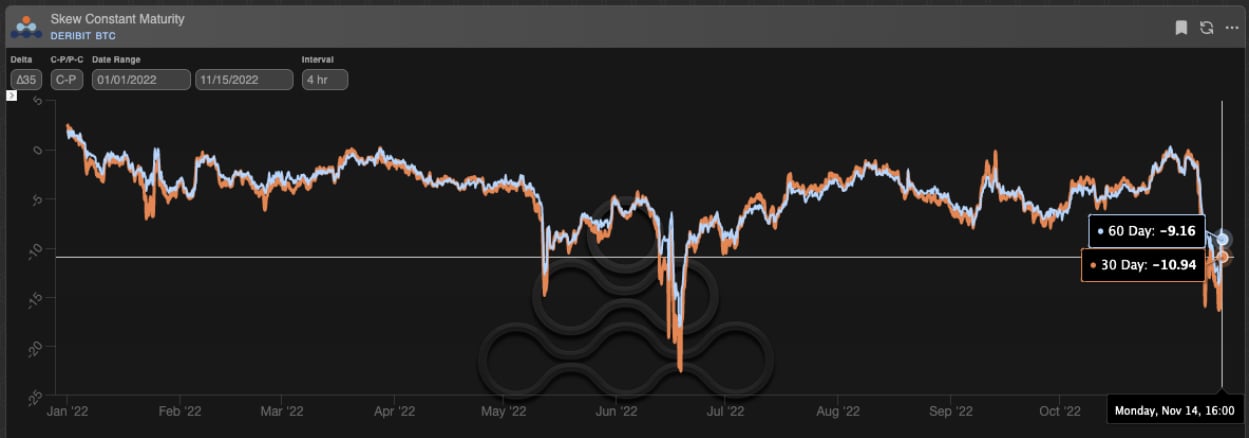

35 delta risk reversals had found value at 0, pricing very little risk to the downside or conversely hope of a rally. However, with BTC touching $15,600, 30 day puts were trading 16% over calls, and sitting at relatively extended levels.

BTC 35 Delta Call Skew

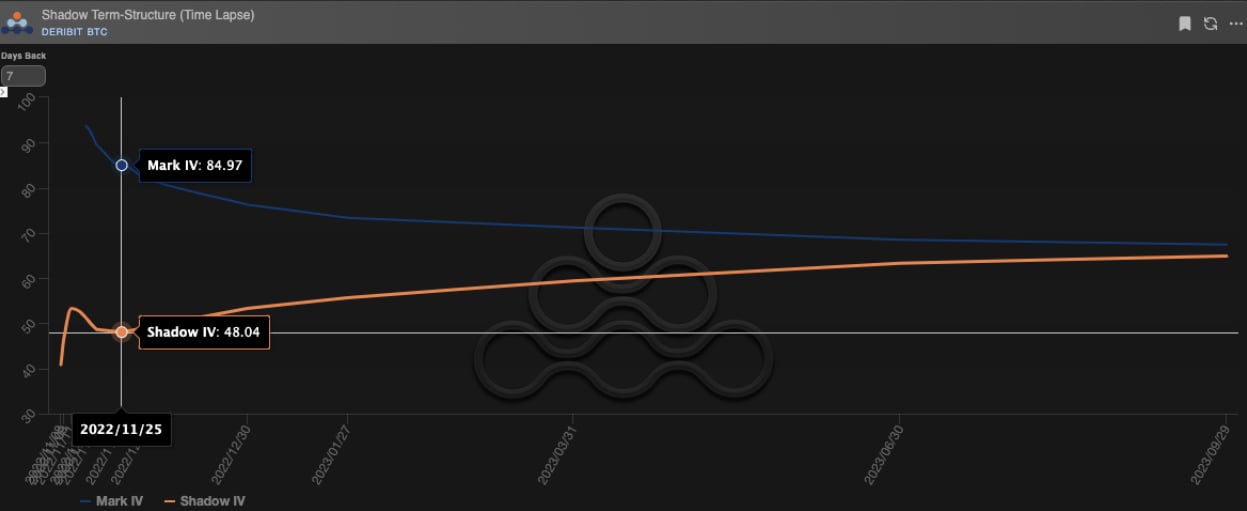

Term structure is in backwardation as Gamma significantly outperformed implied volatility last week.

