Bitcoin price was so flat that crypto analysts had little to discuss besides BTC’s ultra-low volatility

Bitcoin price is officially boring: The price was flat on Thursday at just above $19,000, and data shows that the largest cryptocurrency by market value’s 30-day volatility is at its lowest in almost two years. At the time of writing, BTC is changing hands at $19,116.

BTC/USD 4-hour chart | Source: TradingView

Bitcoin price dips, 30-day volatility at 2-year low; Ether falls, Dogecoin gains

Bitcoin price was holding steady around $19,000 – analysts were remarking on just how much the notoriously volatile cryptocurrency’s price has settled down. At least one technical indicator suggests that bitcoin might be undervalued, but the macroeconomic environment is still so sketchy that investors might not want to hop in just yet.

Bitcoin is as undervalued as it has been since 2020, based on a key indicator that relies on data extracted from the blockchain. The “MVRV Z-Score” is an analytical tool used to assess whether BTC looks cheap or expensive on a relative historical basis. The metric measures the difference between an asset’s market capitalization – the number of tokens outstanding times the spot price – and its “realized cap” – the number of tokens times the price at which the bitcoin last moved over the blockchain. That difference is then divided by the standard deviation of the asset’s market cap. Similar to other technical indicators, it theoretically highlights areas where an asset is overvalued or undervalued.

Polygon posted the biggest losses on the top 10 list, after a strong run of gains in the week off the back of high adoption figures on the network for the year. The token fell 5.38% to $0.80, but is still up 3.8% over the past seven days. Dogecoin rose 1.4% to $0.059, while Tron added 0.7% to $0.62. Cardano and Solana both fell 2.8%, with Cardano at $0.34 and Solana changing hands at $28.08.

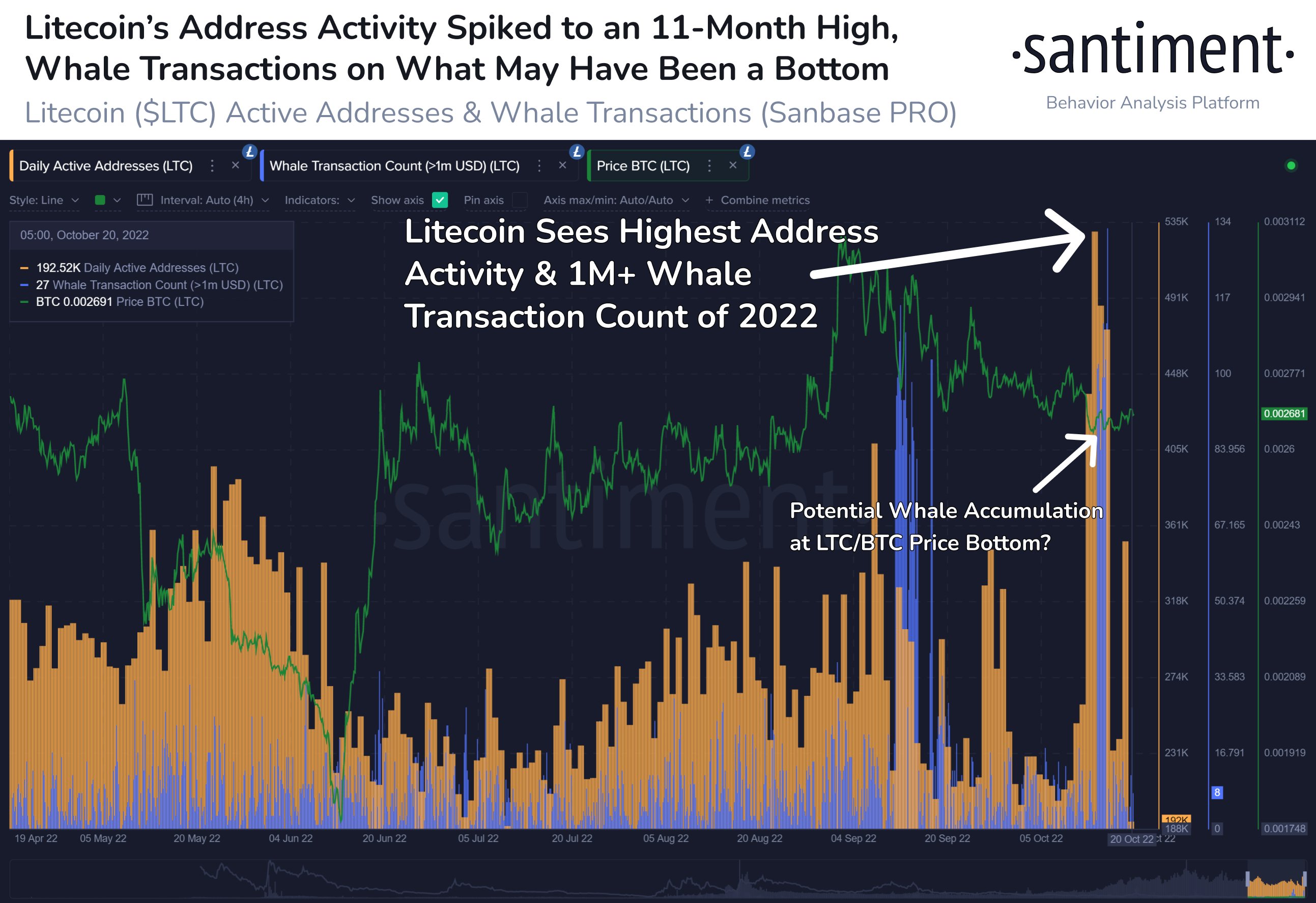

“Litecoin has been quietly under the radar in 2022, but address activity & whale transactions have exploded this week. Particularly with $1m+ valued transactions on the network, the timing of these spikes happened just as $LTC began rising vs”, Santiment reported.

Axie Infinity, the “play-to-earn” crypto gaming platform already a big loser in digital-asset markets this year, faces additional selling pressure as a big “unlock” looms for millions of the native AXS tokens. The concern is that early investors who have been restricted from selling because of vesting periods might now choose to dump the token.

U.S. equities closed lower on Thursday. The Dow Jones Industrial Average fell 0.3%, the S&P 500 Index dropped 0.8%, and the Nasdaq Composite Index finished the day down 0.6%. This followed a Thursday report by financial services company Freddie Mac showing interest rate increases by the U.S. Federal Reserve this year have pumped up the average 30-year fixed-rate mortgage to 6.94%, the highest since April 2002 and more than double the 3.09% last year.

The Fed has raised interest rates from nearly zero in March this year to 3% and 3.25%. It has committed to bringing inflation down to a target range of 2% from its current pace of 8.2%. The Fed is expected to raise interest rates by 75 basis points at its next general meeting in November.

Read more:

- Bitcoin Price Dropped Below Its Bottom Support Of $19,000

- Financial Institutions Moved 48,000 Bitcoin From Coinbase; Historically This Signifies A Price Surge

- Bitcoin Price And Altcoins Point Upward Amid A Renewed Embrace Of Riskier Assets

- Investors Can Track Bitcoin Whale Transactions To Derivatives Exchanges To Mark Market Bottoms