[Deribit] BTC Derivatives: Analytics Report – Week 27

Weekly recap of the crypto derivatives markets by BlockScholes.

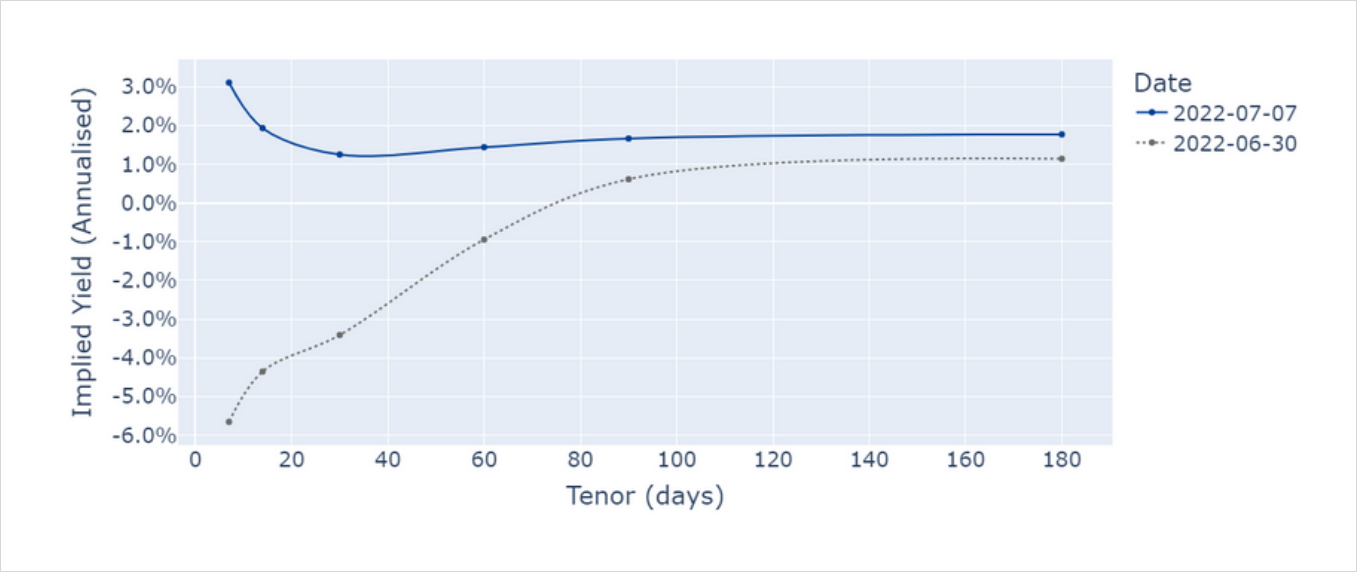

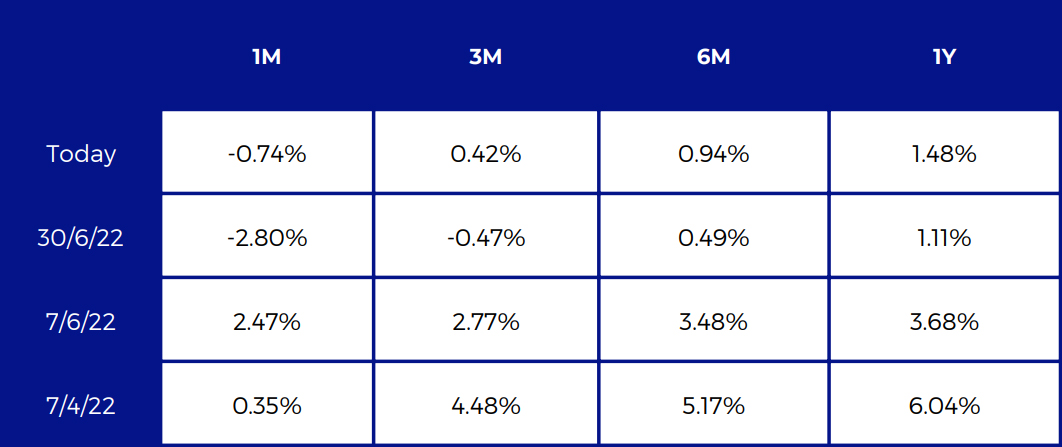

BTC’s implied yields turn positive for shorter tenors

Annualised yields flatten at a higher level as short term tenors rise to match the implied yields of longer dated tenors

