[Deribit] Option Flow – Week 3, 2022

January 16

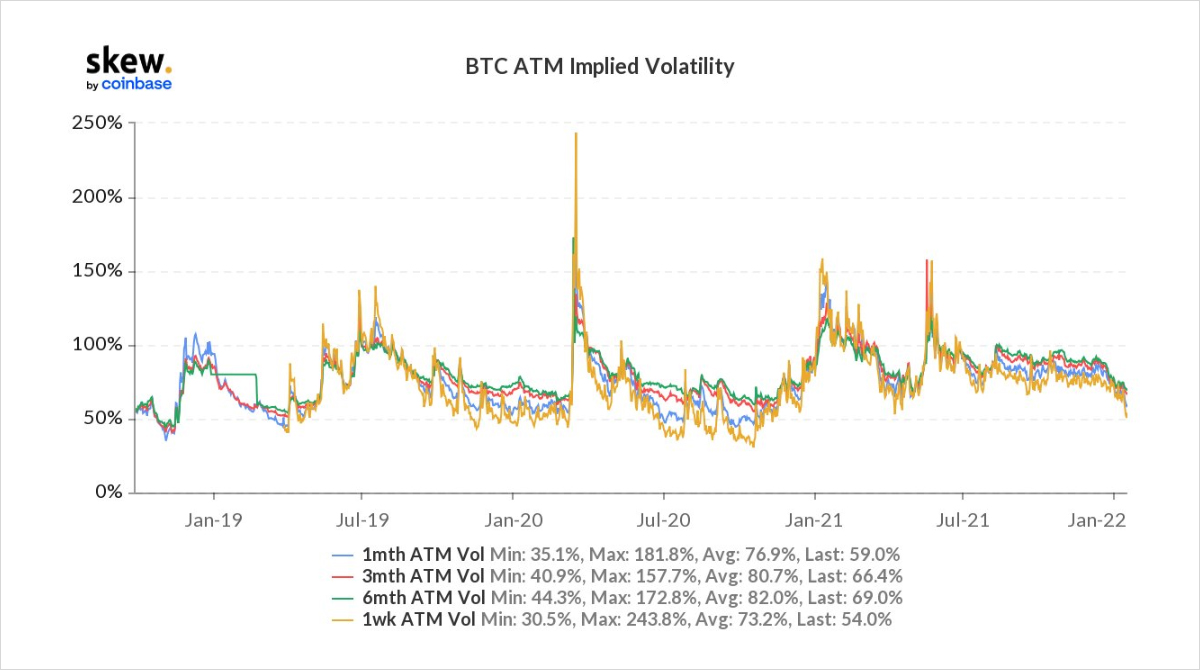

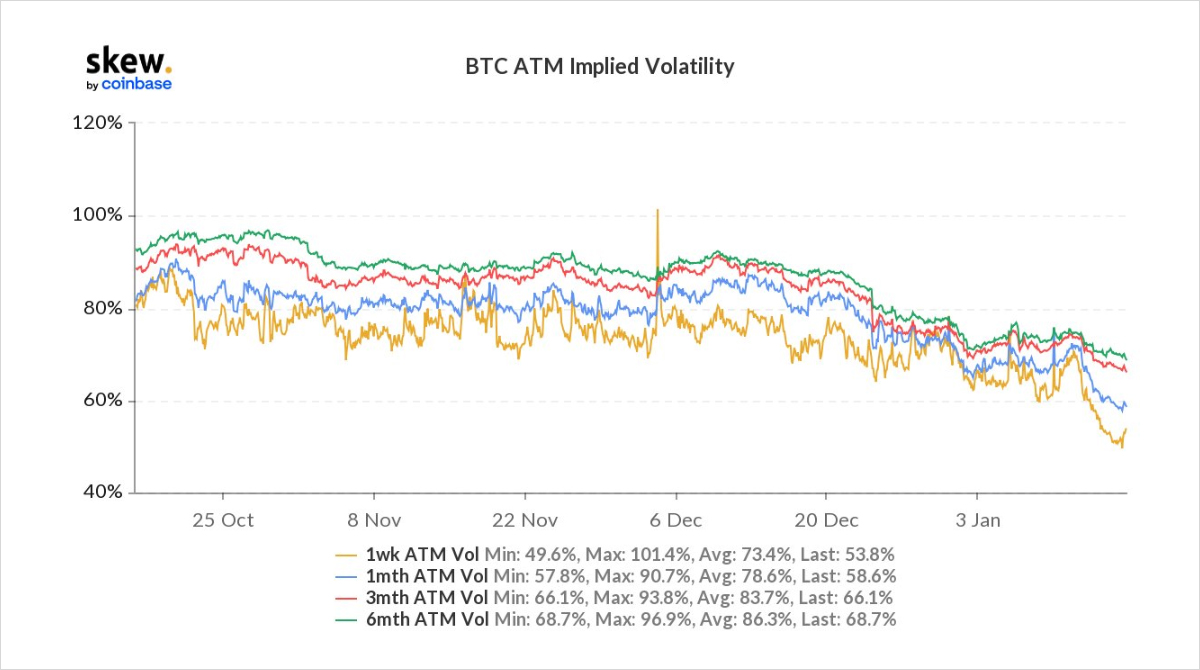

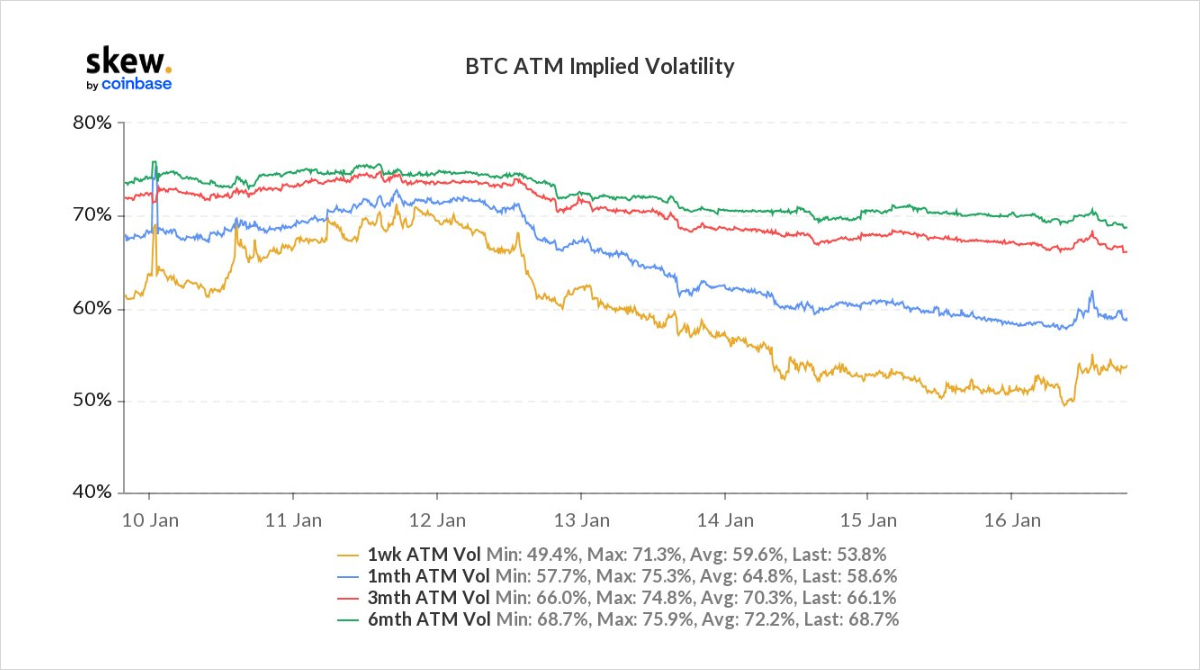

Crypto Implied Vol (the cost of Options) hit a 1year low. The narrative is being driven by Defi-Option Vaults (DOVs). Let’s take a closer look into previous IV dips, what caused them, the current DOV inner workings, why this has an impact on Deribit Vols, and how to play them.

