[Deribit] Option Flow – Week 4, 2022

In this week’s edition of Option Flows, Tony Stewart is commenting on Ukraine tensions and Macro rate predictions, Call selling on rallies and nervous Put buying on retraces.

January 29

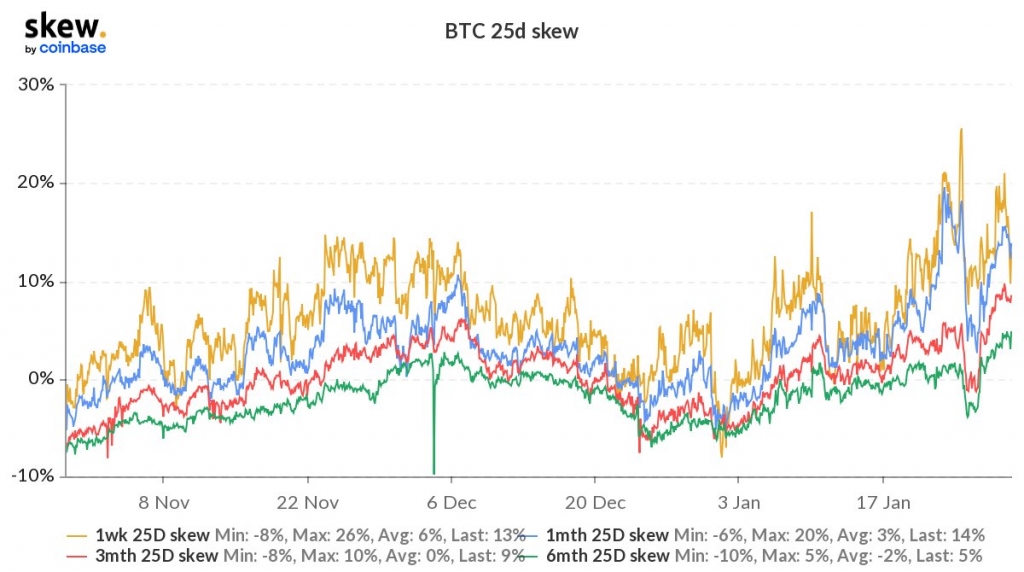

Ukraine tensions & Macro rate predictions combined with internal Crypto Protocol struggles to dampen sentiment this week. In Core Crypto, contagion worries are exhibited by elevated Put Skew, derived from Call selling on rallies, nervous Put buying on retraces. IV uncommitted.

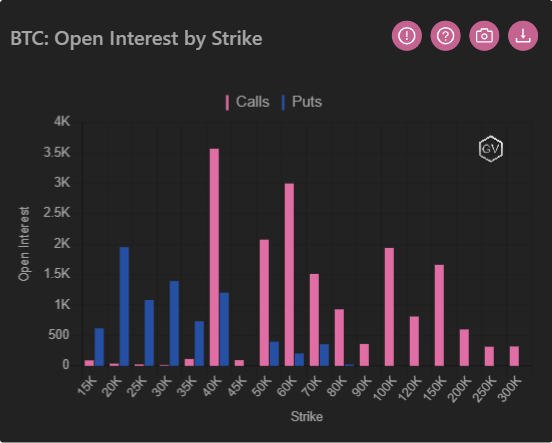

2) Put demand strong from several sources: – RiskReversals buying Puts, selling Calls. – Rolling down profitable Puts to lower strikes. – Outright buying; BTC+ETH far OTM strikes remain firm after aggression on spot lows. Call supply (focus Feb 40-50k strikes) heavy on rallies.

3) On the first strong rally from the low, saw one Fund initiate large Feb+Mar 25-35k Put strike selling as perhaps protection no longer needed, but was absorbed easily. Near-dated Call selling seems to be the flow with optimism only reserved for longer-term (Jun) Call spreads.