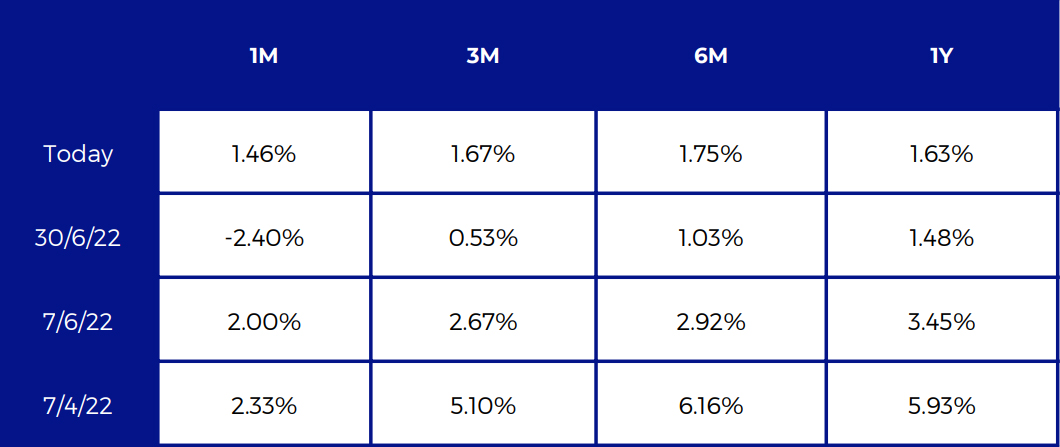

BTC Annualised Futures Implied Yields Table

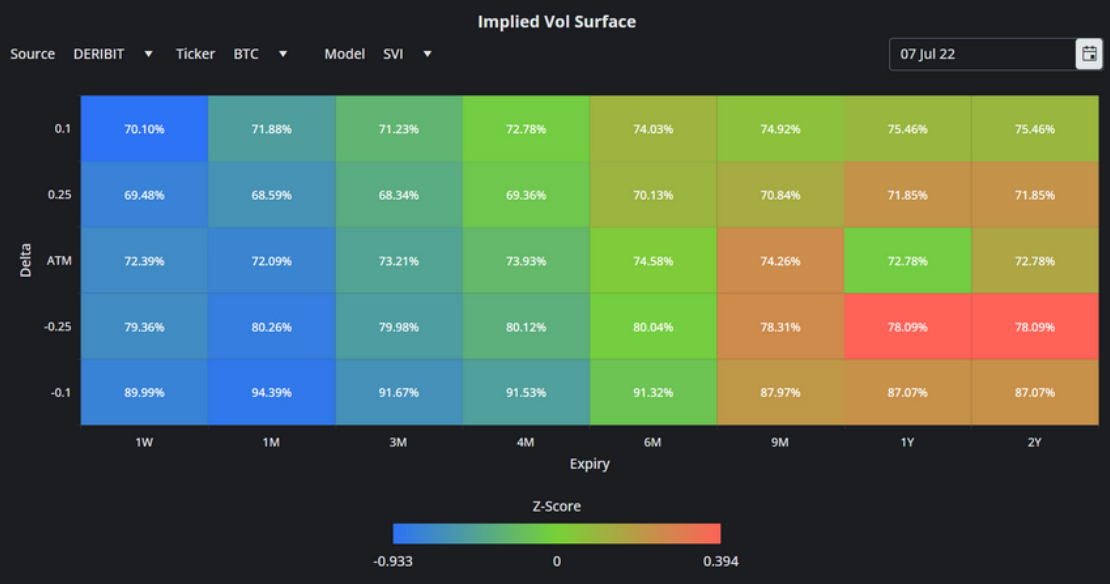

Short-term ATM vol is back below long-term vol as the ATM term structure trades flat in the low 70s

