Bitcoin price rose early but later fell after Fed damped enthusiasm stemming from a less-aggressive rate hike

Bitcoin price appeared poised to maintain momentum this week. Still, US Federal Reserve Chair Jerome Powell dampened investors’ spirits with a sharp warning that the Fed was not finished with its monetary hawkishness, despite cutting its latest interest rate hike to 50 basis points. The top cryptocurrency by market capitalization was recently trading at $17,695, roughly where it was 24 hours ago.

BTC/USD 4-hour chart | Source: TradingView

US Regulation Heats Up; Bitcoin Price Rises, Then Falls

BTC had surpassed $18,300 earlier in the day, owing to an unexpected deceleration in November’s inflation figures and the Fed’s predicted dovish shift. However, in a news conference following the FOMC rate announcement, Powell reiterated a months-long theme that rising prices posed the greatest threat to the economy.

“The FOMC did the expected, raising corporate interest rates by 0.5%. During his press conference, Jerome Powell indicated inflation is still a main focus. Crypto platform topics like inflation & recession hit their 4th highest spike ever”, Santiment added.

Ether followed the same path, climbing earlier in the day before falling to $1,308, down roughly a percentage point from Tuesday’s time. Earlier in the day, PayPal and MetaMask announced the payments company will integrate its buy, sell and hold crypto services with MetaMask Wallet as the companies look to broaden users’ options to transfer digital assets from their platforms. Users will be able to buy and transfer ETH from PayPal to MetaMask.

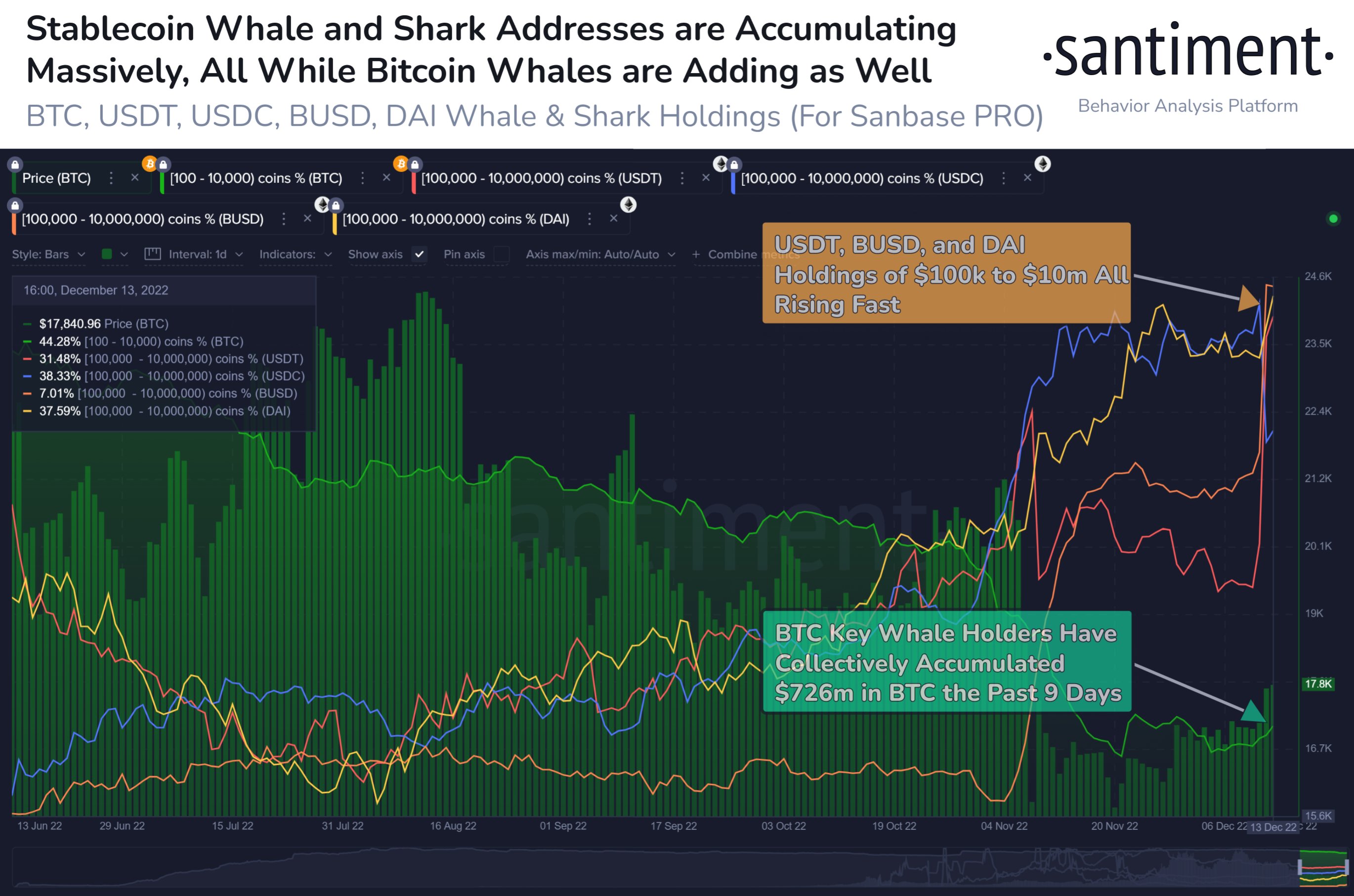

“Bitcoin’s addresses holding between 100 to 10,000 BTC have bought 726m in BTC the past 9 days. Meanwhile, stablecoin assets like USDT, BUSD, & DAI are also being bought quickly. This is a recipe for good things”, Santiment reported.

BNB dropped 1.7% to $267.94. The cryptocurrency has lost 5.8% over the previous seven days amid news that its issuer, the world’s largest crypto exchange Binance Global Inc., is under investigation by the U.S. Justice Department. Furthermore, an independent assessment of Binance’s assets, intended to provide trust following the FTX debacle, generated concerns about the review being less than comprehensive.

XRP declined 2.4% to $0.38 on fears that the Securities and Exchange Commission will be harder on tokens it considers securities. The SEC charged former FTX.com CEO Sam Bankman-Fried with fraud this week, following a years-long legal battle with Ripple Labs Inc., whose payment network is powered by XRP, over whether the coin is a security.

Most other prominent cryptocurrencies fell, albeit by a small margin, with UNI, the decentralized exchange Uniswap, and LINK, the token of software platform Chainlink, losing 3.2% and 3.1%, respectively.

The entire crypto market capitalization remained unchanged at $867.47 billion, but total trading volume in the previous 24 hours plummeted 15.6% to $44.98 billion.

Read more:

- Bitcoin Price And Altcoins Liked The Sound Of Inflation Slowing By More Than Expected In November

- Bitcoin Price Returned Above $17,000 After Dipping Amid Binance Was The Subject Of A U.S. Federal Prob

- Tim Draper Predicted That Bitcoin Price Would Reach $250,000 By The End Of 2022