[Deribit] Option Flow – Week 1, 2022

In this week’s edition of Option Flows, Tony Stewart is commenting on market wide January optimism, liquidations to 42K + incoming puts for BTC 14 Jan.

January 7

Mkt-wide Jan Optimism crushed as Cap inflows met with aggressive unwinds+rotations from majors into specialized Alts. Active players hedged+reversed at 46k/3.8k with BTC Jan14 44k Puts, ETH Mar 3k-6k RRs +Jan Puts while special opps Alts reign strong. Vol off lows. Skew surge.

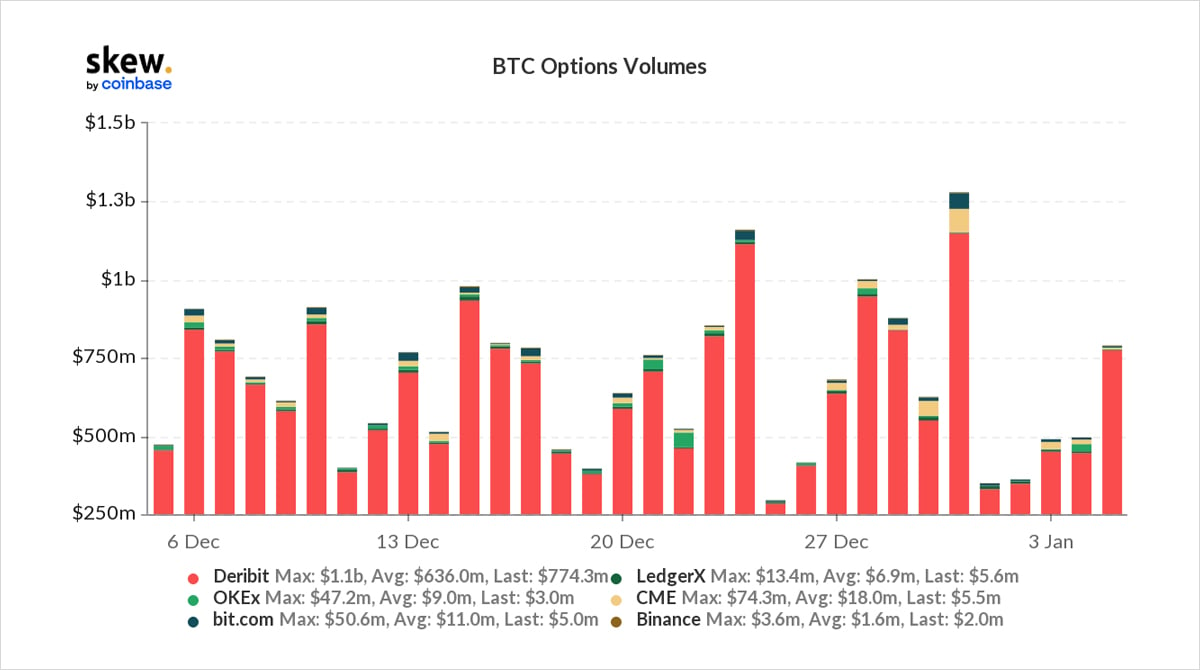

2) Mainland Asia 12am-NY sparked selling as BTC dumped 2.5k and US cap inflows were insufficient to power the market higher. Then for a few days, RV plummeted and IV followed as investors rotated to Beta plays. OI dropped significantly post Dec21 exp, volumes light on NY holiday.