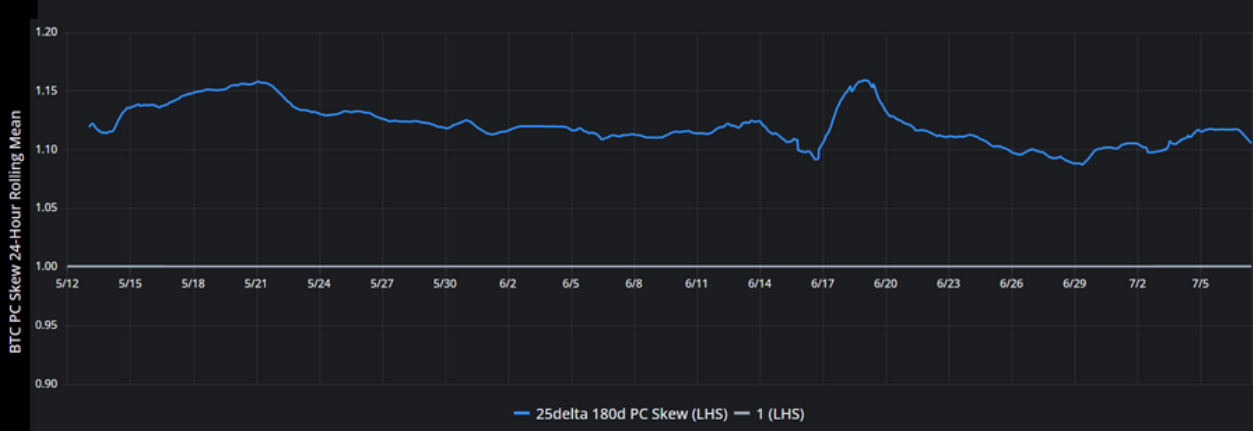

BTC’s PC skew shows no sign of falling at long dated tenors

BTC Implied Volatility Surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data