BTC Shadow Term Structure

Ethereum

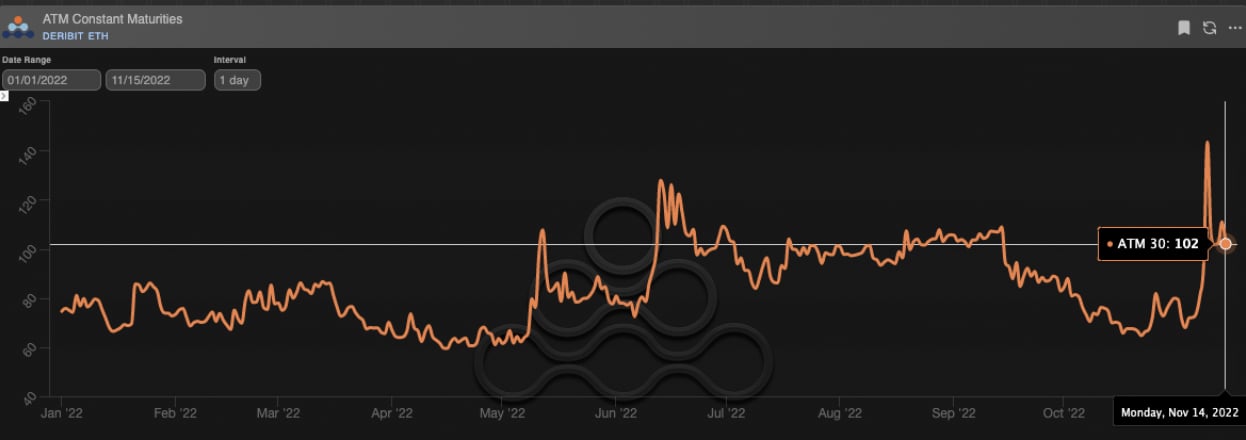

With ETH also closing the week down 22% (though not making year-to-date lows as BTC has done), 30 day implied volatility hit a year-to-date high of 143%, and currently sits at 102%.

ETH ATM Implied Volatility

ETH 30 day call skew was optimistically trading over puts at the start of the week, but is now marked 14% under.

ETH 35 Delta Call Skew

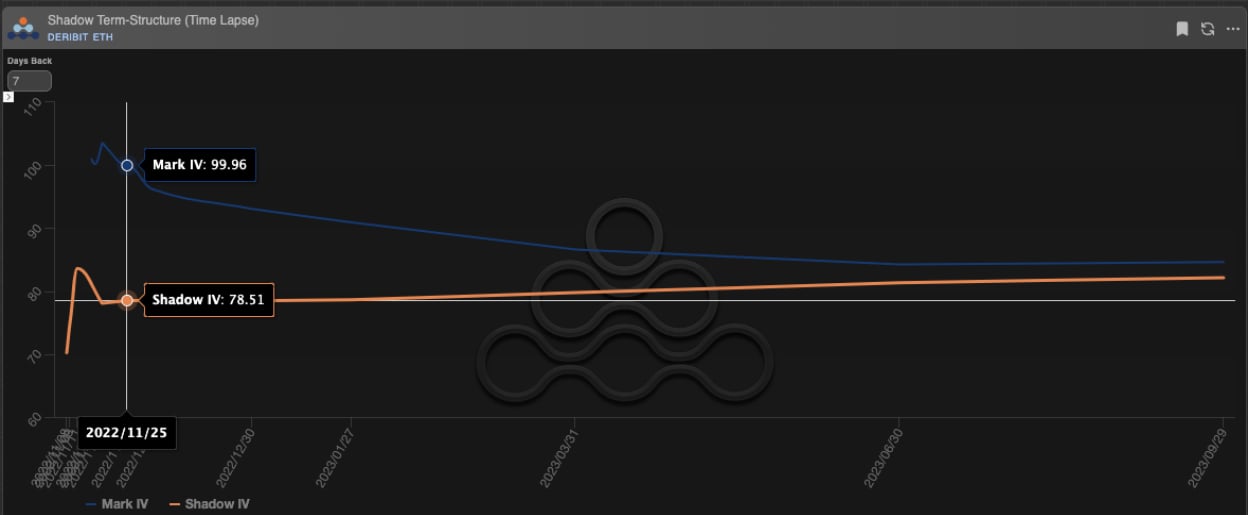

Interestingly, ETH Term structure was flat on Monday, November 7th compared to BTC being in contango.

