Bitcoin price stayed below $19,000 for most of the weekend, despite a couple of brief gains

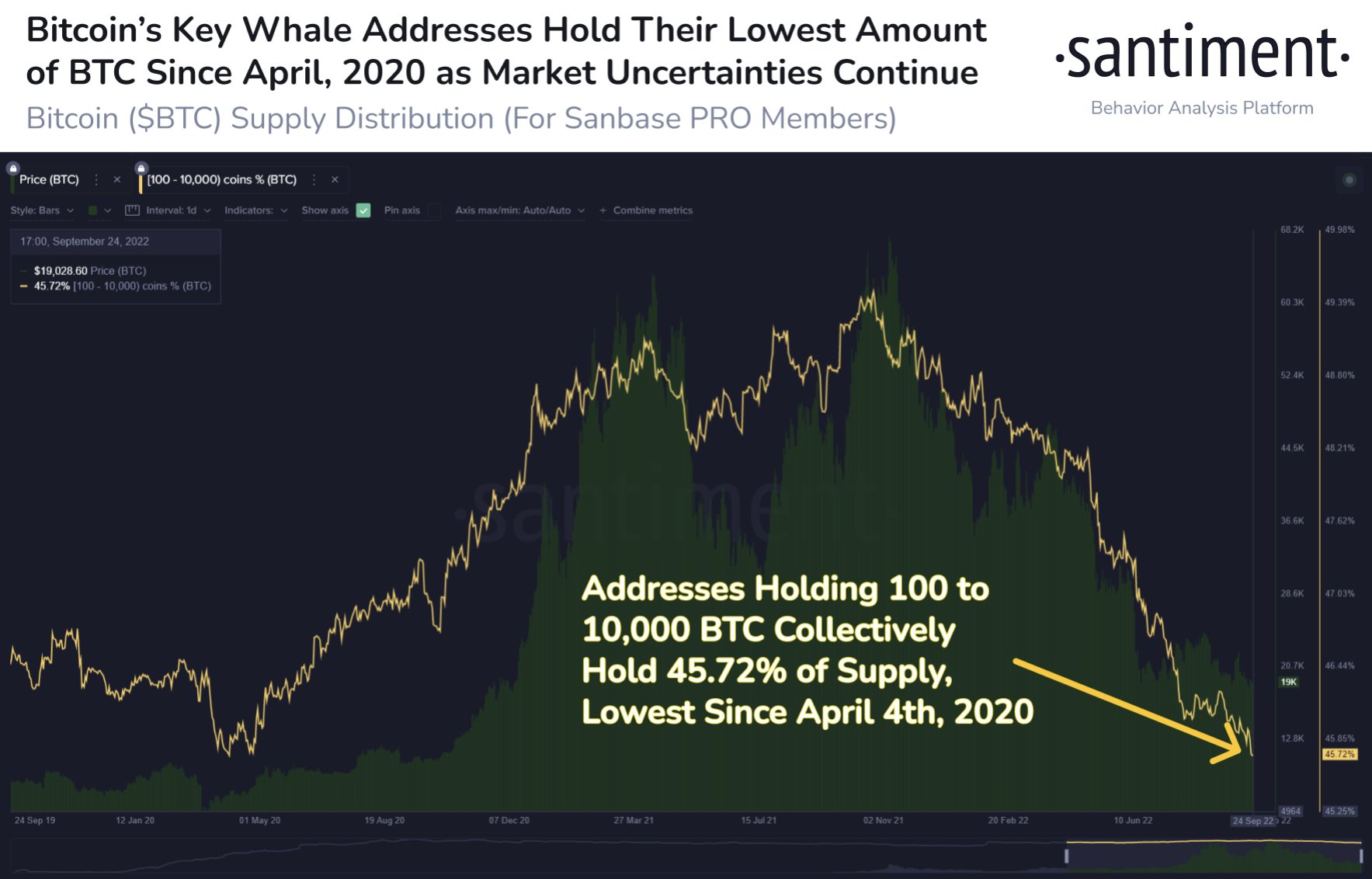

According to on-chain analytics firm Santiment, the amount of Bitcoin held by whales has been in decline for 11 months now. It notes that as fears of inflation and global recession dominate, addresses holding 100 to 10,000 BTC have lowered the percentage of the Bitcoin supply held to 29-month lows. This category of addresses now holds 45.72% of the supply, which is the lowest since April 4, 2020.

Per Glassnode data, coins that have been held for several months record the highest dormancy ever. The on-chain analytics firm notes that the total volume of Bitcoin “coin-days” destroyed in the last 90 days has, effectively, reached an all-time low.

“The amount of Bitcoin held by whales has been dropping for 11 months now. As fears of inflation and a world #ecession continue, addresses holding 100 to 10k BTC have lowered their percentage of supply held of crypto’s top asset to 29-month lows”, Santiment reported.

Despite a few brief gains, Bitcoin stayed below $19,000 for most of the weekend. The lead cryptocurrency recently traded at over $19,157, up 1.17% in the previous 24 hours. This came after volatility in the past week amid significant interest rate hikes by the U.S. Federal Reserve and other central banks and declining economic indicators that point to a recession.