BTC ATM Implied Volatility Table

All timestamps 10:00 UTC, SVI Smile Calibration

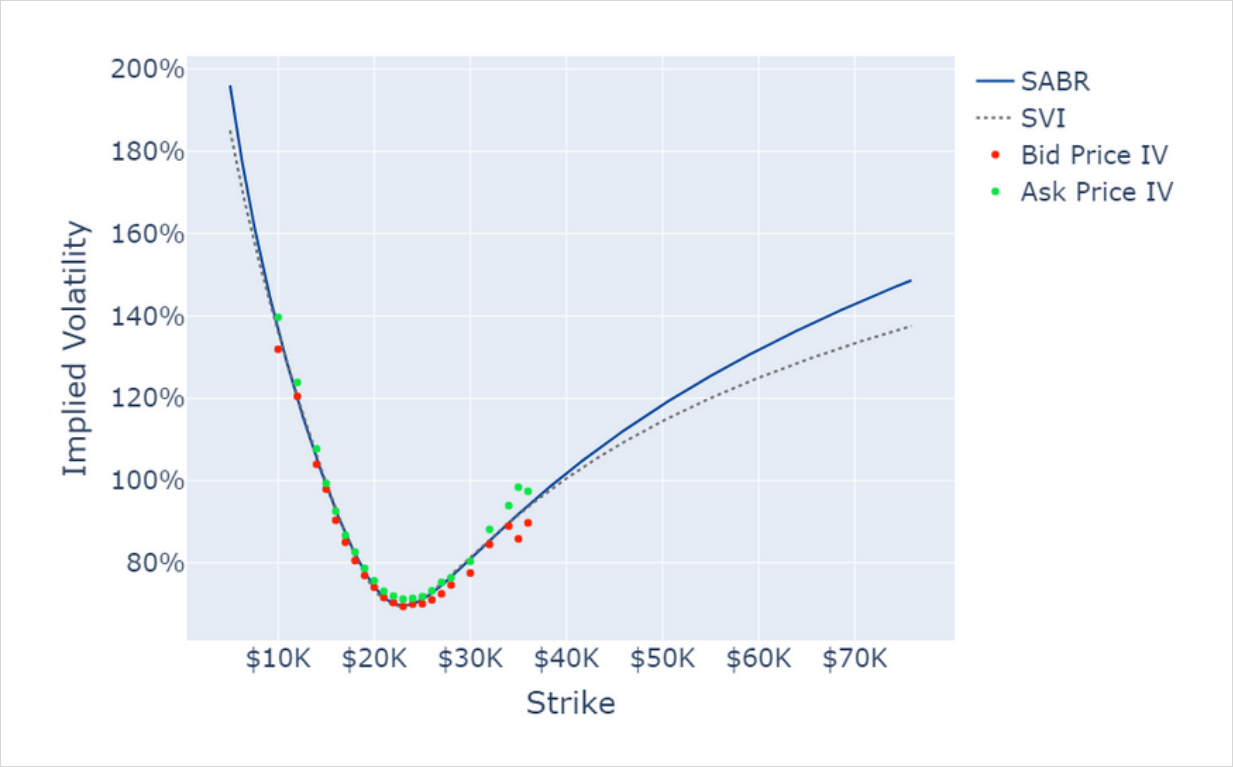

Bid and Ask implied volatilities are tight across strike domain

SABR and SVI Smile Calibrations, 29th July Expiry.

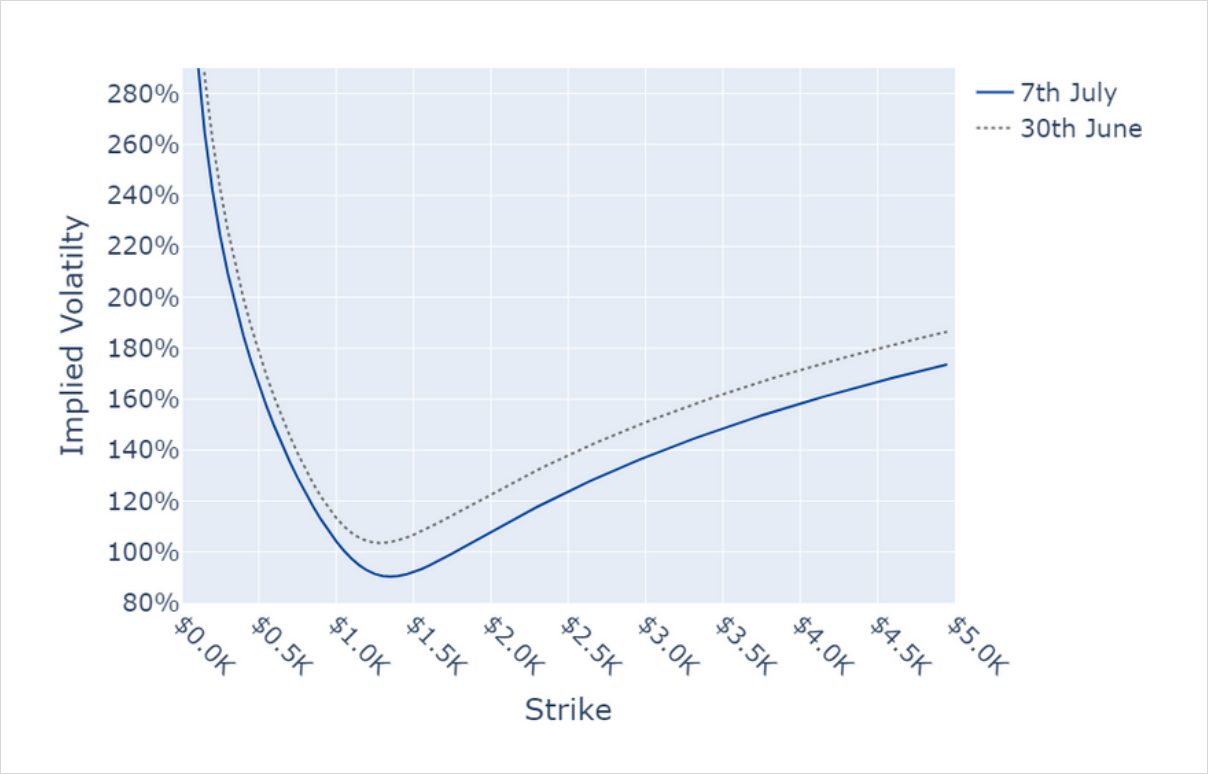

BTC’s vol smile drops across the strike domain, with no reduction in the steepening of the wings we saw last week