2) Tradfi has seen for many years the use of options primarily for hedging and increasing yield. Attaining yield on underlying spot exposure is done by selling options, which collects option premiums. Yield is dictated by how much premium is generated and suits high-IV products.

3) Crypto being a high-IV creates opportunities to collect high premiums. The most popular method is the Covered Call.

Similarly, cash-secured-Put employed to collect Put premium at a strike ur happy to buy the underlying. On Deribit +Spot, -Perp, -Put.

1. There has been a great deal of interest around selling covered calls on CT lately, so I thought I would briefly describe how they work.

Selling covered calls is actually simple, so don’t tune out, this can be a great way to earn yield on your #BTC.

Ps. Happy New Year! pic.twitter.com/Q8u4mrQYIr

— Deribit (@DeribitExchange) December 31, 2021

4) Back in 2019, we saw many Covered Calls and Cash-Secured-Puts (CSPs) combined together, known as a Strangle. Ideally, a short option never wants to be exercised – ie you never want to go through your short strike. So theoretically you want to sell low delta OTM options.

5) But the further OTM the options are the less premium you collect, and the lower yield you receive. So it is tempting, particularly after a few months of success, to increase the Option delta (moving the strike closer to the ATM current spot), to receive greater yield.

6) Also range-bound markets with low Realized Vol (RV), can make an options seller feel comfortable. The 2019 Strangle seller had started to grow quite big and have an influence on Implied Vol, as by selling Options you apply pressure. BTC 10k. Sold 8k-14k, 7k-12k etc Strangles.

7) Of course, In March 2020 we experienced global risk capitulation on the back of the spread of Covid19 and the seller was forced to cover the shorts as IV re-adjusted higher, finally pushing short-term IV >400%.

8) The same has happened in trad-fi going back years: 1987 market crash Soros attack on the £, Barings collapse, LTCM collapse, Nasdaq collapse, Financial collapse 2008, European credit crisis, Oil sub-zero delivery fiasco etc etc. Black-swan events happen too often.

As such, the Long Calls >$150m profit.

9) IV shocks don’t just come from black-swan events. They can come from the fear of something happening (observed by Put buying), or expectation, under-exposure, FOMO (observed by Call buying) in generally low IV environments where RV is expected to rise, therefore IV will rise.

10) In the summer of 2020, BTC was rangebound 10-12k, while Defi became the focus. RV fell, demand for IV drifted as attention was elsewhere. A new player (affectionately called Red-Bull due to jurisdiction and strategy of loving wings), bought OTM, and sold ATM dampening IV.

11) But then into a low vol environment (1week IV 35%, 1month 50%), Microstrategy + prominent Hedge funds started accumulating, pushing spot higher and followed quickly by Call buyers, culminating in the largest notional exposure listed trade Oct30 ’21 of Jan32k+36k Calls x20k.

12) In 2months, Spot went parabolic, 1week Implied Vol 4x, from 40% to 160%+ as short vol players were squeezed and forced to cover. For some time after, Covered Call strategies become less popular and certainly more discretionary rather than systematic.

