[Deribit] BTC Derivatives: Analytics Report – Week 24

Weekly recap of the crypto derivatives markets by BlockScholes.

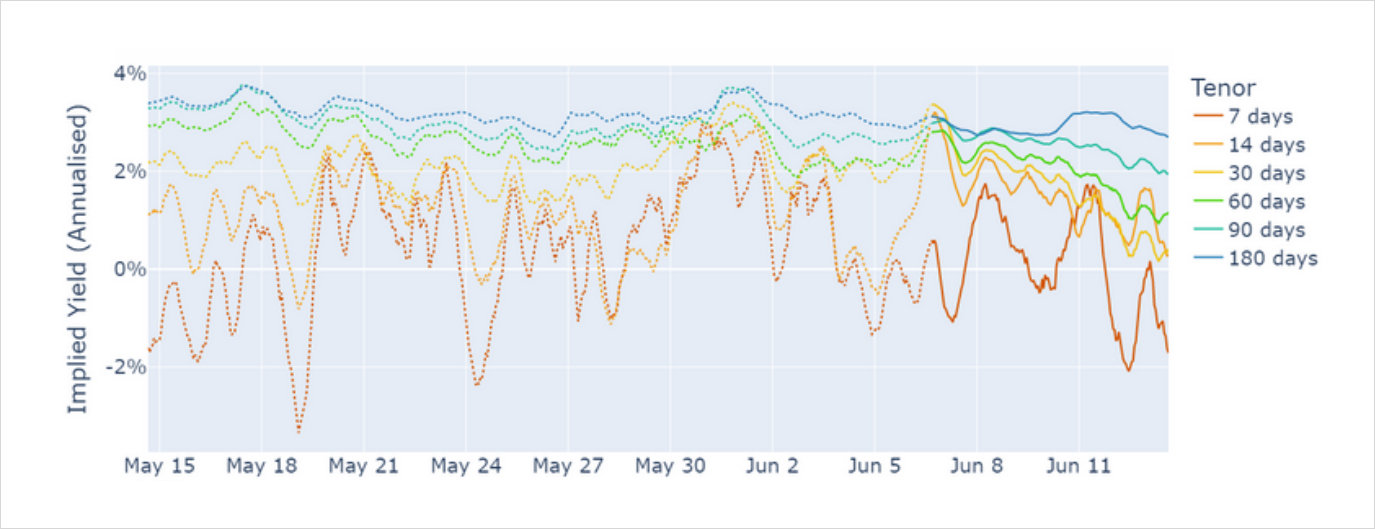

BTC futures term structure falls negative for short term tenors

Annualised Futures Implied Yields

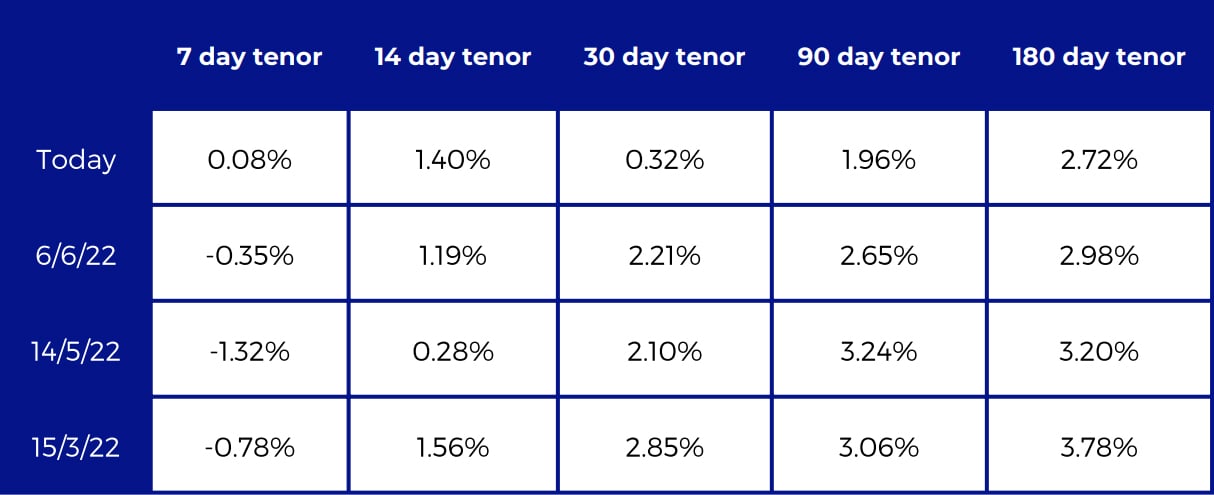

Annualised Futures Implied Yields Table

NB: Data from the past week is plotted in block colour, whilst dotted lines denote data from between 30 and 7 days before publishing date. The implied yields series has been smoothed with a 12 hour rolling mean.