BTC 1 Month SABR Implied Vol Smile.

ETH Derivatives Analytics

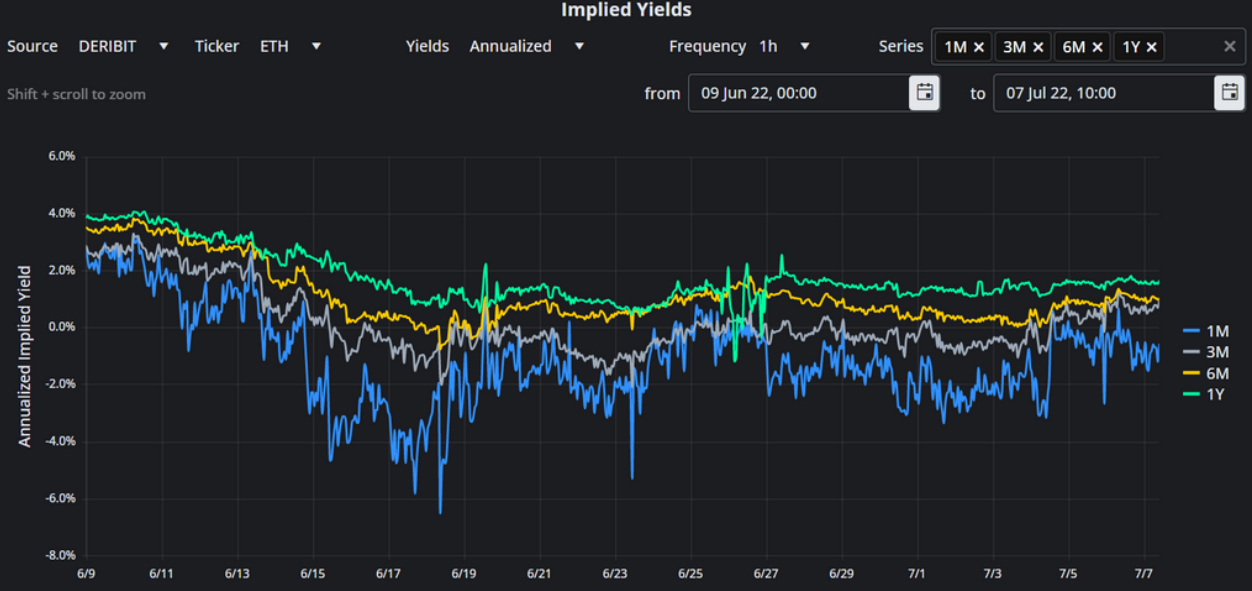

ETH’s annualised yields have not recovered at the same pace as BTC’s, remaining negative at a 1M tenor