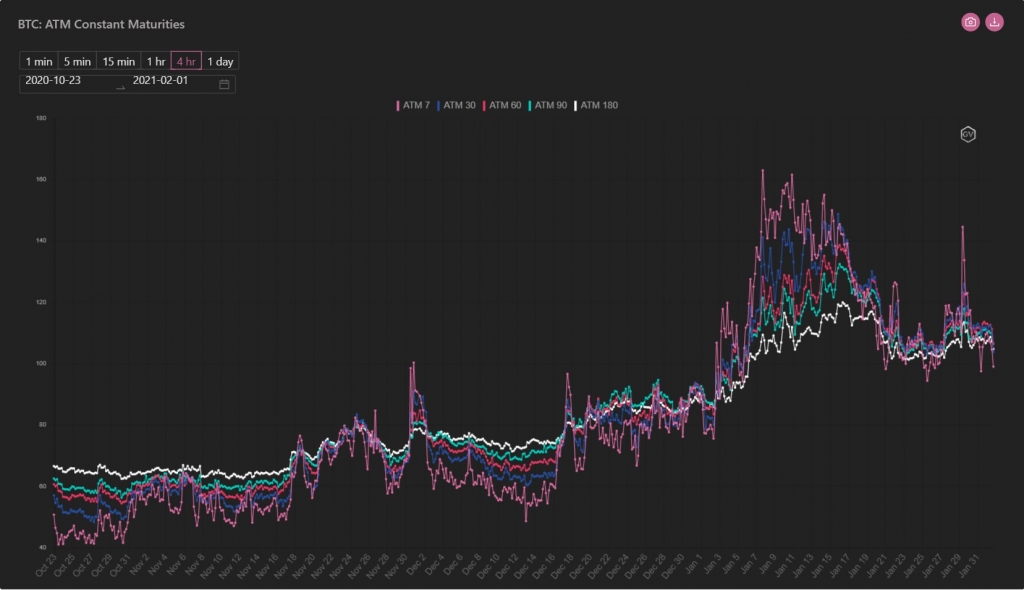

13) The first major DOV started soon after, well timed in terms of IV, poorly timed in terms of BTC racing higher to ATHs. TVL was slow to accumulate as crypto investors got their heads around new protocol structures, and the TVL had no impact on the underlying options market.

14) At first DOVs selected 10delta options to sell against collateralized holdings on ETH+BTC. Buyers were large MMs, that were not buying them for punts, but to buy cheap IV within a DOV and sell related Options on Deribit chains, to lock in an arb. Token incentives offered too.

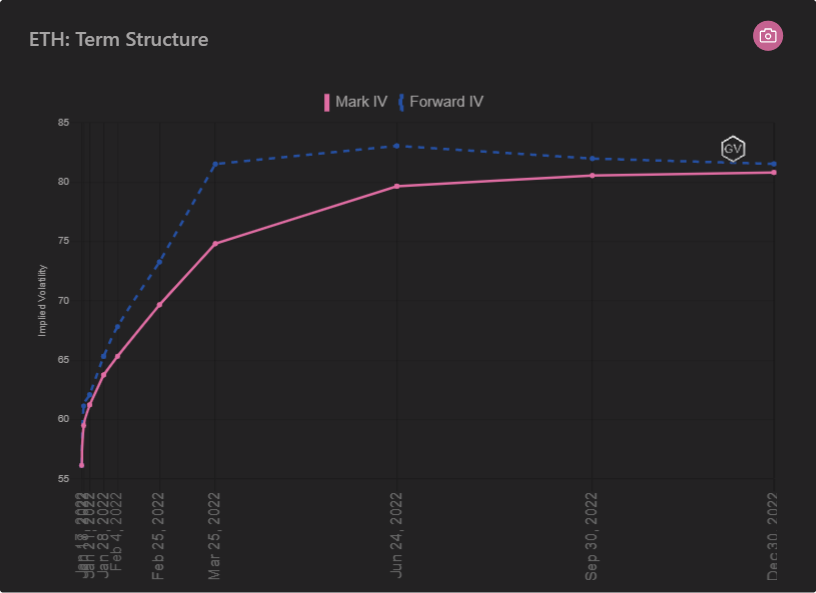

15) The premium sold in these vaults is not large, but the fact the MM prefer not to warehouse but to sell ETH+BTC options on Deribit is important for what has since transpired.

16) DOVs have increased in size and L1, Alt options available. As basis yields have compressed in the core market, holders of coins are looking for other types of yield. In addition, there is a hope that Vault sellers can earn retrospective token rewards. ~$1bn is now vaulted.

17) Deribit also continues to see large clients with vol selling structures and it is known that OTC clients that come from tradfi backgrounds also find selling covered Calls or straddles/strangles attractive in their newfound asset-class.

