[Deribit] Option Flow – Week 40, 2021

In this week’s edition of Option Flows, Tony Stewart is commenting on Soros allocation and ETF speculation powering upward momentum.

October 7

Soros allocation, ETF speculation powering upward momentum. Continued accumulation of Calls + Call Spreads across maturities, heavy focus ATM Oct22nd (first week ETF deadlines) +Nov 70k+80k strikes. Some profit-taking and rolling up of Strike exposure in Oct 15+29th expiries.

2) Unfortunate timing sale of Oct29 50k Calls x1k, preceded a 10%+ spot rally. Cross maturity Call spreads continue to be bought: Oct22 55ks bought, financed by Oct29 60k Calls 1k+ Nov 70k and 80k strikes bought, financed with Dec 100-120k Calls; seems ongoing, OI > 5k now.

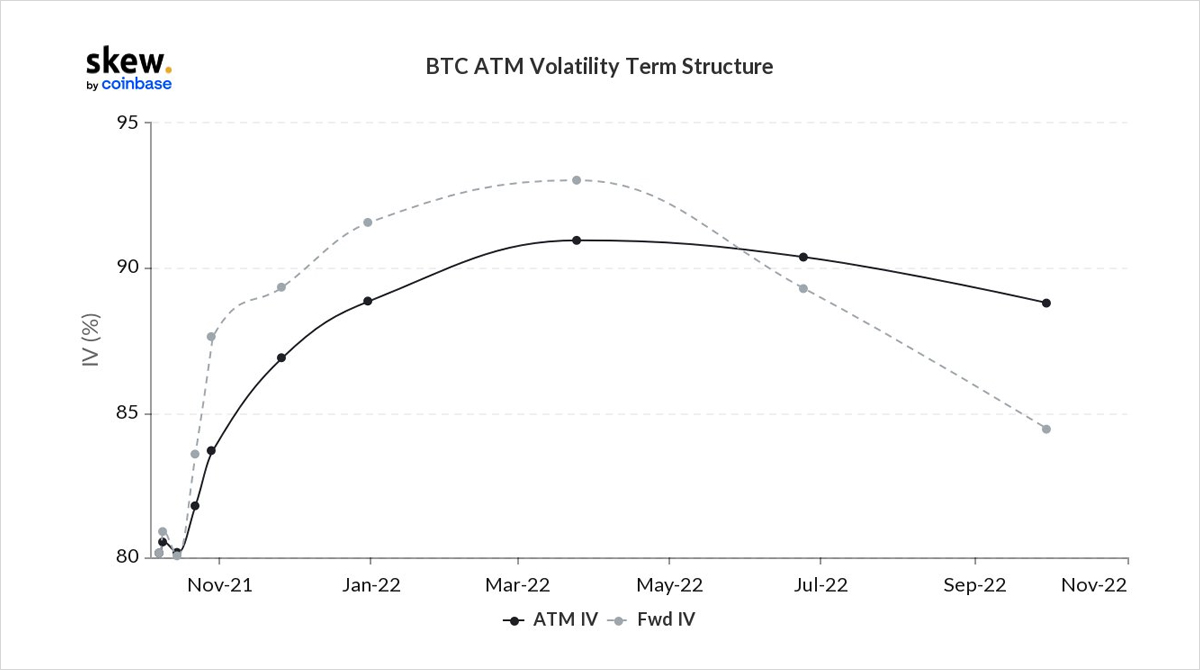

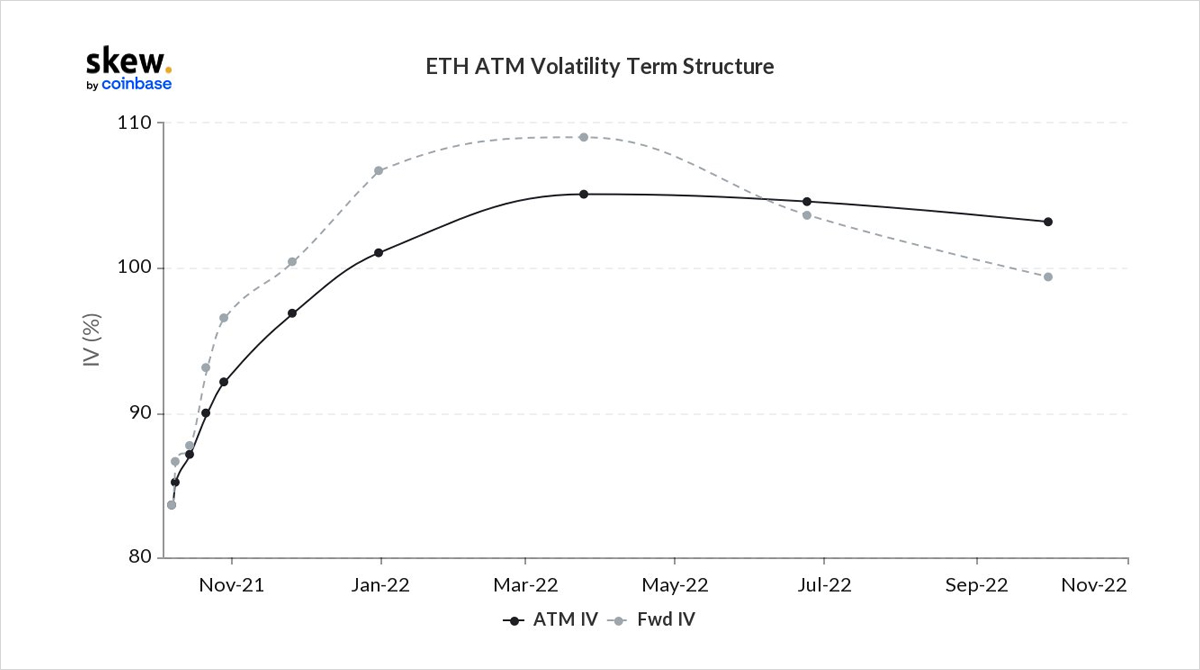

3) These structures take advantage of the shape of the term structure. Buy nearer-dated (lower on curve), sell longer-dated (higher). Also technically, the longer-dated, more OTM Call has elevated Call Skew, and decent premium to fund primary (nearer ATM) strike.