Annualised Futures Implied Yields Table

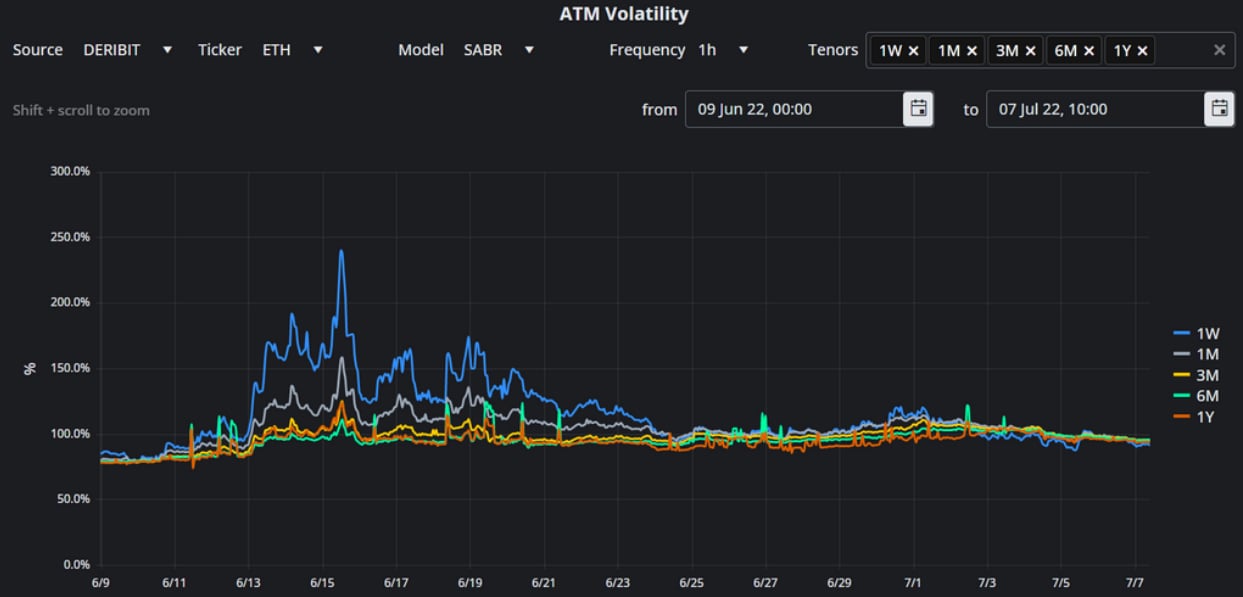

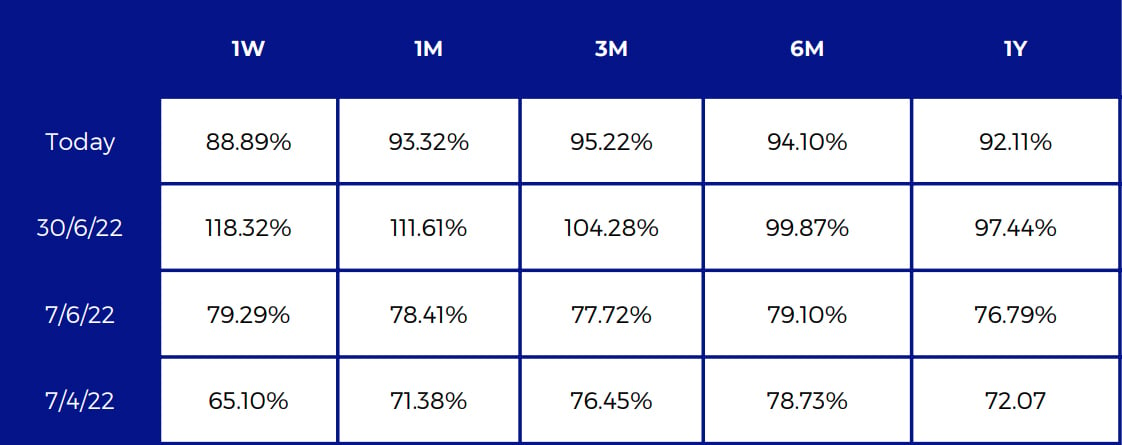

ETH’s ATM term structure remains flat in the mid 90s, significantly higher than the 70% level held by BTC

