Bitcoin price and Ether trade sideways a day before the opening of the Fed’s Economic Symposium

Bitcoin and other crypto assets rose along with U.S. stocks, which broke a three-day losing streak on Wednesday, as investors’ appetite for riskier assets returned. At the time of writing, the Bitcoin price is changing hands at $21,530.

Bitcoin Price Trades Flat a Day Before Fed Economic Symposium Starts

Bitcoin and ether traded sideways. Bitcoin was recently changing hands at about $21,500, up a few fractions of a percentage point over the past 24 hours. After plunging late last week, the largest cryptocurrency by market value has been stubbornly clinging to its handhold above $21,000 amid largely tepid trading as investors wait for more clarity about the U.S. central bank’s monetary policy going forward. Bitcoin is not at the bottom and the crypto winter is not turning to spring quite yet.

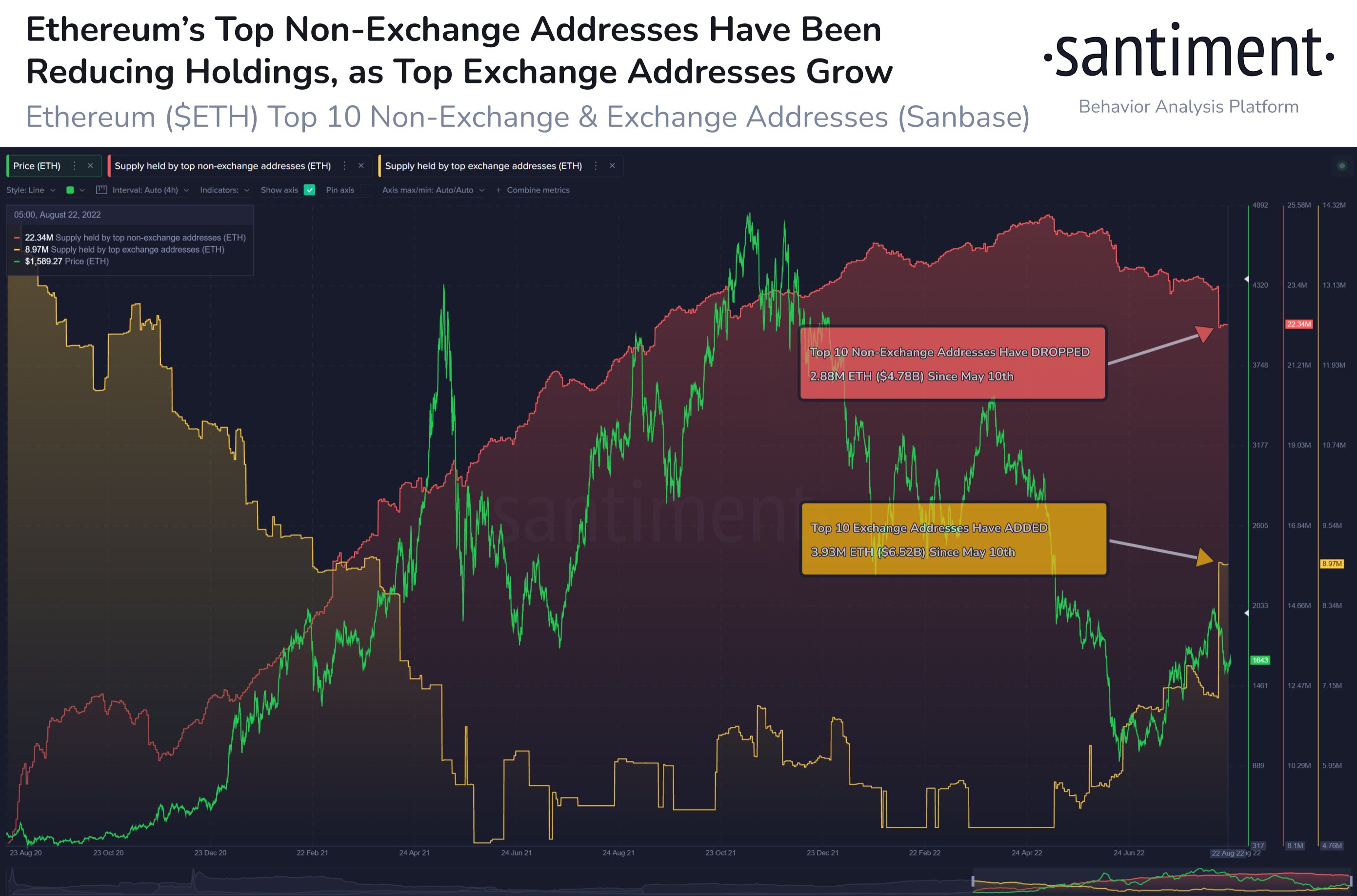

“The gap between Ethereum’s top 10 largest non-exchange addresses & exchange addresses is closing as we head toward the merge in 3 weeks. Since May 10th, these top non-exchange ETH addresses hold 11% fewer coins, & top exchange addresses hold 78% more”, Santiment reported.