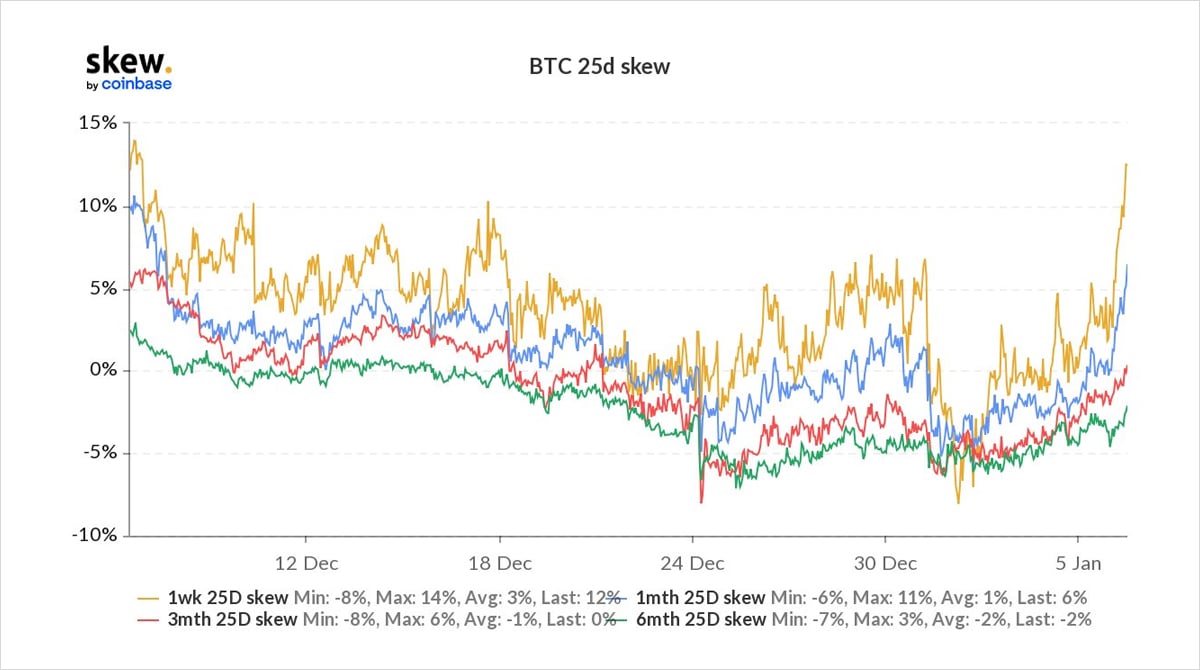

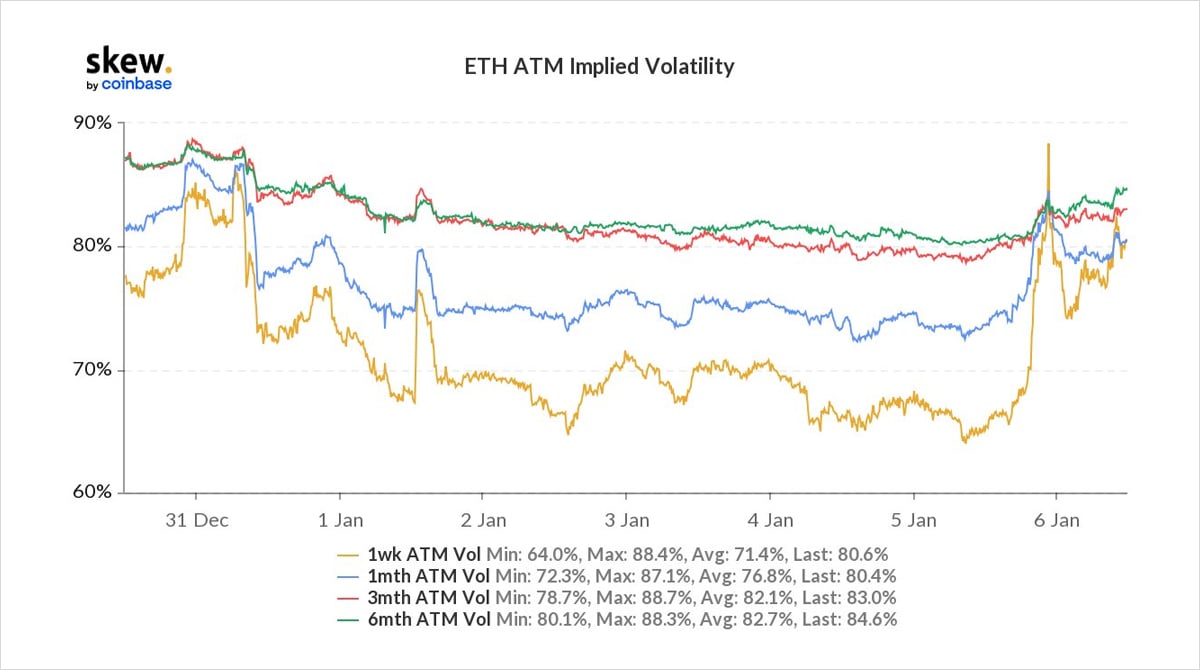

3) The lack of indicated upward spot follow-through set off some tingling alerts to experienced PMs, who hedged and reversed ahead of Fed minutes which proved disappointing, setting off cascading liquidations to 42k/3.3k. IV spiked, as did Skew. IV retraced a little. Skew firm.

4) The Skew firmness shows fear of the downside and temporary abandonment of the upside. Near-date 15% Skew is closing in on