ETH Shadow Term Structure

Flows and Liquidations

Mainly driven by the FTX implosion and following a relatively range-bound OCtober, November has been a particularly chaotic and volatile month for the cryptocurrency market. To kick November off, we saw some of the largest liquidations of longs (over $1B) as BTC hit new lows and tested the $16,000 level. The volatile price action led to liquidations on the short side as well (around $500m), as market participants clung on to hopes of a potential acquisition of FTX by Binance or others.

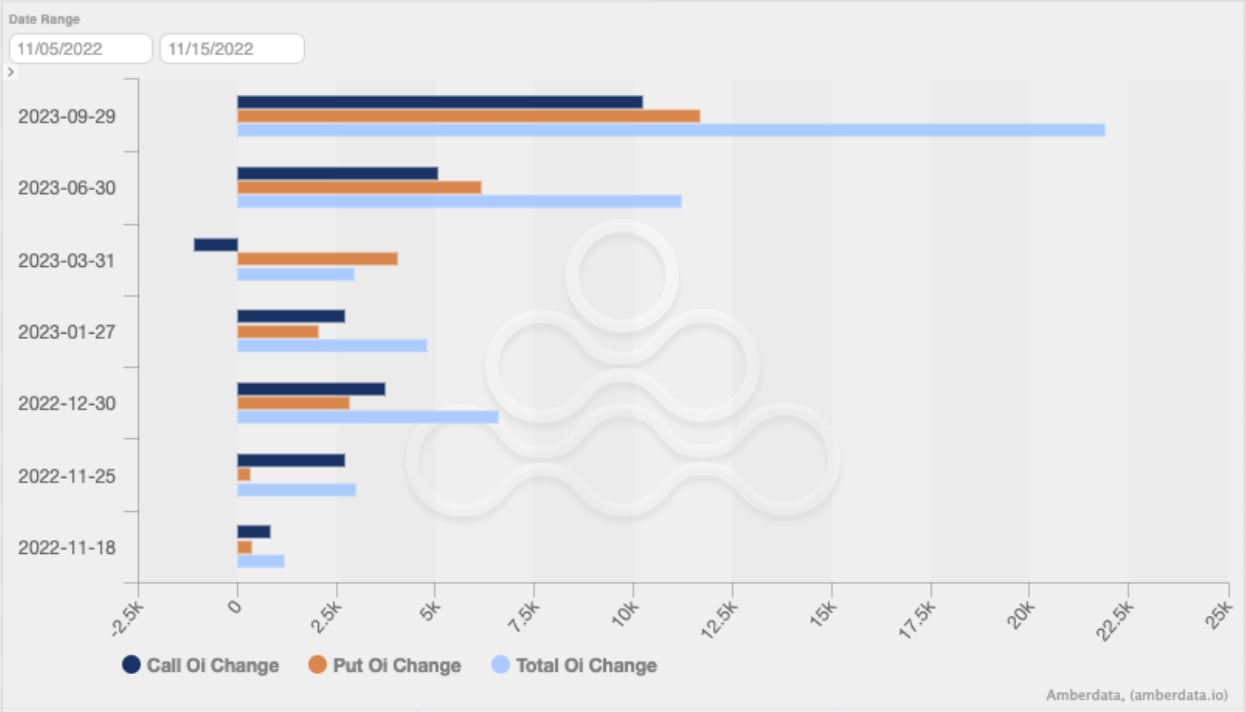

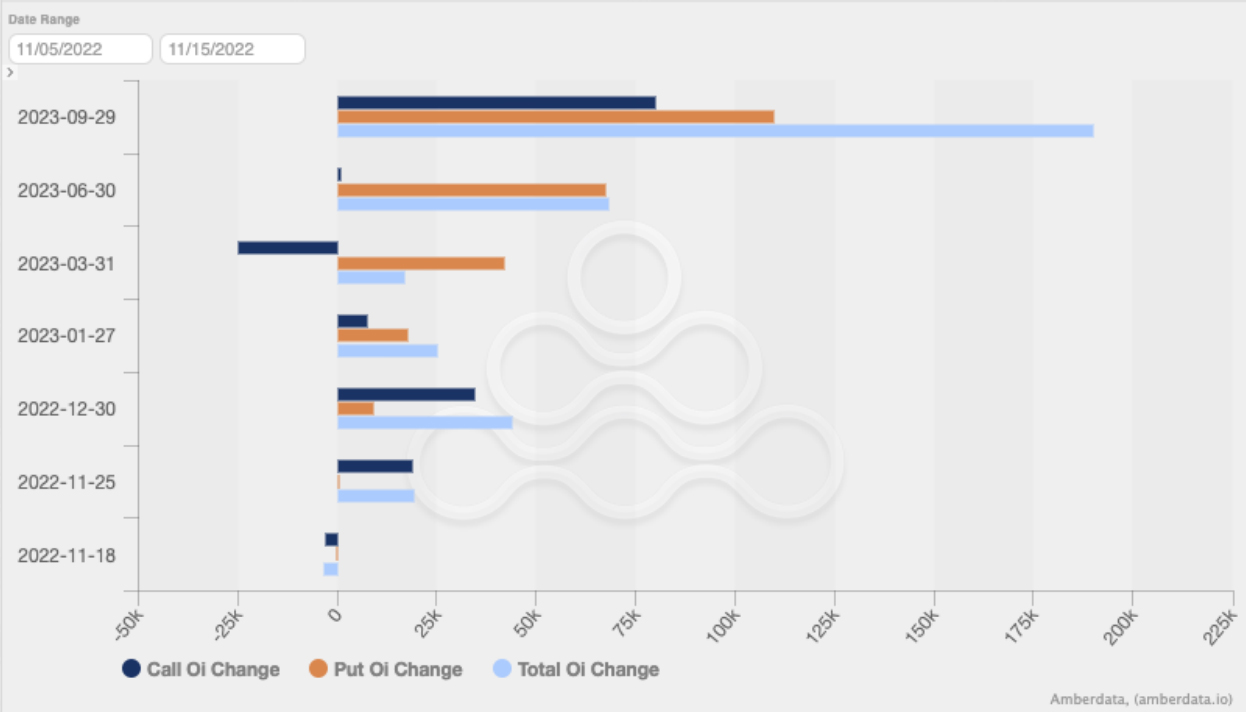

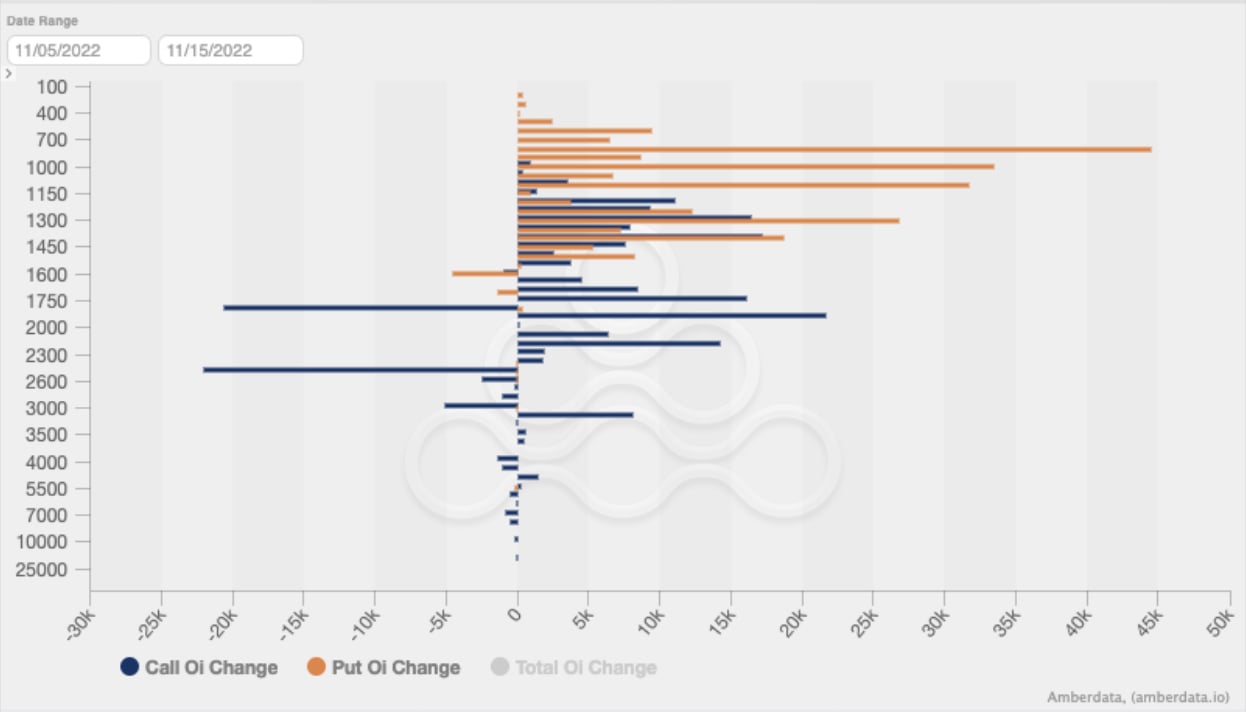

Unsurprisingly, the volatility, speculation, and uncertainty led to significant activity including hedging and de-risking by market participants, as seen in the option flows and other derivatives metrics. In short, ETH and BTC open interest in upside calls faltered, as downside open interest picked up.

In the BTC option markets, the September 29th 2023 expiry picked up momentum with a large increase in open interest. Most of the call open interest that was closed out occurred in the March 31st expiry that comes up in a few months. In addition, call open interest declined in the $22,000 levels, and open interest increased the most around the levels of which BTC is currently trading. Most put open interest declined at the $20,000 level, and most put open interest has increased further toward the downside with the $12,000 and $15,000 strikes as popular.

BTC Historical OI Change By Expiration

BTC Historical OI Change By Strike