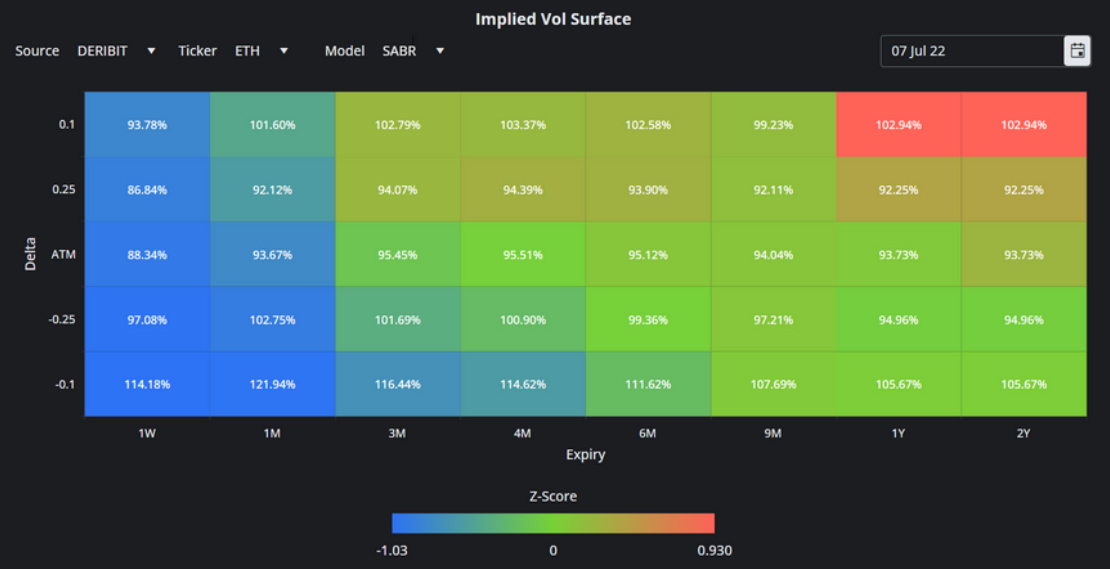

ETH’s PC skew remains much lower than BTC’s after it’s fall in late June

ETH Implied Volatility Surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data