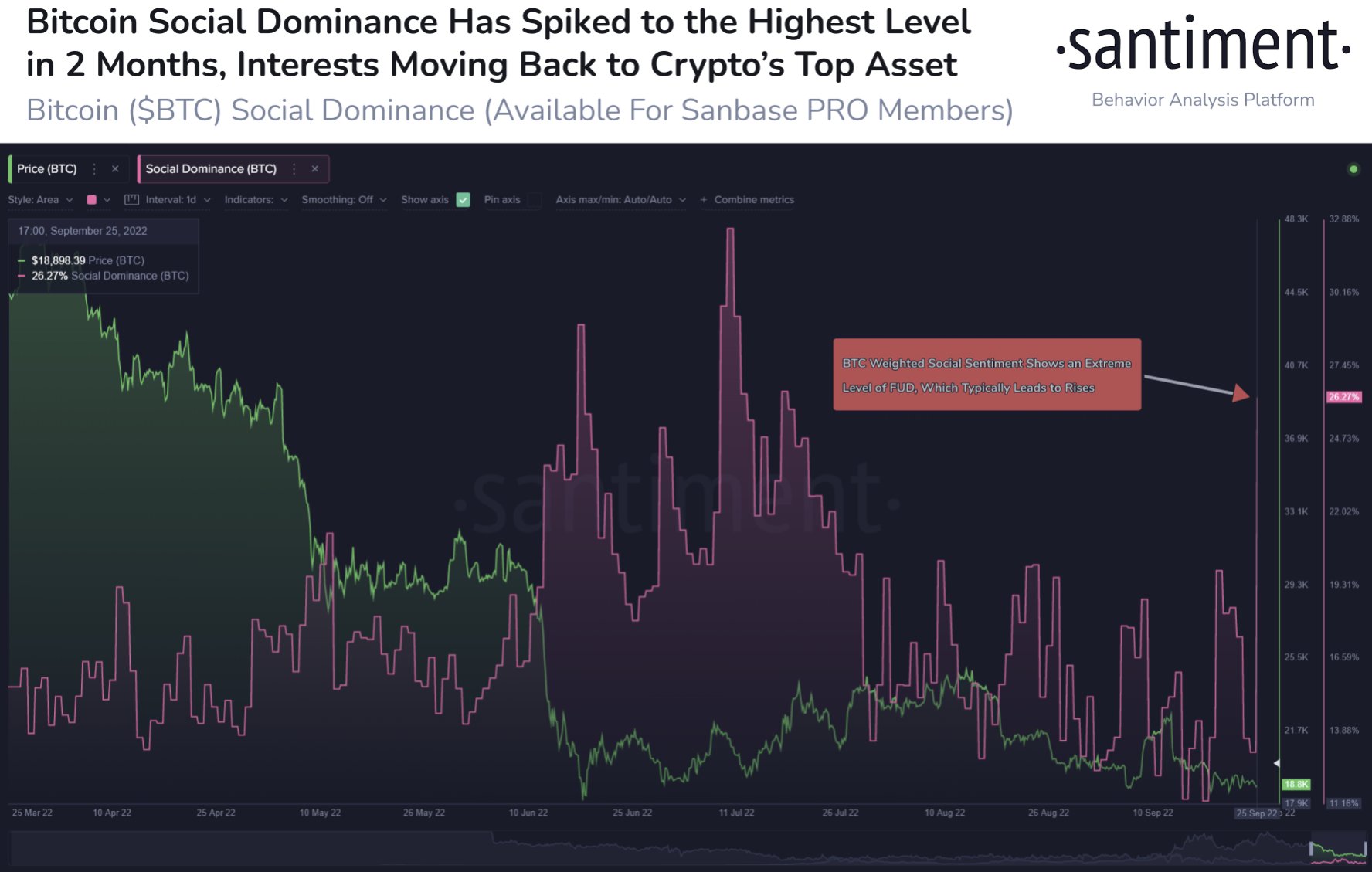

“A spike in Bitcoin interest on social platforms came this weekend. Among crypto’s top 100 assets, BTC is the topic in 26%+ of discussions for the first time since mid-July. Our backtesting shows 20%+ dedicated to Bitcoin is a positive for the sector”, Santiment stated.

As the crypto market generally remained under pressure, Santiment reports a spike in Bitcoin interest on social platforms over the weekend. It noted that among the top 100 cryptos, Bitcoin was the subject of discourse in over 26% of discussions for the first time since mid-July. Santiment added, “Our backtesting shows 20%+ dedicated to Bitcoin is a positive for the sector.”

The Root, an on-chain data-focused Twitter handle, shared an analysis that might suggest that Bitcoin may soon reach its bear market bottom: “Short & Long Term Holder cost basis just crossed. Previous bear market bottoms happened within days of crossing. Is this time different?” The Root tweeted.

Crypto analyst Will Clemente believes Bitcoin might have started a bottoming process. “After months of waiting, for just the fourth time, Bitcoin’s short-term holder cost basis has fallen below its long-term holder cost basis. This indicates a bottoming process. The next cross to watch for is a bull cross of the short term back above the long term.”

Read more:

- Bitcoin Price Spent Much Of The Weekend In The Red And Below $19,000; Altcoin Also Fell

- Three Alternatives To Celsius You Should Consider