In the ETH option markets, open interest in the March 31 expiry saw a similar decline, with most open interest increasing in the September 29th, 2023 expiry. Interestingly, June 30th has seen almost no interest in calls and an outsized demand for puts. Regarding strikes, upside calls at the $1,800 and $2,500 level have been closed out, with some new demand in the $1,900 strike. The greatest increase in put open interest occurred at the $800 strike level, but there has also been significant interest for puts anywhere near current levels.

ETH Historical OI Change By Expiration

ETH Historical OI Change By Strike

Altcoin Vol

Realized volatility in the altcoin space has increased across the board, but still lags the volatility seen in the majors. The events of last week caused a spike in the volatility risk premium seen in the options markets, and tokens with heavily publicized relationships to Alameda and FTX have seen massive price swings as rumors around potential delistings or forced liquidations float around. Skew in altcoins is heavily biased towards puts, and implied volatility across the board has also spiked compared to realized volatility.

As more skepticism surrounds various centralized exchanges and institutional market participants, specific altcoins may experience periods of heightened volatility. At the moment, however, it is nearly impossible to predict the exact impact or degree of volatility that specific altcoins may experience. In fact, we contend that expected volatility for a specific altcoin may become binary: if it gets caught up in delisting or liquidation speculation, we may see short-term volatility rise very significantly , but if the altcoin escapes the public eye, realized volatility will likely stay at levels experienced over the past month.

DeFi

DeFi activity has exploded over the last two weeks in the wake of the spectacular crash of FTX and Alameda.

The Solana DeFi ecosystem has been hit hard, with total value locked (TVL) falling from $1b a week ago, to $300m currently. Moreover, Marinade Finance, a liquid staking protocol for the SOL token, comprises more than 40% of Solana’s TVL. Further concerns have arisen over the survivability of the ecosystem as the private key controlling Serum, a composable central limit order book used by many Solana-based DeFi applications, was potentially compromised. In response, developers forked Serum, but it will take time for the projects to move over. With FTX and associated venture capital firms as big backers of the ecosystem, it will be interesting to watch how the chain fairs in the coming weeks.

Elsewhere, the aftershocks from the FTX implosion have cast a shadow on other centralized exchanges and boosted DeFi applications. Uniswap, SushiSwap, dYdX and other decentralized exchanges are seeing record volumes as users move to self custody their crypto. In addition, wallets such as TWT, C98, MTL are seeing a resurgence of interest as well

Looking ahead, while this is a bad time for the whole industry, we continue to see strength in crypto-native applications as some centralized entities in the space falter. We have faith that the industry will only bounce back stronger but appreciate that it will take time for the contagion to play out.

Disclaimer

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.