ETH ATM Implied Volatility Table

All timestamps 10:00 UTC, SABR Smile Calibration

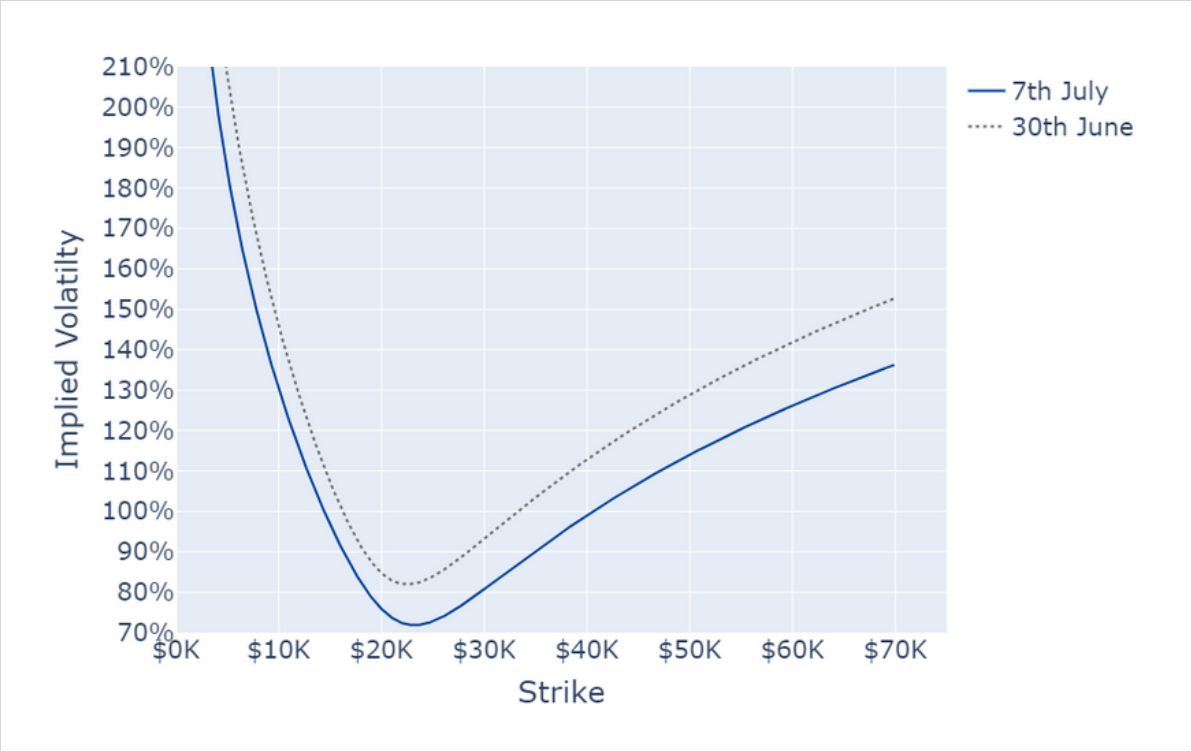

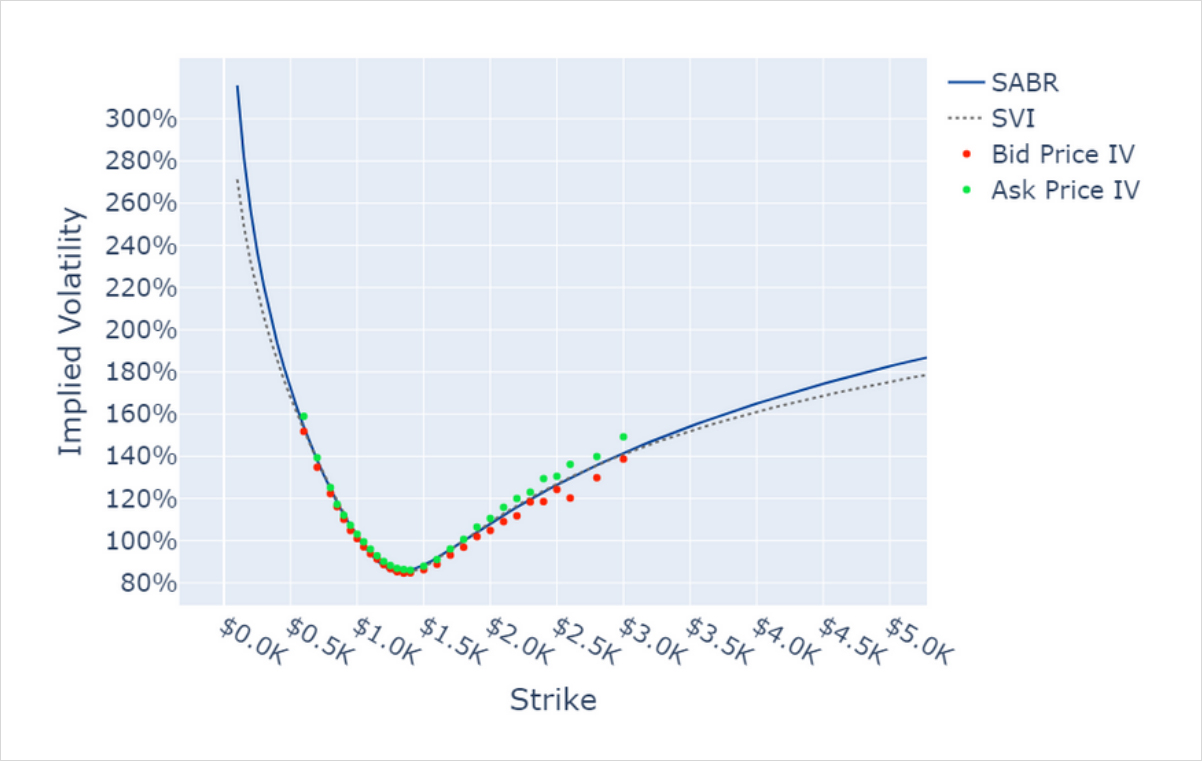

Implied vol of ETH’s bid and offer prices is tight for low strikes

SABR and SVI Smile Calibrations, 29th July Expiry.

ETH’s vol smile drops for all strikes in a similar fashion to BTC’s smile

ETH 1 Month SABR Implied Vol Smile.