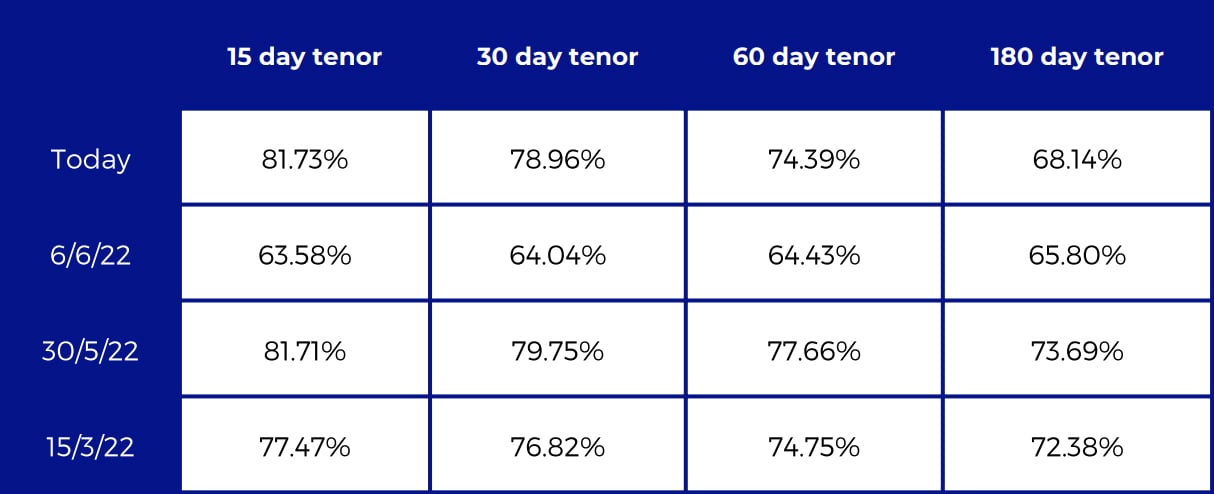

Bitcoin Volatility Metrics

Implied volatility spikes across all tenors after most recent selloff in the spot market

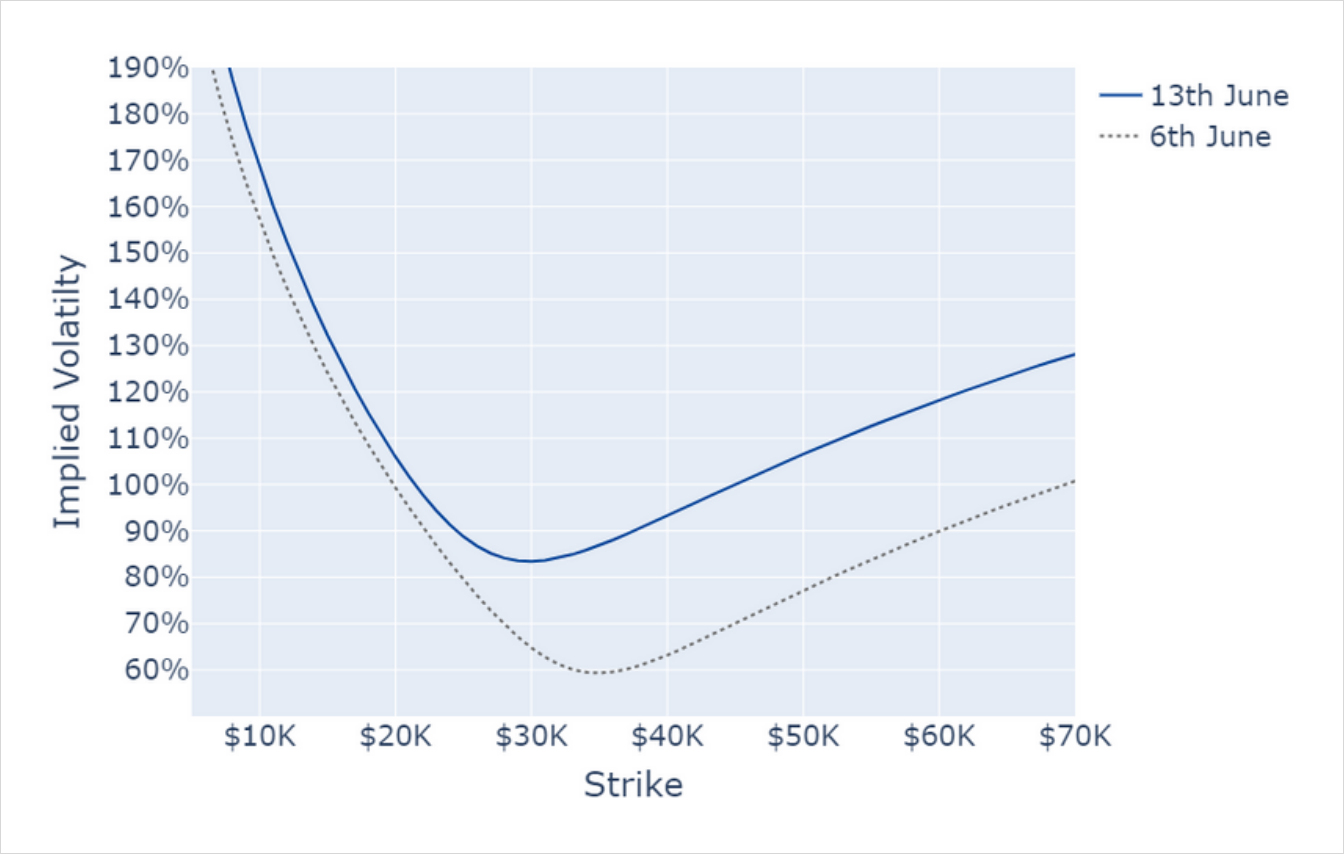

Put skew braces for further selloffs

ATM Implied Volatility Table

NB: Data from the past week is plotted regularly, whilst dotted lines denote data from more than 7 days before publishing.

NB: BTC 29th July Expiry smiles

SABR and SVI Smile Calibrations.

The smile rises across the strike domain whilst remaining steep and skewed towards puts

1 Month SABR Implied Vol Smile.