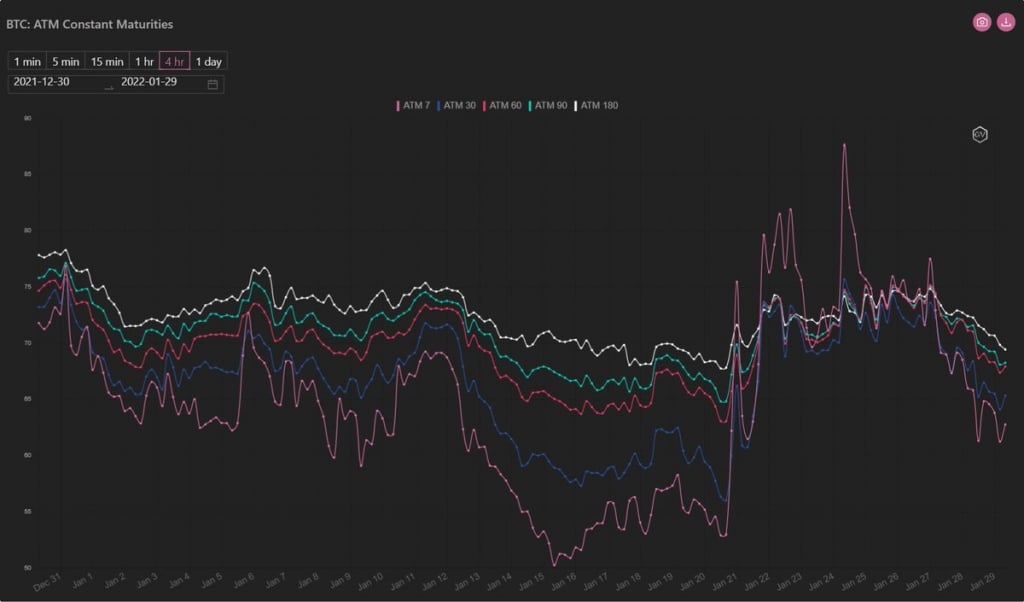

4) Last week, with year-low IV, DOVs sold strikes that were rapidly tested; most Puts expired ITM. Spirits were not lifted when the Call yield hit accounts for Vault locked ETH+BTC, which had been exposed to falling Spot. Priorities challenged. DOV TVL and Option supply pruned.

5) As we know, the near-dated IVs got crushed pre-DOV last week, before surging on spot capitulation. IV still dipped this week, but not the same ferocious front-running. ETH supply well absorbed. IV reaction was more a standard consequence of benign RV and weekend theta decay.

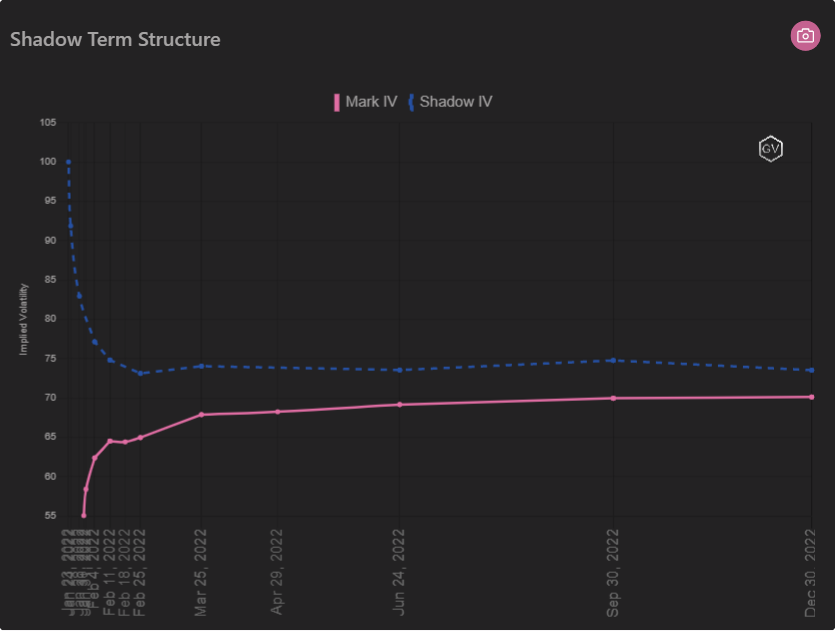

6) The term-structure shape has flipped from backwardation (on spot lows) to contango (current spot). This is a reflection of the signs of panic at the front-end of the curve observed last week and the exit post-Fed, while medium-term drifted. Of note, now some calendar selling.

View Twitter thread.