Ether was recently trading below $1,700, rising over 1% during the same period. The second largest crypto by market value has been outperforming bitcoin over the past few weeks amid eager anticipation of the Ethereum blockchain Merge, which will shift the protocol from energy-sapping proof-of-work to faster, more environmentally friendly proof-of-stake.

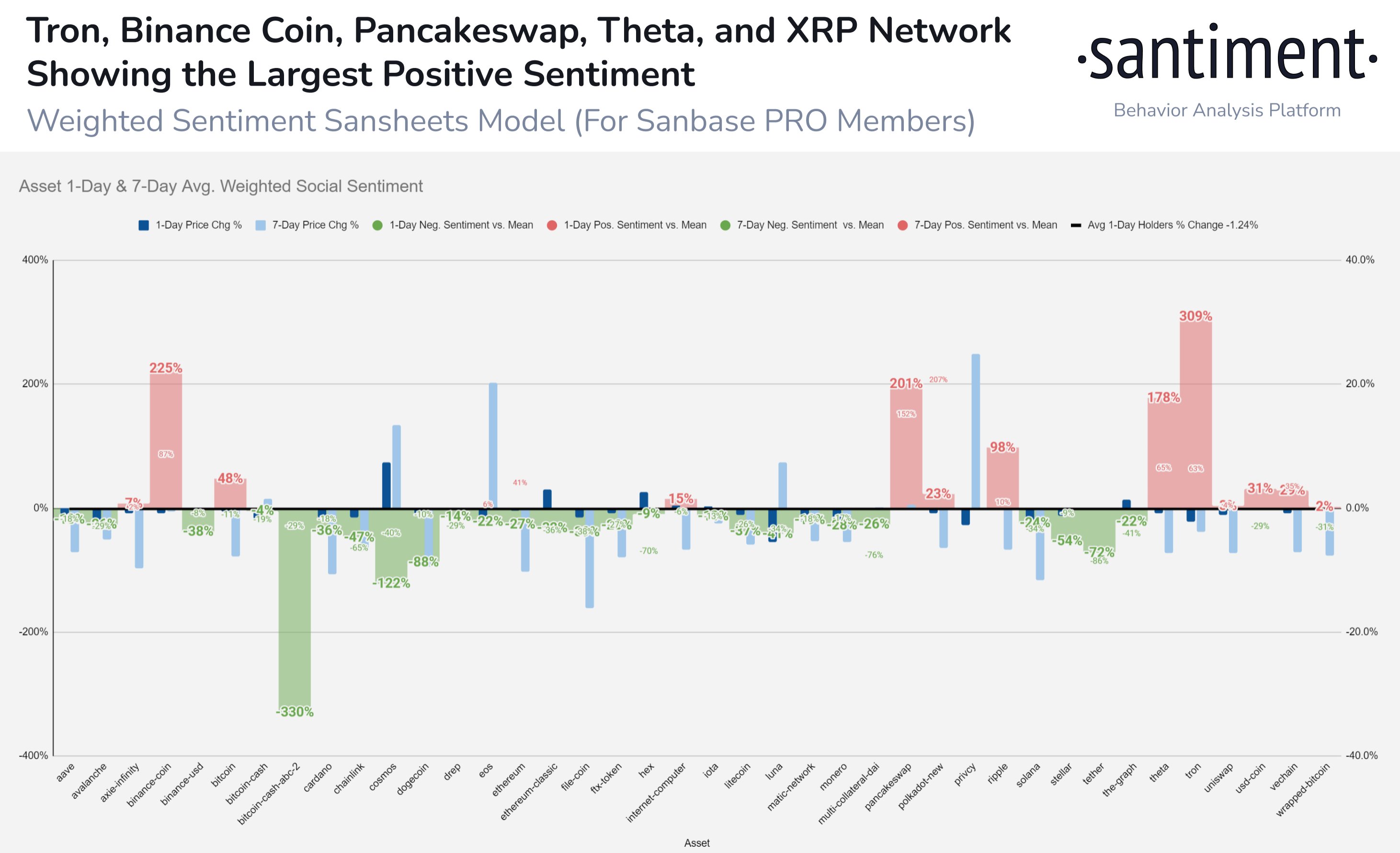

“Among top market cap assets in crypto, those with the largest positive sentiment right now are Binance Coin, Pancakeswap, Theta, and XRP Network”, Santiment stated.

Other major altcoins were mixed with AVAX and SHIB slightly on the reddish side but ATOM rose more than 7%. Markets have been running in place this week until Powell offers some hoped-for hint about the pace of the Fed’s next interest rate hike. Minutes from last month’s Federal Open Market Committee (FOMC) meeting have suggested that the bank will approve a third consecutive 75-basis point rate hike, although most indicators lately point to an economy slowing but not headed for recession – moderate enough to merit a dovish touch likely to please markets.

The overall cryptocurrency market cap stands at $1,036 trillion, and Bitcoin’s dominance rate is 39.7%.

Read more:

- Bitcoin Price Could Drop To As Low As $18,300 In The Near Future

- Bitcoin Price Flirted With $25,000 While Ethereum Broke Through $2,000 Before Both Lost Steam