extremes of 20%+. Implied Vol is not showing that fear though. While there was a sudden surge, an overnight retrace suggests MM still long, demand low.

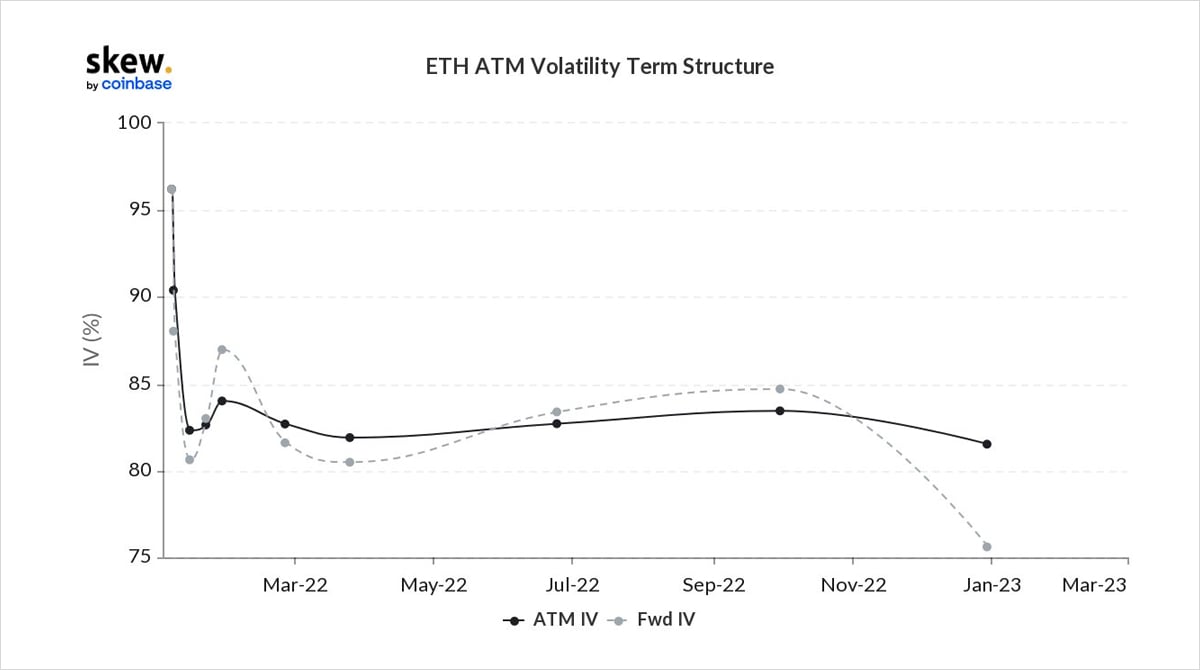

5) Some of that near-dated retrace in vol came from a roll of BTC Jan14 43+44k Puts supply into Mar 35k Puts for low premium – taking profits, reducing decay and picking up Mar skew at flat. Mar Skew has been a favorite in BTC + ETH in order to hedge books with low vol exposure.

View Twitter thread.