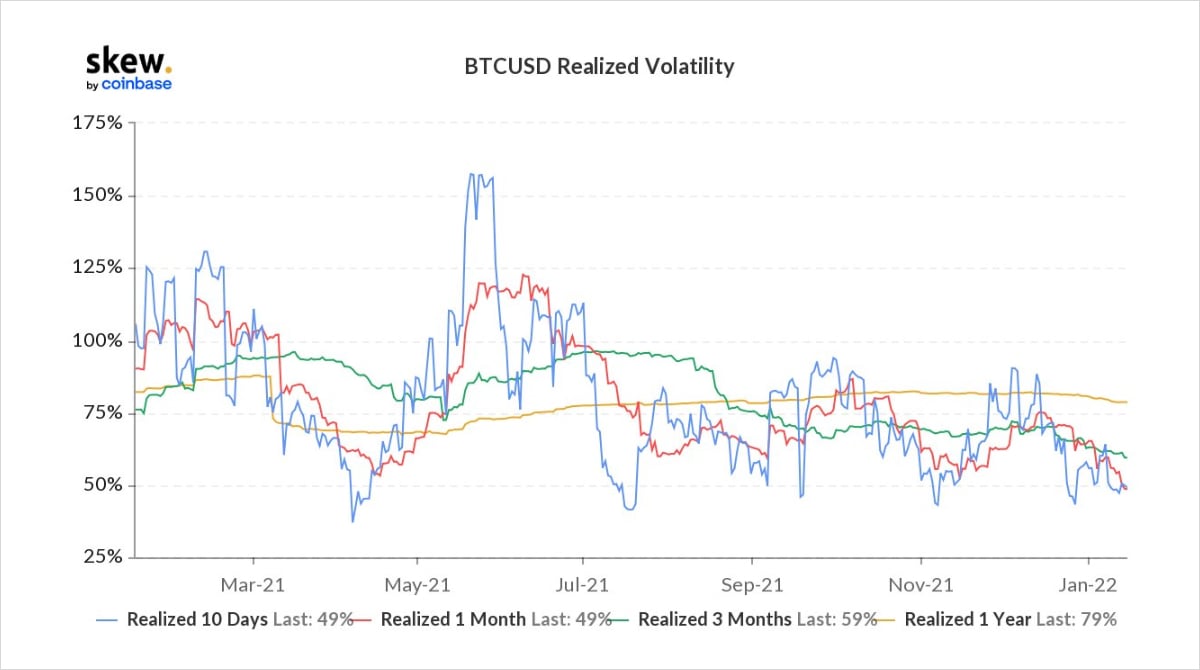

18) With the occasional Crypto spot+derivs liquidation cascades that pump RV, the general move in RV has been one of consolidation lower. The move into New-year was considerably less exciting in terms of moves than many expected and RV has fallen further. That impacts IV demand.

19) With the occasional Crypto spot+derivs liquidation cascades that pump RV, the general move in RV has been one of consolidation lower. The move into New-year was considerably less exciting in terms of moves than many expected and RV has fallen further. That impacts IV demand.

20) As IV has dropped, the premium for what would be the same OTM Options strike has fallen. For those that keep a consistent 10delta, the premium is similar but the strike closer to ATM. Risk up. Some DOV protocols have increased the delta to increase APY returns. Risk up.

21) That’s not to say there isn’t appetite, but the impact with increased delta is a closer strike to the ATM, so less spot movement required to blow through. Also, it translates into more gamma/vega/theta being sold onto the market.

22) Currently all the DOVs are 1week maturities. That means all options sold are 1week options and therefore the ideal options that MM wish to sell vs their vault inventory in order to arb is also 1week. This applies massive pressure and creates a steep contango term-structure.

23) Because RV has been low and there has been a lack of strong demand for 1week options, MM have had to sell other maturities. Hence Jan28-Feb28 have also dropped hard. This is a forced MM hedge, not paper-selling. 1month options have less theta than 1week and are a better hold.

24) So low IV Options are not necessarily cheap options. There has to be a reason to buy. If large moves are expected imminently then 1week options are a good purchase – but obviously crowded. If Option exposure is required but not for imminent move then Feb with less decay good.

View Twitter thread.