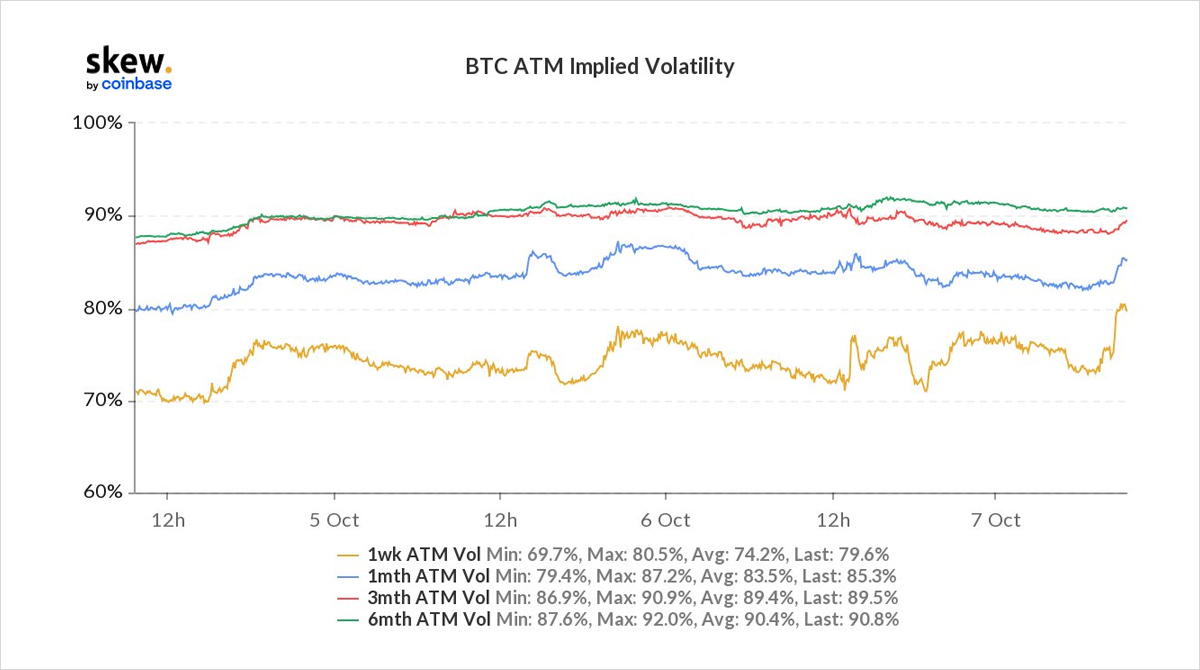

4) Despite these structures, a 10%+ spot move, and break of the recent range, trading back over >55k/3.6k, term structures have remained in Contango. We might expect a flatter (even backwardation) curve in ETH+BTC, representing near-term gamma demand, but not currently observed.

5) Flattening is usually assisted by short-Call covering, but this flow has been very limited. Likewise, Put protection has been offset by Put sellers, comfortable that each spot dip is being bought. Gamma has been easy for MM to get hold of. Just starting to see Fund demand.

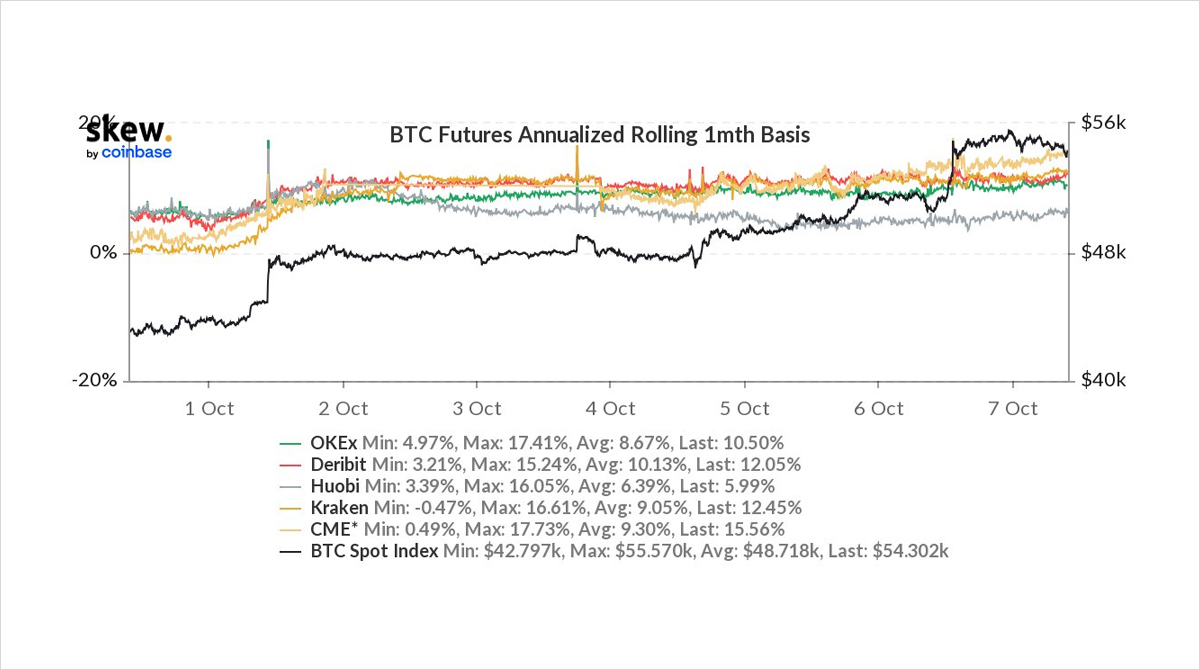

6) BTC funding on the rally has been under control up to now; but basis starting to squeeze, emanating conspicuously from the CME, now passing to Crypto-centric. Speculation this is ETF driven. The first deadlines are 18+19th October. Deribit Perp-Spot 40+ points this morning.

View Twitter thread.